- | Academic & Student Programs Academic & Student Programs

- | Financial Markets Financial Markets

- | Policy Briefs Policy Briefs

- |

The Case Against New Restrictions on Payday Lending

In the wake of the financial crisis, Congress is considering new regulations on non-traditional lending products like payday lending, although there is no evidence that such products were related in

In the wake of the financial crisis, Congress is considering new regulations on non-traditional lending products like payday lending, although there is no evidence that such products were related in any way to the financial crisis. If enacted, the principal legislation, H.R. 1214 (the Payday Loan Reform Act of 2009), would limit the charge for a single-payment loan to an effective 391 percent annual rate ($15 per $100 two-week loan). H.R. 1214 also purports to limit borrowers to one loan at a time from a single lender, prohibit rollovers, and limit borrowers to one extended repayment plan every six months. Economic theory and empirical evidence strongly suggests that these paternalistic regulations would make consumers worse off by limiting their choices to unappealing alternatives. Also, the act would do little to protect consumers from concerns of over-indebtedness and high-cost lending.

THE PAYDAY LOAN INDUSTRY

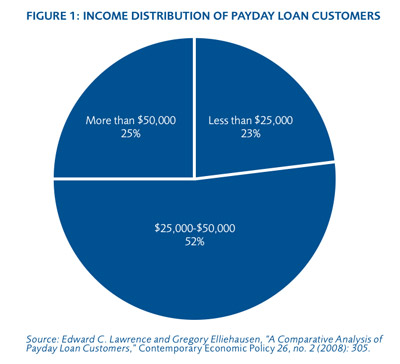

Payday lending arose in big cities as early as the 1880s as an alternative to pawn shops and "chattel lenders,"1 serving as a valuable source of short-term, small-amount lending to wage earners with steady employment but a critical need for short-term emergency funds. Since then, the payday loan industry has grown rapidly during the past two decades, from under 200 offices in the early 1990s2 to over 22,800 offices at the end of 2005.3 Forty percent of payday loan customers earn between $25,000-50,000 per year, and 56 percent earn between $25,000-75,000 (see figure 1).4 Still, despite the intense regulatory attention on payday lending in recent years, only about 2 percent of the population (9 to 14 million people) use payday lenders in any given year. The aggregate outstanding principal balance of all payday loans at any given time is about $2 billion.

Use of payday loans is almost always precipitated by an unexpected expense that the borrower could not postpone, such as a utility bill, fear of a bounced check, healthcare expenses, or the need for funds for vacation or Christmas.5 In one survey of payday loan borrowers, 86 percent of respondents reported that they "strongly" (70.8 percent) or "somewhat" agreed (15.7 percent) that their use of a payday lender was to cope with an unexpected expense.6

Lack of access to emergency funds can be detrimental to consumers. For instance, every bounced check can incur substantial fees and impose indirect costs. If a check is an insurance payment, the policy will be terminated; if it's for utilities, such as telephone or electricity, it may lead to termination of service, penalties, and a substantial security deposit to reconnect service. Bouncing a check may also result in termination of a bank account and even a risk of criminal prosecution, while also damaging the individual's credit score, making subsequent access to credit even more difficult.7

Payday loan customers are not fools; they have carefully weighed all of their options and chosen the best alternative they can afford. Payday lending customers choose this financing option over an array of relatively unattractive options, such as pawn shops, bank overdraft protection, credit card cash advances (where available), and informal lenders or loan sharks. For instance, according to a study by the Federal Deposit Insurance Corporation, a customer repaying a $20 debit overdraft in two weeks would incur an average Annual Percentage Risk (APR) of 3,520 percent, which can be an unattractive alternative for a borrower.8

Payday loan customers are also well informed about the cost of these loans. According to Elliehausen, only 2 percent of payday loan customers reported that they did not know the finance charge for their most recent new payday loan; 94.5 percent reported finance charges consistent with prevailing market prices.9 Whatever concerns have been expressed aboo

Since their inception, regulators have expressed concern about the apparent high cost of short-term, small loans. However, and in light of the recent economic turmoil, anecdotal reports indicate that as a result of a reduction of access to credit, and especially a dramatic reduction in the availability of credit-card credit, middle-class consumers and small businesses increasingly are turning to non-traditional lenders, such as payday loans and pawn shops.10 Banning payday lending in these uncertain times would drive consumers further down the "lending ladder" to pawn shops or alternatives that are not economically desirable.

THE ECONOMICS OF USURY REGULATION

Misguided paternalistic regulation that deprives consumers of access to payday loans is likely to force many of them to turn to even more expensive lenders or to do without emergency funds. This is because substantive regulation, such as price caps on interest rates (often referred to as "usury" regulations), limits the interest rate of loans made to borrowers. This can have several unintended consequences that can be extremely harmful to consumer welfare, which can be summarized under three basic headings: term re-pricing, product substitution, and credit rationing.

Term re-pricing describes the process by which lenders offset limits on what they can charge on regulated terms. By increasing the price of other terms of the loan or related loan products, like the minimum required amount of the loan, lenders can amortize the costs of issuing the loan over a higher loan amount.11 As reported by Policis, this can force borrowers to borrow larger amounts than they prefer or can reasonably manage, thereby reducing the usefulness of the loan and, perversely, promoting over-indebtedness.12

The second unintended consequence of usury regulation, product substitution, arises when certain types of regulation make it impossible to price a particular consumer loan product in a manner that makes it economically feasible for the lender and borrower to enter into a transaction, leading lenders and borrowers to search for alternative, less-desired credit products. For instance, a recent study of U.S. consumers found that in states with strict usury ceilings, unbanked consumers tended to substitute pawn shops while those with access to mainstream credit markets made greater use of retail and revolving credit.13

Pawn shop loans are especially unappealing: Their cost is comparable to payday loans, but they require the borrower to part with personal property to use as collateral.14 In addition, because of the small size ($76 on average)15 and high transaction cost of pawn shop loans, these are of limited usefulness in managing financial difficulties.16 Moreover, those forced to substitute greater use of revolving credit likely end up paying even higher costs for credit and run into greater financial difficulty. Both credit card delinquencies and delinquency-related revenues are higher in states with interest-rate ceilings that squeeze payday lending out of the market.

Finally, regulation may result in rationing of credit to particular borrowers if it is impossible for them to obtain any formal credit on affordable terms. Such rationing could force borrowers to turn to the informal sector (friends and family or illegal loan sharks) or to do without credit. In 2006, Japan severely tightened its rate ceiling on consumer loans (as in the United States; many consumer loans were also small-business loans), resulting in a two-thirds drop in consumer loan acceptances in the two years following the enactment of the law. During that period, Japan saw a dramatic growth in illegal loan sharking, primarily run by organized crime (Yamiken lenders).17 Japanese consumers who admit to having contacted a loan shark during a 12-month period were twice as numerous among those who were unable to borrow as much as they wanted from a legitimate consumer finance lender (26 percent) as among those who were able to obtain the amount that they wanted (13 percent). Those declined by legitimate lenders were also more likely to contact loan sharks (27 percent) and even more likely among those who had been asked to provide guarantors or collateral for a loan (42 percent). As might be expected, illegal lending costs much more than legitimate lending, and collections by illegal lenders rest on threats, intimidation, violence, and forms of exploitation.

Essentially, foreclosing viable options for credit because they are thought to be too expensive does not make the need for credit go away—if a low-income person needs $500 for a car repair in order to get to work, eliminating payday lending as an option does not eliminate the need for the car repair. It simply forces the borrower to find funds elsewhere or live without the car, which could adversely affect job performance.

CONCLUSION

Economists have almost uniformly concluded that usury regulations that force these changes in lending and borrowing behavior is harmful to consumer welfare. Regulations that encourage substitution from one type of high-cost credit to another or encourage a more confusing and opaque price scheme are unlikely to make consumers better off. Once lenders make adjustments and offsetting behaviors in response to substantive regulations, the benefits to be gained from interest-rate caps are clearly understood as small and the costs from the unintended consequences as extremely large. Consumers are left with fewer choices, higher borrowing costs, and less flexibility.

ENDNOTES

1. Mark H. Haller and John V. Alviti, "Loansharking in American Cities: Historical Analysis of a Marginal Enterprise," American Journal of Legal History 21 (2007): 127-129.

2. John P. Caskey, "Payday Lending," Financial Counseling and Planning 12 (2001): 1-14.

3. Michael A. Stegman, "Payday Lending," Journal of Economic Perspectives 21 (2007): 169.

4. Edward C. Lawrence and Gregory Elliehausen, "A Comparative Analysis of Payday Loan Customers," Contemporary Economic Policy 26, no. 2 (2008): 299, 305.

5. Haller and Alviti, "Lonesharking in American Cities," 128.

6. Gregory Elliehausen, An Analysis of Consumers' Use of Payday Loans (Financial Services Research Program Monograph 35, no. 41, January 2009).

7. According to one news story, "At most banks, if you've bounced too many checks, you're banned for five to seven years." Douglas McGray, "Check Cashers, Redeemed," New York Times Magazine, Nov 9, 2008.

8. Federal Deposit Insurance Corporation, FDIC Study of Bank Overdraft Programs (Arlington, VA: FDIC, 2008), 5.

9. Elliehausen, An Analysis of Consumers' Use of Payday Loans, 36-37.

10. Gary Fields, "People Pulling Up to Pawnshops Today Are Driving Cadillacs and BMWs," The Wall Street Journal, December 30, 2008; Jeff Swiatek, "More Middle-Class Families are Learning that Payday Loans Add Up," Indianapolis Star, February 3, 2009.

11. Haller and Alviti, "Loansharking in American Cities," 125, 140.

12. Policis, Economic and Social Risks of Consumer Credit Market Regulation (London: Policis, 2006), 74, 78-79.

13. Anna Ellison and Robert Forster, The Impact of Interest Rate Ceilings: The Evidence from International Experience and the Implications for Regulation and Consumer Protection in the Credit Market in Australia (London: Policis, 2008), 40.

14. John P. Caskey, Fringe Banking: Check-Cashing Outlets, Pawn Shops and the Poor (New York: Russell Sage Foundation, 1994).

15. Paige Marta Skiba and Jeremy Tobacman, "Measuring the Individual- Level Effects of Access to Credit: Evidence from Payday Loans," (working paper, July 3, 2007); Robert W. Johnson and Dixie P. Johnson, Pawnbroking in the U.S.: A Profile of Customers (Credit Research Center Monograph No. 34, 1998).

16. Ellison and Forster, The Impact of Interest Rate Ceilings, 55.

17. Policis, Economic and Social Risks, 47-52.

To speak with a scholar or learn more on this topic, visit our contact page.