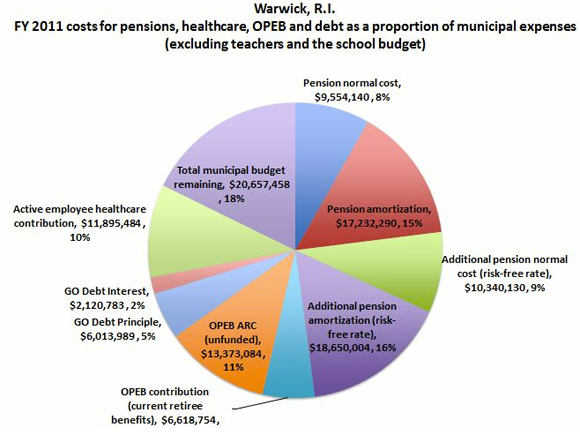

Last week, my collegue Eileen Norcross produced a chart that underlies a very scary unreported threat for many municipal budgets around the country. In this particular case, the chart showcases the Warwick, R.I.’s municipal budget (excluding the school budget) carved up according to current costs for funding the town’s pension benefits, other post-employment benefits (OPEB), current-employee health-care costs and general-obligation bond payment. The figures come from official budget documents.

This article was originally published in National Review Online

Last week, my collegue Eileen Norcross produced a chart that underlies a very scary unreported threat for many municipal budgets around the country. In this particular case, the chart showcases the Warwick, R.I.’s municipal budget (excluding the school budget) carved up according to current costs for funding the town’s pension benefits, other post-employment benefits (OPEB), current-employee health-care costs and general-obligation bond payment. The figures come from official budget documents.

What is different about her chart, however, is that it shows the additional amount needed to fully fund pensions based on the risk-free discount rate, rather than the lala land rate usually used for these calculations.

The main message is that if Warwick wasn’t engaging in discount-rate gimmicks (Warwick followed the state in assuming returns at 7.5 percent –down from 8.5 percent — rather than the much lower rate that most economists would recommend) and other actuarial tricks, 75 percent of the town’s budget should be dedicated to health-care and pension spending. This caused quite a stir because her data shows that the city of Warwick doesn’t account for about 25 percent of their pension costs and they need omit to contribute another 11 percent for some of the health-care benefits for retiree public employees.

Unfortunately, at this point, Mayor Scott Avedisian, like many others, prefers denial to sound accounting and budgeting. That’s because, as Norcross has explained, for the city to fully fund its pensions, it must increase its annual contributions threefold, to $51 million. That means cutting a gigantic amount of “other” spending. Mayors, like governors and congressman, do not like hard choices and spending cuts. That’s too bad, because if the city keeps its head in the sand, it is likely to experience a severe crisis within the next ten years.

But that doesn’t seem to trouble the Warwick city government. In an incredibly uninformed article in the Warwick Beacon last week, journalist John Howell reports with a straight face that the mayor thinks he is right to use a 7.5 discount rate, instead of the 2.4 percent suggested by Norcross, because most states and cities are doing the same.

This would be funny if it weren’t so depressing. This weekend, the New York Timeshad a good piece explaining why “public pension funds across the country are facing a painful reckoning.” As Mary Williams Walsh and Danny Hakim write:

While Americans are typically earning less than 1 percent interest on their savings accounts and watching their 401(k) balances yo-yo along with the stock market, most public pension funds are still betting they will earn annual returns of 7 to 8 percent over the long haul, a practice that Mayor Michael R. Bloomberg recently called “indefensible.”

Now public pension funds across the country are facing a painful reckoning. Their projections look increasingly out of touch in today’s low-interest environment, and pressure is mounting to be more realistic. But lowering their investment assumptions, even slightly, means turning for more cash to local taxpayers — who pay part of the cost of public pensions through property and other taxes. [...]

“The actuary is supposedly going to lower the assumed reinvestment rate from an absolutely hysterical, laughable 8 percent to a totally indefensible 7 or 7.5 percent,” Mr. [Mayor Michael] Bloomberg said during a trip to Albany in late February. “If I can give you one piece of financial advice: If somebody offers you a guaranteed 7 percent on your money for the rest of your life, you take it and just make sure the guy’s name is not Madoff.”

Yes, it is “indefensible,” and “Madoff-like.” Unfortunately, very few state and local officials seem willing to recognize the gigantic mistake they have made. At best, they are willing to cut their rate down to 7 percent, which will only marginally help the situation. Hopefully, sooner or later, they will take the work of Norcross and many other economists seriously, and amend their budgets accordingly.

If you want to know everything there is to know about this issue, read this very comprehensive response by Norcross to the Warwick Beacon article (great video at the end).