- | Government Spending Government Spending

- | Expert Commentary Expert Commentary

- |

Telling It like It Is about Social Security

Social Security is a terrific topic for testing whether presidential candidates are willing to "tell it like it is" -- and whether voters are willing to listen -- when uncomfortable truths are involved.

Many voters have said during this election season that they want a president who "tells it like it is." At the March 10 Republican presidential debate, the candidates were given an opportunity for such candor when the politically treacherous subject of Social Security was raised. With Social Security, "telling it like it is" requires recognition of several difficult realities including the following ones.

#1: Social Security faces a large and growing financing shortfall. According to the latest trustees' report, Social Security faces a financing gap roughly equal to 21 percent of its scheduled tax collections or 16 percent of scheduled benefits over its 75-year actuarial valuation window. Even corrections of this large magnitude would produce only a temporary solvency finding, leaving program finances on an unstable course such that the shortfall would begin to re-emerge the very next year after the fix. Correcting the program's total structural shortfall would require larger adjustments, equal to roughly 33 percent of scheduled taxes or 23 percent of scheduled benefits.

Importantly, Social Security's current shortfall is already much larger than the one corrected in the landmark 1983 amendments, the most comprehensive program financing reforms ever enacted. Today's is larger on its face (2.7 percent of taxable worker wages vs. 1.8 percent) but the actual difference is much greater, a fact disguised by a change in the trustees' actuarial methodology between then and now. Today's shortfall is nearly double that of 1982 -- even relative to today's larger tax base -- if measured with 1982 methods.

#2: The program's trustees have unanimously called for prompt financing reforms. The summary of the latest report states (among other warnings), "The Trustees strongly urge lawmakers to enact legislation promptly to achieve sustainable financial balance."

#3: Literally "not to touch Social Security" would mean allowing it to become insolvent, triggering sudden, deep benefit reductions. Current Social Security law limits benefit payments to those that its trust funds can finance. This means that when trust fund reserves are depleted, payments must be reduced to the amounts that can be financed from incoming tax revenues. Thus a literal "no-action" scenario would trigger sudden benefit reductions, beginning with disabled beneficiaries in 2022.

#4: Because it's unlikely lawmakers would allow a literal "no action" scenario to suddenly slash benefit payments, the more probable consequence of a protracted "don't touch" policy would be the abandonment of Social Security's financing structure. Historically Social Security has been financed mostly by a payroll tax paid by workers, with additional revenue coming from the taxation of benefits. Those individual payroll tax assessments form the basis for calculating each worker's benefits. It's unlikely this framework can long continue if corrective action is further delayed.

Figures published in the annual trustees' report accentuate the point that continued delay would likely doom our chances of maintaining Social Security within its historical financing structure. Even today it would be quite difficult to fix system finances while holding current beneficiaries harmless: a 20 percent reduction in future claimants' scheduled benefits would be needed to attain 75-year balance within projected revenues. But if action were delayed until the point of combined trust fund depletion, even complete elimination of benefits for all new retirees would be insufficient to close the shortfall.

At the brink of insolvency there would be little practicable alternative but to bail out the program from the government's general fund, severing Social Security's longstanding contribution-benefit link and ending its status as an earned benefit. From that point onward, Social Security would just be another general-fund-financed welfare program, competing with other similar programs for funding. Beneficiaries would no longer be protected from sudden and unpredictable benefit changes, while means-tests and other benefit payment restrictions would likely be introduced.

#5: The reason Social Security faces a shortfall is that scheduled benefits substantially exceed worker contributions. Although Social Security is popularly thought of as an earned benefit, this does not mean that participants simply get back what they pay in. To the contrary, scheduled benefits far exceed the value of contributions plus interest. A program cannot remain viably self-financing unless its income and outgo are kept in balance.

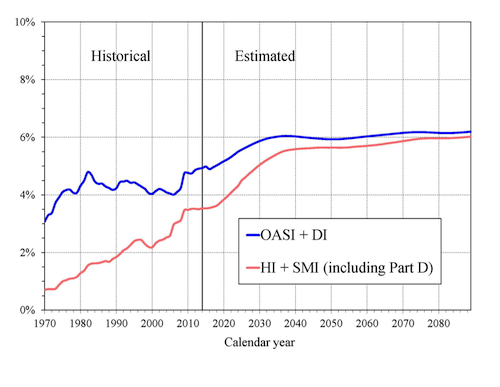

#6: Social Security benefit costs are growing much faster than the economy's ability to keep pace, an unsustainable rate of increase requiring corrections. Figure 1, pasted from the trustees' report summary, shows Social Security (blue line) and Medicare (red line) costs growing far faster than Gross Domestic Product (GDP).

Figure 1: Social Security (OASI+DI) and Medicare (HI+SMI) Costs as % of GDP

#7: Under a "don't touch" scenario the program will make mounting demands upon federal taxpayers in upcoming years. Last year Social Security costs exceeded its tax collections by $84 billion, the difference being made up by payments of interest -- financed by general taxpayers -- to its trust funds. Before the program's combined trust funds are depleted, these annual general revenue obligations will exceed $300 billion in $2015 dollars. Such payments would be required above and beyond payroll tax and benefit tax collections.

#8: Under current law younger generations will face significant net income losses through Social Security, even if they receive all scheduled benefits. According to the trustees' report, Social Security alone will subtract net income from those now entering the workforce, equal to 4 percent of their lifetime earnings. These income losses would likely render Social Security unable to perform its intended function of protecting future seniors from poverty. If the system is restored to financial balance solely by raising taxes or by constraining these younger generations' benefits, these losses will not be ameliorated. The only way to reduce the hit on the young is if baby boomers contribute to the solution.

#9: Currently workers can claim Social Security benefits three years younger than in FDR's time, despite lifespans having lengthened considerably since then. Virtually every proposal to keep the growth of Social Security costs within sustainable rates involves some long-overdue changes to eligibility ages, as some of the debate participants responsibly acknowledged. One candidate suggested that finances could be sustained without addressing eligibility ages, though a proposal fitting that description was developed several years ago when the financing shortfall was smaller. Measures which then would have fixed system finances no longer will. And as noted previously, promising "not to touch" Social Security would lead to the worst outcomes of all.

Social Security is a terrific topic for testing whether presidential candidates are willing to "tell it like it is" -- and whether voters are willing to listen -- when uncomfortable truths are involved. One core truth is that no responsible president can leave Social Security finances careening along their currently untenable course.