- | Government Spending Government Spending

- | Policy Briefs Policy Briefs

- |

The Charitable Contributions Deduction

Taxpayers who make contributions to approved charitable organizations can deduct those contributions from their income before computing their tax liability. In fiscal year 2014, the deduction lowered taxes by $47 billion, with over 93 percent of the benefits going to tax filers under the individual income tax rather than the corporate tax. Most taxpayers would benefit from removing the deduction and lowering tax rates since most taxpayers do not use the deduction regularly. The only economic justification for the deduction would be to encourage donations to organizations that provide public goods or quasi-public goods. It is unclear, however, that the charitable deduction actually encourages private sector provision of these goods.

Taxpayers who make contributions to approved charitable organizations can deduct those contributions from their income before computing their tax liability. In fiscal year 2014, the deduction lowered taxes by $47 billion, with over 93 percent of the benefits going to tax filers under the individual income tax rather than the corporate tax. Most taxpayers would benefit from removing the deduction and lowering tax rates since most taxpayers do not use the deduction regularly. The only economic justification for the deduction would be to encourage donations to organizations that provide public goods or quasi-public goods. It is unclear, however, that the charitable deduction actually encourages private sector provision of these goods.

One of the primary purposes of government is to provide certain public goods that it is not possible for the private sector to provide. Providing public goods is one of the primary roles of government as defined by almost every economist from Adam Smith through the authors of modern public finance textbooks. But just because government should assist in providing certain public goods, it does not necessarily have to provide them directly. Government could finance the private provision of public goods, or simply encourage their provision in some way.

The deduction for charitable contributions is a form of this last option: government will let private philanthropic organizations provide some public goods, and it will encourage taxpayers to fund these organizations by offering a tax benefit rather than funding the public goods out of tax revenue. To be justified economically, this tax deduction must pass several tests. Two threshold tests are: Are the organizations actually providing public goods? Does the deduction actually increase charitable donations?

Are Charitable Organizations Providing Public Goods?

For the charitable deduction to be justified economically, the government cannot simply encourage more donations to nonprofit organizations. The government must encourage donations to organizations that are providing goods undersupplied by the normal market process—or, as economists refer to them, public goods. A public good has a precise definition in economics, which is that the good in question must be nonrival in consumption (at the margin, adding more users does not diminish the quantity available) and that it must be difficult to exclude non-payers from benefitting from the good (“difficult” meaning prohibitively expensive). In common language, the term “public good” is used in a less precise way, often to mean “something nice” or “something the government supplies,” but economists have in mind a clear definition that has a very high burden. I acknowledge that governments may have other goals in mind when the tax code rewards charitable contributions, such as encouraging charity generally even if there are no positive externalities, but such other goals are hard to justify using economic criteria.

For quasi-public goods, those with some elements of both private and public goods, the role for government is less clear than for pure public goods. Education and healthcare are two clear examples of quasi-public goods. While most of the benefits of consuming these services accrue to the individual consuming them, there are also clearly some external benefits to society. (For example, society benefits from educating voters and containing contagious diseases.) And as we will see below, education and healthcare are some of the most widely supplied services by public charities.

In the case of quasi-public goods, there is a real question of how government should be involved. To facilitate access to quasi-public goods that have primarily private benefits, one possible solution is for government to encourage private provision with subsidies, with government refraining from providing the goods directly. Encouraging private provision is certainly one of the purposes of the charitable deduction, though as I will discuss below, it is questionable whether the deduction has achieved this goal.

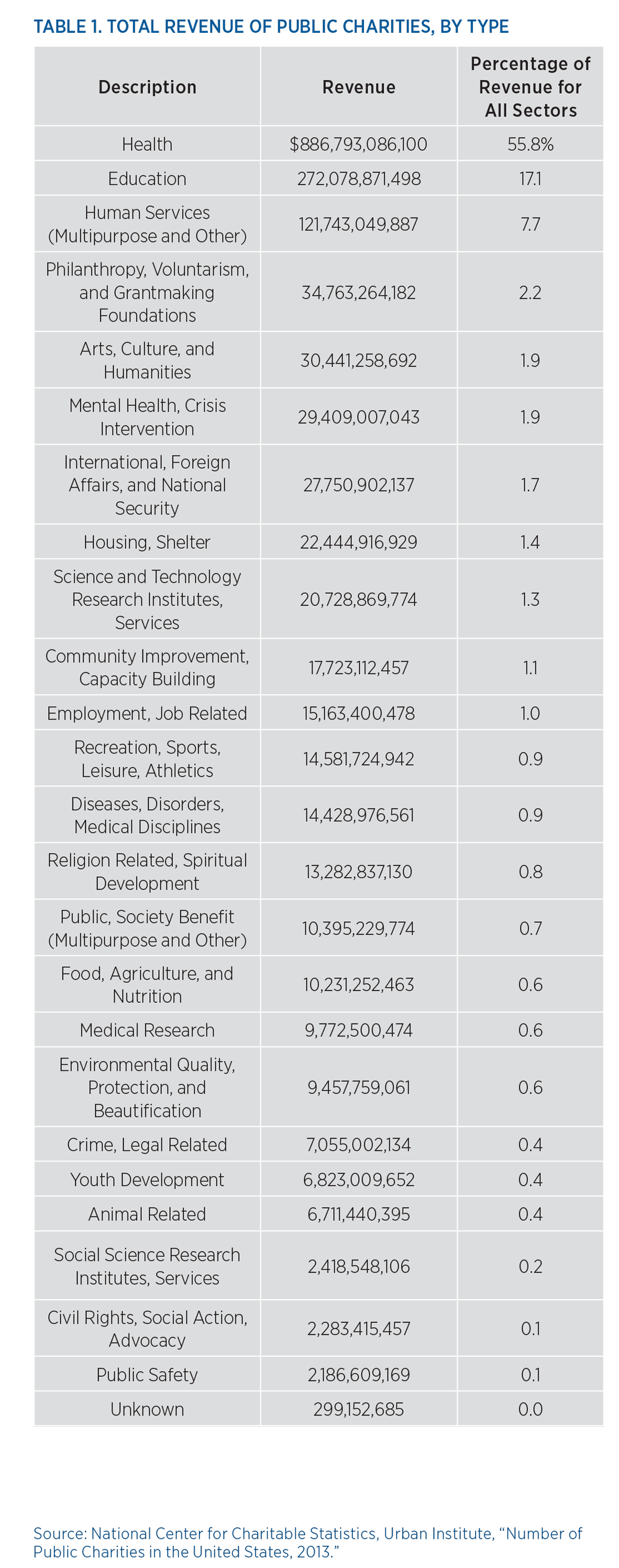

What activities are the charitable organizations engaged in? Economists Cyril Chang and Howard Tuckman examined tax-exempt organizations in the United States. They found that the majority of them provide a mixture of private and public goods, which may call into question whether they should be subsidized at all (or whether the subsidy should be based on the outputs they produce). The table below uses IRS data compiled by the Urban Institute on 501(c)(3) public charities, the main group of organizations that the charitable deduction applies to. It shows total revenue for the sectors that these charities fall into. The data are for total revenue of these organizations, not just donations, as many of these organizations obtain a significant amount of revenue from other sources (e.g., charging for services provided).

While the list of charity categories is long, the two largest—health and education—have nearly 73 percent of the revenues among public charities. These two categories certainly produce a mix of private and public goods, but arguably most of their output is private goods. As discussed above in this paper, the charitable deduction is often defended as a way of encouraging the private provision of the quasi-public goods.

Has the deduction been effective in achieving the goal of private provision? There is no easy way to answer this question, but a cursory look at health expenditure data suggests that the charitable deduction has not been powerful enough to encourage health spending to stay in the private sector. In 1960 about 70 percent of health spending was from private sources and 20 percent was from government sources, while in 2013 about 49 percent was private and 45 percent was government (the balance in each case is from categories that are a mix of private and public sources). Even starting from a later date, such as 1970, after Medicare and Medicaid had been established, private health spending was still about 56 percent and government spending was only about 33 percent.

It appears that, at the very least, the charitable deduction has not stopped the funding of quasi-public goods in healthcare from drifting into the public sector. On the other hand, the United States does still have much more private provision of education and healthcare compared to other industrialized countries.

Most other categories in the table also provide some mix of private and public goods, but there are only a few on the list that likely provide mostly public goods: national security, science and technology research, medical research, environment, crime, social science research, civil rights, and public safety. But these categories combined only represent about 5 percent of the total public charity revenues, meaning that 95 percent of the charities, based on revenue, are not clearly providing mostly public goods. Thus, the benefits to society are not clear from this tax deduction, and many of the benefits of charitable activities flow to private groups and individuals.

Does the Deduction Increase Charitable Donations?

The first important test for justifying the charitable deduction is whether or not it increases donations to charity beyond what they would be without the deduction. Ideally, a justification would also provide a benefit-cost analysis of the increase in donations since this implies that marginal tax rates must be higher than otherwise (and thus lower economic growth), but I am not aware of any studies that provide a direct comparison.

Several studies do provide a kind of benefit-cost analysis on this issue, but the “cost” they use is forgone tax revenue to the government. Nearly all of the studies in this literature find that there is some increase in charitable giving from its current tax treatment. However, one study by William C. Randolph casts doubt on the claim that the deduction increases giving in the long run. Randolph’s paper analyzes both major tax reforms in the 1980s and follows individuals for 10 years, finding that taxpayers alter the timing of their giving in response to changes in tax policy, but not necessarily the total amount of giving.

Recent experimental research attempts to answer similar questions in a slightly different venue. For example, Dean Karlan and John List find that offering to match charitable contributions ($1:$1) does increase both the size of the gift (by 19 percent) and the probability of donating (by 22 percent). But they also find that larger matches ($2:$1 and $3:$1) do not further increase an individual’s donations beyond the $1:$1 match. The current match in the federal tax code is, of course, much less than $1:$1, being determined instead by the taxpayer’s marginal tax rate. But one possible application of this result to the charitable contributions deduction is that the government may be able to make the deduction less generous but still elicit roughly the same amount in contributions.

Distribution of Benefits Across Income Groups and Suggestions for Reform

The benefits of this tax deduction skew largely to upper-income earners, as with most tax expenditures. There are three primary reasons for this, among many others: higher-income earners are more likely to itemize deductions; higher-income earners have a larger tax burden as a share of their income; and the progressive tax schedule means higher-income earners have a stronger incentive to reduce their tax burden. For the lowest-income households, those with annual income under $20,000, only 0.3 percent claim the charitable deduction. By contrast, for households with over $100,000 in annual income, almost 59 percent claim the deduction in a given year—and for those over $200,000, it is still higher at over 72 percent. For households closer to the middle of the income distribution (between $40,000 and $75,000), around 20 percent claim the charitable deduction.

There is, however, an interesting twist to the numbers for this deduction, because lower-income households also donate to charities in large numbers. Using data from the Panel Survey of Income Dynamics, economist John List shows that, first, the relationship between income and propensity to give to charity is as we would expect. Over 90 percent of higher-income households (above $100,000 in annual income) give to charity, but only 37 percent of lower-income households (under $20,000) do so. A majority of middle-income households (between $40,000 and $75,000), over 70 percent, also donate to charity. But looking only at the households that donate to charity, a reverse pattern occurs: lower-income households give a large percent of their household income (12 percent) to charity, and this declines as income increases to just 2 percent for the highest-income group (over $130,000). Thus, it is not that lower-income households do not donate to charity: many do, and on average they give a substantial portion of their income. However, very few of them benefit in terms of their tax burden, because many lower-income households have no positive tax liability.

For middle-income households the disparity is most evident: over 70 percent donate to charity, but only 20 percent can claim the tax deduction. And for those that do claim the deduction, the average tax benefits are quite small: $229 for filers in the $40,000–$50,000 group and $348 for filers in the $50,000–$75,000 group. These small dollar amounts are no doubt important to households receiving the benefit, but if the deduction were eliminated, they could easily be offset by a small reduction in marginal tax rates.

For the 80 percent of middle-income filers who do not currently claim the charitable deduction, any cut in marginal tax rates is a pure benefit. Most taxpayers would be better served by eliminating the charitable contributions deduction and using the additional revenue to lower tax rates.