- | Government Spending Government Spending

- | Expert Commentary Expert Commentary

- |

What to Take Away from the Trustees Reports

A few weeks ago, the annual reports of the Social Security and Medicare trustees were released. (For a very good explanation about who the trustees are and what these reports are for, read this piece by Chuck Blahous, a trustee.) Here are some of the important points that the reports bring to light:

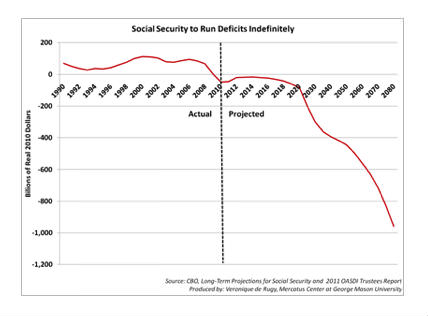

1. From now on, Social Security will be running a permanent cash-flow deficit, which means that taxes collected for the program aren’t enough to cover the benefits paid to retirees. Starting now, the program will draw from the trust fund balances to keep payments to retirees going; in concrete terms, Treasury will borrow money to pay back the trust funds.

2. The Social Security Trust Fund will be exhausted by 2036 — a year sooner than was projected last year. The trust fund determines the spending authority of the program: Without a positive balance in trust fund, the program won’t have the authority to pay out all benefits, only what the program collects in taxes — which means a cut in benefits across the board.

By the way, for all the people out there who don’t think there’s a problem with Social Security, the trustees performed stochastic modeling estimating the likelihood of various exhaustion dates under different assumptions, and this modeling concluded that there is less than a 2.5 percent chance that the trust fund will continue to exist beyond 2048.

3. The Medicare Hospital Insurance Trust Fund will run out of assets in 2024, five years earlier than projected last year. This is a very big story that hasn’t been covered much. One reason it’s so important is that one of the stated accomplishments of the Affordable Care Act (ACA) was that it would push back the insolvency date of the program from 2017 to 2029. The HI trust fund, like the SS one, determines the spending authority of the programs. Without a positive balance in the HI trust fund, the program won’t have the authority to pay out all benefits, just what the program collects in taxes. (Medicare HI gets some income from premiums and from payments by states.)

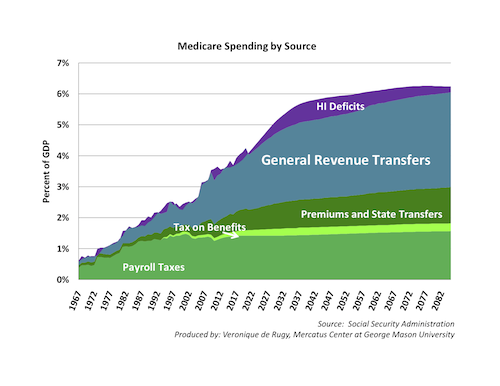

This chart shows Medicare spending by revenue sources. The purple section at the top represents continued HI deficits, which remain unfunded under current law. These deficits will ultimately be reconciled either through benefit cuts or yet more general-fund spending.

4. Projected savings in the ACA are unrealistic. First, as you can see on this chart, even under the best assumptions about Obamacare’s success, less than 60 percent of future Medicare spending will come from dedicated sources. By law, the vast majority of the spending gaps will be filled using the federal government’s general revenue fund, the federal tax dollars of the average American taxpayer. As Medicare costs consume a greater portion of tax dollars (and of GDP), new taxes, spending cuts, or programmatic cuts will be required.

But things will actually be worse than they look in the chart. Throughout the trustees’ report, the authors give a variety of reasons why actual costs are likely to be much higher than projected in the report: For instance, while Medicare costs over the next 75 years are projected to be 25 percent lower due to the ACA, these cost savings rest primarily on drastic reductions in the reimbursement rates for Medicare services — reductions that are unlikely to materialize in a world where politicians are subject to powerful pressures from their constituencies. A “Statement of Actuarial Opinion,” signed by the Chief Actuary of the program, Richard Foster, explains:

For these reasons, the financial projections shown in this report for Medicare do not represent reasonable expectation for actual program operations in either the short range (as a result of the unsustainable reductions in physician payment rates) or the long range (because of the strong likelihood that the statutory reductions in price updates for most categories of Medicare provider services will not be viable).

As always, Reason magazine’s Peter Suderman has several good posts on the issue, here and here.

5. The Disability Insurance Trust Fund will be insolvent by 2018. My understanding is that this program is highly dysfunctional. From what my colleague Jason Fichtner tells me, “SSA makes an initial determination to see whether an applicant is covered under the program. By covered, that just means whether or not they have enough of a work history to be covered. If so, SSA then sends the application to the states. Each state runs their own State Disability Determination Service, or DDS. They have to make the decision on whether or not to award DI benefits. If they do then the process stops there. If denied, an applicant can appeal the decision to an Administrative Law Judge (ALJ).” Like any judicial process, the judge you get matters. (Here is a Wall Street Journal piece explaining abuses in the system.)

Now what? Fichtner breaks down what it would concretely mean if we were to save the system as it is — without even thinking of about the effect such a spending explosion would have on our economy.

To Achieve Social Security Actuarial Balance Over 75 years:

● Could immediately increase payroll taxes for Social Security by approximately 2.2 percentage points from 12.4% to 14.6% (17.7% increase)

● Immediate reduction of Social Security benefits by approximately 14% of scheduled benefits (13.8%)

● Combination of above payroll tax increase and benefit reduction

● $6.5 trillion in present value needed to make SS trust fund “solvent” over 75 years. This is the unfunded obligation in present value terms over the next 75 years.

To Achieve Medicare Actuarial Balance Over 75 years:

● Could immediately increase payroll taxes for Medicare by approximately 21 percent.

Please Note – with Medicare this is a little bit trickier than it is with Social Security. The Trustees actually say the shortfall amounts to 21 percent of “tax receipts” over the 75-year horizon. Hence, the 0.79 figure actually applies to taxable wages including the portion of wages on which the new 0.9 percent HI surtax the ACA imposes beginning in 2013 on earnings over $200,000 for individuals and $250,000 for joint filers. What this means is that we can’t just say the 0.79 percentage point gap can be made up by increasing the HI payroll tax from 2.9% to 3.69%. But it would be close.

● Immediate reduction of Medicare benefits by approximately 17% of scheduled benefits

● $3.0 trillion in present value needed to make HI Trust Fund “solvent” over 75 years. This is the unfunded obligation in present value terms over the next 75 years.

That’s a lot of tax increases or benefit cut — which is why the system needs to be reformed.

I did a Reality Check on Bloomberg TV last week about the Trustees Report. You can check it out here.

Update: Read this great post by Yuval Levin about Richard Foster’s report.

Originally posted on National Review Online - The Corner.