- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

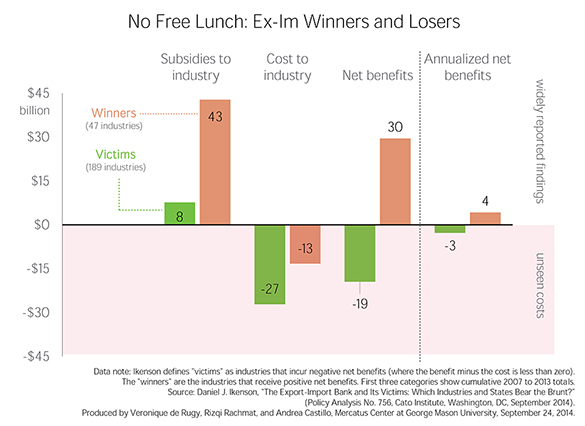

No Free Lunch: Ex-Im Winners and Losers

This week’s chart uses data from a new Cato Institute study quantifying some of the industrial “winners” and “victims” of Ex-Im subsidy policies. The chart shows that Ex-Im policies benefit far fewer industries than they penalize.

Supporters of the Export-Import Bank (Ex-Im) are quick to tout the alleged benefits that its policies bring to the few firms that receive assistance, but they rarely consider who might be harmed by these export credit subsidies and by how much.

This week’s chart uses data from a new Cato Institute study quantifying some of the industrial “winners” and “victims” of Ex-Im subsidy policies. The chart shows that Ex-Im policies benefit far fewer industries than they penalize. Out of 236 industries (defined at the six-digit level of the North American Industry Classification System [NAICS]), 189 are victims, incurring a combined annual net cost of almost $3 billion, while Ex-Im provides subsidies to its chosen firms to the tune of over $4 billion. This, however, measures only direct costs and ignores other costs that flow from distortions in investment and other choices as a consequence of Ex-Im’s actions.

Economist Daniel Ikenson estimates the relative cost disadvantage imposed on the US competitors of Ex-Im–subsidized foreign companies using seven years of Ex-Im transactions records and official input-output tables from the Bureau of Economic Analysis. As Ikenson explains:

When a foreign farm machinery producer purchases steel on credit at subsidized interest rates, it obtains an advantage over its competitors—including its U.S. competitors. So, when that subsidized rate comes courtesy of a U.S. government program committed to increasing U.S. exports, it only seems reasonable to consider the effects on firms in downstream U.S. industries before claiming success. Has the subsidy to the foreign farm machinery producer made John Deere, Caterpillar, New Holland, or other U.S. farm machinery producers less competitive? Has it hurt their bottom lines?

Ikenson calculated the “benefit” of Ex-Im subsidies to a given industry as the aggregate of Ex-Im subsidies for all companies in that industry. The downstream cost of the Ex-Im subsidy to each industry was calculated as the benefits accruing to all of its supplier industries, weighted by the relative importance of each input to the industry’s output, and then aggregated.

To discern which industries “win” and which industries “lose” under Ex-Im industrial policy, Ikenson calculates the net benefit for each, which is equal to the gross benefits (or the benefits that Ex-Im claims for each NAICS industry in its annual reports) minus the downstream industry costs. A positive net benefit indicates that an industry benefits more than it loses from Ex-Im subsidies and is therefore a “winner.” Industries with negative net benefits, on the other hand, are “victims” of Ex-Im subsidies. Ikenson notes that he simply takes the total benefits reported by Ex-Im as a given; it is likely that benefits are less or even greater than reported in some cases. However, Ikenson decided to accept their reported benefits in order to focus on what he sees as the greater error of ignoring downstream industry costs.

The chart displays the results of Ikenson’s analysis. His study yielded 189 industries that are net “victims” of Ex-Im policy, represented in green, and a mere 47 industries that are net “winners,” represented in red. The total amount of subsidies, costs and net benefits from 2007 to 2013, along with the annualized net benefits for each category, are displayed on the chart from left to right.

The chart shows that Ex-Im subsidies impose net downstream costs on far more industries than they benefit. Each year, the 189 victim industries of Ex-Im incur costs of roughly $2.8 billion because of distorting industry subsidies. The 47 winner industries, on the other hand, enjoy net benefits of roughly $4.2 billion each year.

The chart and study show that Ex-Im is far from a free lunch. Its subsidies impose billions in downstream costs on hundreds of industries each year. What’s more, Ikenson’s study only analyzed one kind of economic cost: the downstream costs. The study did not consider the costs imposed on domestic manufacturers who compete with Ex-Im–subsidized domestic exporters, nor does it consider what alternative opportunities might have been otherwise viable in the absence of subsidies. If these indirect costs are factored in, the total true costs of Ex-Im subsidies could be even greater.

Proper debate on trade policy will consider the benefits and the costs of Ex-Im before attempting to claim that it is a good deal for all Americans. This chart shows that the costs of Ex-Im are substantial, a point that has not been fully acknowledged throughout the debate.