- | Corporate Welfare Corporate Welfare

- | Research Papers Research Papers

- |

Basic Economics of the Export-Import Bank of the United States

We find that a domestic economy should not offer an export subsidy, whether a foreign government offers its own export subsidy or not. Finally, regardless of the Ex-Im Bank’s impact on economic efficiency, the ultimate decision about whether to intervene is political. Economic analysis can help political decision makers better understand the benefits and costs of their decisions.

Authorization for the Export-Import Bank of the United States (Ex-Im Bank) recently lapsed for the first time in more than 80 years, though the bank may be reestablished at any time. The debate continues over whether the United States government should reauthorize funding for the Ex-Im Bank. We hear that “without an Ex-Im Bank . . . there’d be little incentive for American manufacturers to actually make their goods in the United States” and that the Ex-Im Bank is needed to balance the competitive disadvantages created by similar banks of foreign nations. Indeed, the Ex-Im Bank itself holds this view:

"All major exporting countries, including America’s fiercest competitors in the global marketplace, have their own export credit agencies (ECAs), which support their respective countries’ exports. In fact, nearly 60 countries operate an ECA. Many of the world’s ECAs provide larger levels of financing than Ex-Im Bank, without being subject to the rules and restrictions that Ex-Im Bank follows. For example, China financed more than $100 billion of Chinese exports in 2013, compared to Ex-Im Bank’s support of $37.4 billion worth of US exports last year. Likewise, it is estimated that South Korea, which has an economy that is less than one-tenth the size of the US economy, also finances more than $100 billion per year to support exports from South Korea. In contrast, Ex-Im Bank steps in, only when needed, to help level the playing field against aggressive financing by foreign governments so US companies and workers can compete on the basis of the price and quality of their goods and services."

Against that view, we offer a simple, open-economy trade model to demonstrate that there is, in fact, a deadweight loss in the domestic economy when a government offers an export subsidy. In addition to a loss in economic efficiency, the Ex-Im Bank amounts to a special privilege for the connected few—big subsidies to powerful companies. For example, nearly $8 billion of the $12 billion in Ex-Im Bank loan guarantees in 2013 went to support Boeing exports. In fact, of that $12 billion, 97 percent supported the sales of only 10 firms. While Ex-Im Bank programs may indeed benefit select domestic firms, we will demonstrate that the bank’s overall impact on the US economy is negative.

The Ex-Im Bank’s Tools

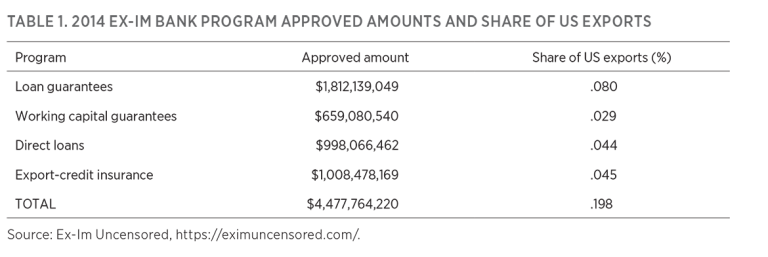

The Ex-Im Bank’s main tools are loan guarantees, working capital guarantees, direct loans, and export-credit insurance. Table 1 reports the 2014 approved totals for each program.

Loan guarantees are the largest portion of the Ex-Im Bank’s financing. These guarantees allow foreign and domestic lenders to finance foreign buyers of US exports at a reduced risk. The bank charges a foreign buyer of US exports a fee based on the loan’s length, size, and risk. The bank then guarantees lenders that it will cover up to 85 percent of the contract value of the loan’s outstanding principal and interest if the foreign buyer of US exports defaults. The bank approved $1.8 billion in loan guarantees in 2014.

The working capital guarantee program guarantees short-term loans made to qualified US exporters to fund everyday operations of a company. These guarantees are made on a one-time basis or as a revolving line of credit. The Ex-Im Bank guarantees to pay up to 90 percent of the outstanding balance of the working capital loan to the lender if the borrower defaults. The bank approved $659 million in working capital guarantees in 2014.

The direct loan program provides loans to foreign buyers of US exports for up to 80 percent of the US contract value. The Ex-Im Bank is responsible for the total value of the loan’s outstanding principal and interest if the foreign borrower defaults. The bank approved $998 million in direct loans in 2014.

Last, the Ex-Im Bank provides loss insurance to US banks and exporters that extend credit directly to foreign buyers. The exporter pays a fee to the Ex-Im Bank that serves as an insurance premium. The Ex-Im Bank approved $1 billion in export-credit insurance in 2014.

In 2014, total US exports were $2.26 trillion. In the same year, the estimated export value of Ex-Im Bank activity was $4.48 billion. Ex-Im Bank activity, therefore, amounted to 0.198 percent of total US exports in 2014.

Simple International Trade Models

We model the Ex-Im Bank’s actions as a subsidy to US exporting firms. The Ex-Im Bank’s programs provide financial assistance that ordinarily would be unattainable, would have less favorable terms, or at minimum would be more expensive in the open market. As long as the Ex-Im Bank intervenes in markets, crowding out private market participants, we cannot know the true market terms and rates.

To better understand the economics behind the Ex-Im Bank, let’s construct a simplified story for one market, the market for tires. Suppose tires are made in many countries around the globe and the global market for tires is large. We will use a competitive open-economy model to show how a country’s welfare changes when governments subsidize international trade. Assume that our economy—let’s call it Henrystonia—is small relative to the world market and that its domestic decisions have no effect on the international marketplace.

The pleasant nation of Henrystonia has all that a free community would desire, including the right to import or export goods and services. Citizens of Henrystonia are price takers in the world marketplace; domestic consumers and producers are so few in number relative to the world market that they can’t influence the price. Thus, no consumer would pay more than the world price and no producer would accept less than the world price. Consumers and producers base their decisions to exchange in the world marketplace on the world price.

A Small-Economy Model

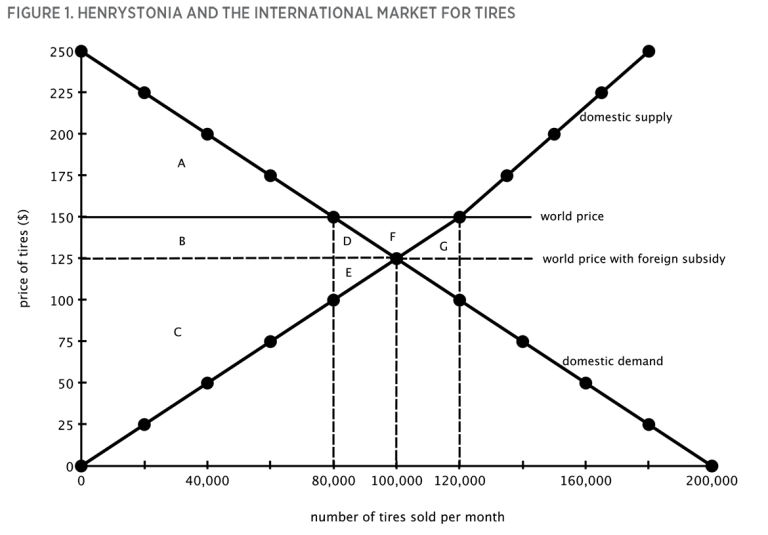

Figure 1 depicts the market for tires in Henrystonia. The curve labeled “domestic demand” represents domestic consumers and the curve labeled “domestic supply” represents domestic producers.

Henrystonia, however, is an open economy that participates in international trade. Domestic producers sell tires at the world price, which is assumed to be $150 per tire. We’ve illustrated this price in figure 1 by inserting the horizontal line labeled “world price” at $150. The world price is the equilibrium price in the international market for tires, made up of an international supply curve and an international demand curve.

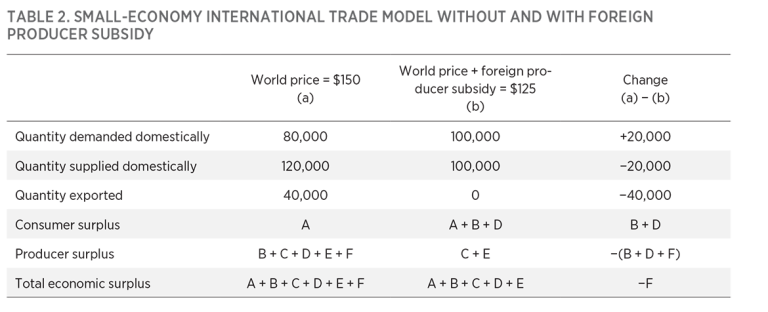

Table 2 summarizes Henrystonia’s tire market when the world price is $150 per tire. We make three observations: (1) The world price is higher than the domestic price, so local producers are interested in exchanging 120,000 tires at $150 per tire. (2) Domestic consumers are only interested in buying 80,000 tires at the higher world price. (3) Because of international trade, domestic producers are able to export 40,000 tires outside Henrystonia.

Table 2 reports how economic surplus in the domestic tire market is distributed in Henrystonia, as shown in figure 1. Domestic consumers have a consumer surplus equal to the area A. The producer surplus equals the area B + C + D + E + F. The total economic surplus, which measures how much better off consumers and producers are because they have exchanged tires, is equal to A + B + C + D + E + F.

Now, we want to measure this free-market outcome against two alternative cases: (1) all countries except Henrystonia offer their producers a subsidy, and (2) Henrystonia’s government decides to retaliate by offering its producers a subsidy to level the playing field.

Let’s assume that all countries except Henrystonia offer their producers a subsidy for each tire they sell in order to compete with Henrystonia’s producers. The net impact of the foreign subsidy causes the world price to decrease to $125 per tire. We’ve demonstrated this price in figure 1 with the horizontal line labeled “world price with foreign subsidy.”

Table 2 summarizes Henrystonia’s tire market with a world price of $125 per tire. Local producers are interested in exchanging 100,000 tires at $125 per tire. Domestic consumers are interested in buying 100,000 tires at the world price. Because of the lower subsidized world price, domestic producers no longer export tires outside Henrystonia.

Because of the lower world price, domestic consumers have a higher consumer surplus equal to the area A + B + D shown in figure 1. The domestic producer surplus decreases to the area C + E, and the total economic surplus decreases to equal A + B + C + D + E. The net impact of foreign governments’ subsidizing their exports harms Henrystonia—it causes Henrystonia’s total economic surplus to decrease by an amount equal to area F.

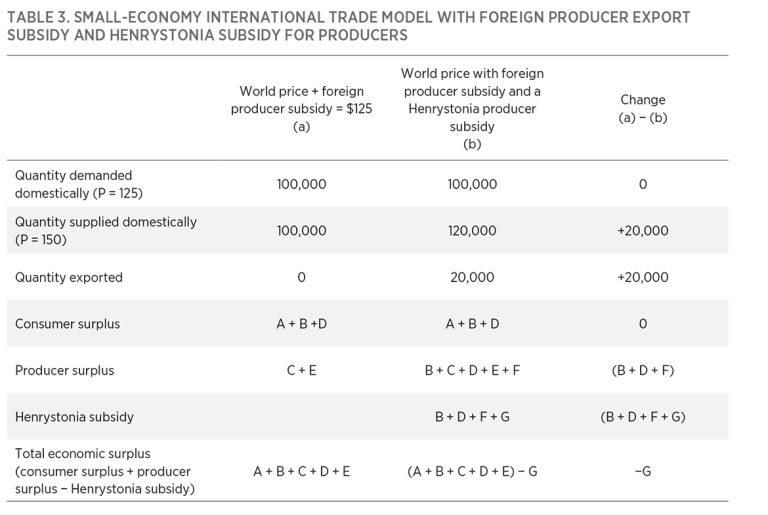

The next question to investigate is, Does it make sense for Henrystonia to retaliate—to level the so-called “international playing field”—by subsidizing the production costs of local Henrystonia producers?

Suppose Henrystonia offers a $25 subsidy for each tire produced in Henrystonia. Table 3 summarizes the results. Domestic consumers in Henrystonia do not receive a subsidy and therefore continue to pay $125 per tire. At this price, domestic consumers buy 100,000 tires. Each domestic producer receives $125 per tire from consumers (domestic or foreign) and $25 per tire from the government of Henrystonia. So at the combined price of $150 per tire, local producers are willing to produce 120,000 tires. Because of international trade, domestic producers are now able to export 20,000 tires outside of Henrystonia.

Because the price has not changed for consumers, domestic consumer surplus has not changed—it is equal to the area A + B + D in figure 1. The producer surplus now increases to the area B + C + D + E + F. The net gain of B + D + F is a rent. Producers are willing to exhaust real resources—on political activity and inefficient production decisions—to obtain and maintain this rent. The subsidy’s total cost equals the area B + D + F + G ($25 for each of the 120,000 tires produced in Henrystonia). The total economic surplus is the sum of the consumer surplus and producer surplus minus the subsidy, or A + B + C + D + E − G.

The bottom line is that if Henrystonia retaliates by offering its own subsidy to “level the playing field,” Henrystonia is actually made worse off by the value of area G. When a foreign government decides to subsidize the production of its local producers, Henrystonia is better off—in terms of efficiency—by not retaliating. Specifically, if Henrystonia retaliates consumers are indifferent, producers win B + D + F, and taxpayers lose B + D + F + G. Retaliating is inefficient because taxpayers lose more than producers win by area G.

A Large-Economy Model

Our small-economy model captures important features of many markets in which the Ex-Im Bank operates. However, a large-economy model is more appropriate for some of the Ex-Im Bank’s most conspicuous operations, such as wide-bodied aircraft financing. The key difference between a large-economy and a small-economy model is that changes to the demand and supply in a large economy affect the world price. Small-economy demand and supply shocks have no effect on the world price.

Consider Boeing, a prominent player in the world market for wide-bodied aircraft. If the Ex-Im Bank offers a subsidy to finance Boeing exports, Boeing will increase the quantity of wide-bodied exports. Because Boeing has such a large share of the world market, when it increases its exports, the world price for wide-bodied aircraft declines.

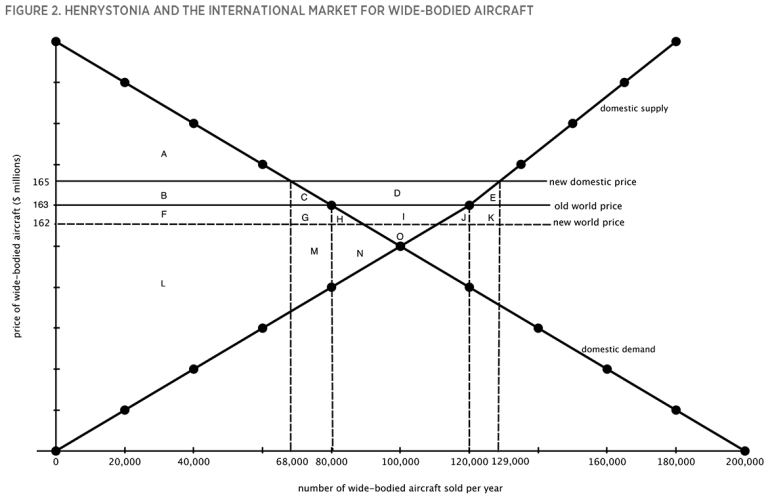

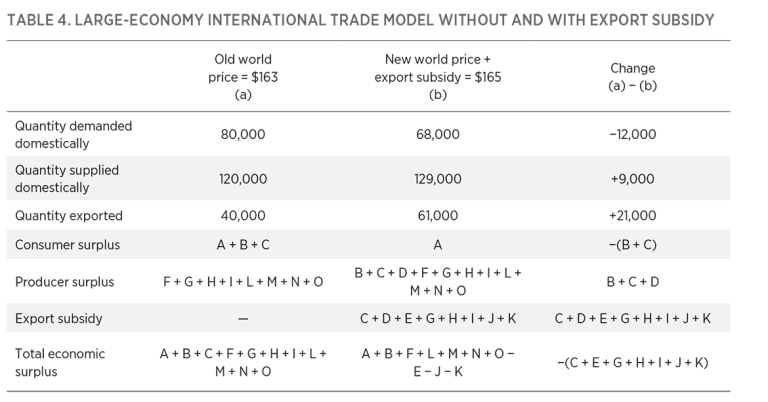

Figure 2 offers a stylized demonstration of the impact of a $3 million per unit subsidy on wide-bodied aircraft exports out of Henrystonia. The export subsidy causes the world price to decrease from $163 million to $162 million per unit. Domestic producers now receive $165 million per unit. This price equals the new world price plus the $3 million per unit export subsidy. Because producers in Henrystonia will receive $165 million for each exported unit, they require domestic consumers (e.g., Delta) to also pay $165 million per unit. Thus, the net impact of the export subsidy is to increase the price of wide-bodied aircraft in the domestic economy from $163 million to $165 million. At $165 million per unit, domestic producers increase their quantity sold to 129,000 units, domestic consumers decrease their quantity purchased to 68,000 units, and exports increase to 61,000.

Table 4 summarizes Henrystonia’s wide-bodied aircraft market with and without the $3 million subsidy. Because of the higher domestic price, domestic consumers have a lower consumer surplus equal to the area A. Domestic producer surplus increases to area B + C + D + F + G + H + I + L + M + N + O. The cost of the export subsidy equals the area C + D + E + G + H + I + J + K, which equals $3 million for each of the 61,000 exported wide-bodied aircraft. Total economic surplus decreases to equal A + B + F + L + M + N + O − (E + J + K). The export subsidy generates a deadweight loss equal to the area C + E + G + H + I + J + K. The diminution of economic efficiency observed in the large-economy model is greater than what would be observed a small-economy model, ceteris paribus.

Unfair Competition

Different countries have different regulations, subsidies, and rules of the game. These differences are perceived to make international trade unfair. Thus, particular constituents often ask their governments to intervene with programs such as the Ex-Im Bank’s to make international trade “fairer.”

For example, as we have demonstrated, national governments often intervene and give production subsidies to their domestic businesses. Most economists would regard those subsidies as a bad policy for the foreign government (in terms of the foreign country’s own economic efficiency). Foreign subsidies would also put domestic producers at a disadvantage, but domestic consumers would benefit because the price they pay for goods and services would decrease, compliments of the foreign government. However, if the domestic government does intervene and retaliates to “level the playing field,” there will be a deadweight loss for the overall domestic economy. The gains from a retaliatory subsidy are less than the costs of that subsidy.

Discussion

Different groups view the proposal to fund the Ex-Im Bank differently. If we use economic efficiency to judge how the bank helps or harms various groups, we learn from the small-economy example presented earlier that domestic producers benefit from the subsidy, domestic consumers are neutral, and Ex-Im Bank interventions lead to a net reduction of total economic surplus for the domestic economy. Specifically, a broad base of domestic taxpayers (who are both consumers and producers) bears the brunt of the loss in economic surplus (area B + D + F + G), but the subset of US producers that receive Ex-Im Bank assistance are better off to some degree (area B + D + F). Beyond this wealth transfer from the many to the few is a net loss in economic surplus for the US economy (area G). In the large-economy example, the export subsidy creates a deadweight loss (C + E + G + H + I + J + K), domestic producers benefit from the subsidy (B + C + D), and domestic consumers are made worse off (B + C).

A basic question remains: Why do we have an Ex-Im Bank? Many people maintain that government should not intervene in international trade because it negatively affects overall economic efficiency. Thus, there should be no Ex-Im Bank, and its charter should not be reauthorized.

Others argue that government must intervene and the bank’s current authorization should be renewed. There are two common arguments in support of Ex-Im Bank intervention: (1) protection of domestic jobs and (2) unavailability of traditional financing. In the next sections we briefly explore each argument for intervention.

Regardless of the Ex-Im Bank’s effect on economic efficiency, the ultimate decision about whether to intervene is political. Economic analysis, however, can help decision makers better understand the benefits and costs of their political decisions.

Protection of Domestic Jobs

Many producer groups are proponents of the Ex-Im Bank because it protects some domestic jobs. Many of these protected jobs may indeed be eliminated without the bank’s subsidies because these goods and services would be produced outside the country at a lower cost. However, the concept of comparative advantage reminds us that even if a country is better at producing everything (that is, it has an absolute advantage), each country is still better off trading. That is, free and open trade creates jobs at the same time that it destroys jobs, and it leads to better and lower-priced goods. Upon removal of a special privilege to one business or industry, other jobs may be created within other, more efficient businesses or industries. The reallocation of resources to more efficient uses can be a painful process, especially in the short run. But the Ex-Im Bank’s subsidies lower total economic efficiency because they retain workers in less-efficient industries—a so-called allocative inefficiency that adds to the deadweight loss demonstrated previously. The overall level of domestic job creation is diminished, not enhanced, as a result of Ex-Im Bank interventions.

Unavailability of Traditional Financing

Ex-Im Bank supporters argue that private banks do not offer the services provided by the Ex-Im Bank. Further, proponents point out that the institution returned $1.057 billion to the US Treasury in FY 2013 and approximately $2 billion over the past five years. Proponents say that these returns demonstrate that the bank’s services are needed and that the bank is well managed.

We must ask, though, why private financial institutions cannot provide the loans and loan guarantees rather than a government agency. In our economic analysis, we characterize the financial intervention of the Ex-Im Bank as a government subsidy of the domestic producers. The implication is that those financial products would otherwise not be available to the domestic exporters, or that if they were available, they would be priced higher. In fact, a vast majority of export transactions—99.802 percent in 2014—are financed privately, with the Ex-Im Bank stepping in to support marginal transactions that private commercial banks do not want to fund or do not want to fund on the terms that the Ex-Im Bank is willing to offer.

It appears that the US government is bearing financial risk at below-market prices to promote additional exports. As long as the Ex-Im Bank is able to price these transactions below market rates, the private market will not be competitive in those marginal deals. The Ex-Im Bank is not solving a failure of private markets, but is instead crowding out properly priced and structured private-market transactions. If the bank were to be eliminated, we should not assume that the marginal export transactions would be unable to secure funding. The private market would likely step in for most of those transactions, though perhaps at a higher price or with additional requirements. The transactions that did not receive private funding would be ones that lenders deemed too risky at that price. Economizing on scarce capital, steering it toward the best projects and away from the worst, is a key feature of a well-functioning financial market; it is not a flaw.

Supporters often point to the Ex-Im Bank’s successes in managing its portfolio of transactions. For example, the Ex-Im Bank’s active default rate was 0.175 percent—less than one-fifth of 1 percent—as of September 30, 2014. If the Ex-Im Bank can manage its portfolio of transactions, why couldn’t a private firm do the same, and price the risk competitively at prevailing market prices?

Conclusion

The Ex-Im Bank provides financing for US exporters and their foreign buyers. There is an open debate over whether the United States should reauthorize funds to support the Ex-Im Bank. We’ve presented an economic efficiency analysis of Ex-Im Bank activities in a small and large open-economy model. We find that a domestic economy should not offer an export subsidy, whether a foreign government offers its own export subsidy or not. Finally, regardless of the Ex-Im Bank’s impact on economic efficiency, the ultimate decision about whether to intervene is political. Economic analysis can help political decision makers better understand the benefits and costs of their decisions.