- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

Budget Deal Is Business-as-Usual in Washington

The Bipartisan Budget Act of 2015, freshly signed into law by President Obama, suspends the $18.1 trillion federal debt ceiling until March 2017. It also busts the 2011 Budget Control Act—which I previously discussed—for the second time. It does so by raising the caps on discretionary funding by $50 billion for fiscal year (FY) 2016 and $30 billion for FY 2017.

The Bipartisan Budget Act of 2015, freshly signed into law by President Obama, suspends the $18.1 trillion federal debt ceiling until March 2017. It also busts the 2011 Budget Control Act—which I previously discussed—for the second time. It does so by raising the caps on discretionary funding by $50 billion for fiscal year (FY) 2016 and $30 billion for FY 2017.

The deal’s defenders claim that it is fiscally responsible because the additional funding is paid for with a combination of revenue increases and funding reductions elsewhere. To be able to make this claim, however, the deal’s authors turned to a well-worn budget trick: the Congressional Budget Office’s (CBO) scoring of the legislation. The CBO score attempts to measure the fiscal effects of a particular piece of legislation over a 10-year period by estimating the changes in revenues and spending versus a baseline projection. In the case of the budget agreement, the CBO’s score shows that over the next decade the increased spending would be completely offset.

But the devil is in the details.

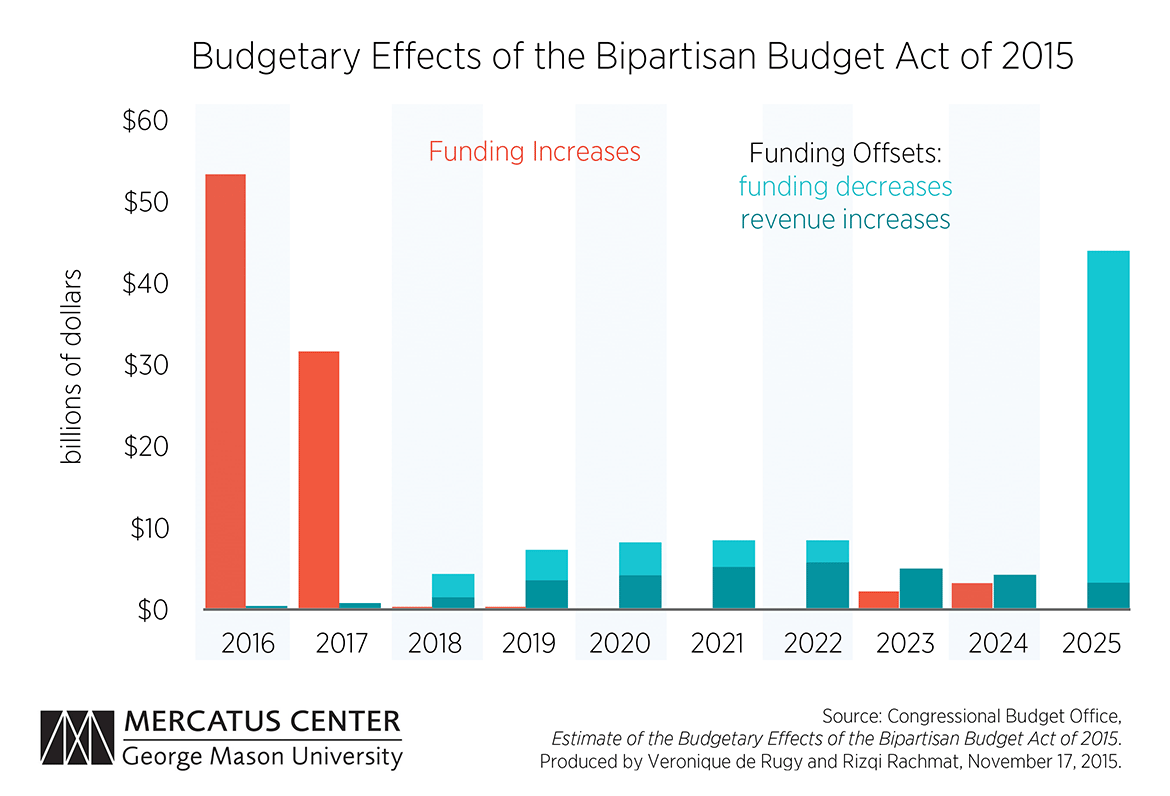

This week’s chart shows the CBO’s score of the budget deal broken down annually from FY 2016 to FY 2025. The red bars show the funding increases. The bars in two shades of blue show the offsetting combination of funding decreases elsewhere and revenue increases.

While the funding increases occur up front, the offsets would largely occur in the future. Indeed, roughly half of the “savings” wouldn’t occur until the final year, FY 2025. That begs an obvious question: If Congress can’t muster the fortitude to abide by spending constraints now, why should it be expected to abide by them in the future? As noted, this is the second time Congress has failed to uphold the cap limits since they were enacted in 2011. And even though the ink has barely dried on the president’s signature, policymakers are already promising the farm lobby that they will scrap the $3 billion in savings from cuts to the federal crop insurance program.

Unfortunately, the gimmickry doesn’t end there. As the Center for a Responsible Federal Budget details on its website, only half of the deal is “truly paid for” thanks to double-counted savings, “pension smoothing,” ignoring additional interest costs, and additional funding for the Overseas Contingency Operations account that the deal’s authors made sure didn’t make it into the final score.

I had previously warned that with the Republicans wanting more military funding and the Democrats wanting more nondefense funding, the likely outcome would be a deal that increased both. Unfortunately, with this deal that has proven to be the case. Such business-as-usual budgeting is just more evidence that policymakers remain incapable of getting the federal government’s finances on sustainable footing.