- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

A Better Balanced Budget Rule

One way to “internalize the externality” is to require those who benefit from current government services to pay for them. This could be accomplished by a balanced budget requirement.

A negative externality arises when A’s actions impose costs on B without the latter’s consent. If a manufacturer is allowed to dump noxious byproducts into a river, imposing costs on downstream residents, it creates a negative externality. Because he fails to account for the costs he imposes on others, the manufacturer will make too much of his product.

So it is with structural deficits.

One generation of voters is able to purchase government services for itself while dumping the cost on to future generations. This problem was highlighted by Nobel Prize-winning economist James Buchanan and his fellow economist, Richard Wagner. Over thirty years ago, they wrote:

This bias toward deficits produces, in turn, a bias toward growth in the provision of services and transfers through government. Deficit financing creates signals for taxpayers that public services have become relatively cheaper. Because of these signals, voters will demand a shift in the composition of real output toward publicly provided services (including transfers).1

One way to “internalize the externality” is to require those who benefit from current government services to pay for them. This could be accomplished by a balanced budget requirement.

There are, of course, objections to such a requirement. Three of the strongest are:

- A transition to balance would be too jarring. This year, the federal government shifted about 20 percent of the cost of current spending onto future generations. And if we tried to immediately balance the budget, it would require a large tax increase, a large spending cut, or some painful combination of the two.

- Because deficits coincide with recessions, a balanced budget requirement would force the government to raise taxes, cut spending, or both, just when the economy can least afford it.

- Revenue estimation involves too much guess work, opening the door to political manipulation.

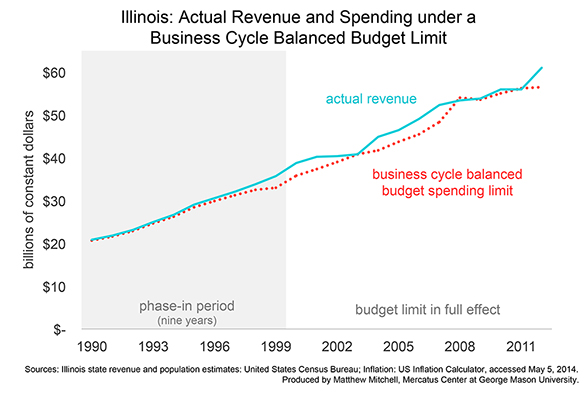

One way to address each of these problems is to phase-in the limit and to require balance over a period of time longer than one year. Some governments, such as Sweden’s, have already adopted such a rule, and one proposal would create a similar rule for the US federal government. It would phase the requirement in over nine years. And from then on out—with an adjustment for inflation and population growth—it would limit spending in any one year to the average of revenue over the three previous years. Because the current limit would be derived from simple arithmetic, it would leave no room for guesswork or manipulation.

A requirement like this could also be adopted by states. And legislators in Illinois have proposed just such a rule. The chart above indicates how the requirement would have affected Illinois’s budget if it had been adopted in 1990 and if it had included a nine-year phase in. From 1990 to 2002 and from 2004 to 2007, the rule would have kept state spending in line with state revenue and would have even permitted surpluses that could have been used for rainy-day funds or for tax cuts. Then, during recession years such as 2008, the requirement would have permitted the state to run a deficit, allowing budgeters to ease the pain of belt-tightening.

Such a balanced budget rule would eliminate the fiscal externality problem while avoiding the most serious problems of most balanced budget requirements.

1 James M. Buchanan and Richard E. Wagner, Democracy in Deficit (Indianapolis: Liberty Fund, 1977) Chapter 7.