- | Academic & Student Programs Academic & Student Programs

- | Government Spending Government Spending

- | Working Papers Working Papers

- |

Closing America’s Enormous Fiscal Gap: Who Will Pay?

No adjustment that sufficiently addresses the US government’s enormous fiscal gap will be small, but delaying the adjustment only increases the magnitude of the burden and shifts more of it onto future generations.

The true US debt is 16 times larger than what the government reports. Closing this fiscal gap with taxes alone would require a massive, immediate, and permanent tax increase on every American family. The burden grows with each year of congressional and presidential inaction, threatening future standards of living.

How would such a tax hike affect individual American households? A new study published by the Mercatus Center at George Mason University details how much Americans would have to pay to actually close the true fiscal gap with tax increases.

UNCLE SAM’S ZERO-SUM GAME

- The US government has a long-standing habit of understating the severity of its fiscal condition, because estimators weigh fiscal sustainability over limited time periods. When measured properly—over an infinite time horizon—the difference between all projected future government spending and all projected future government revenue and resources over time is $210 trillion, far greater than the $13 trillion usually cited.

- The true fiscal gap is 12 times the size of the US economy, and about 10.5 percent of the present value of all future US GDP. To eliminate the shortfall solely through tax increases, the government would have to immediately and permanently raise all federal taxes—personal and corporate income taxes, excise taxes, and Social Security taxes—by 58 percent.

- The required tax increase is 1 percentage point more than it was in 2013, because the fiscal gap has widened by $5 trillion since then. The increase is mainly because tens of millions of baby boomers are drawing closer to retirement, when they will be eligible for Social Security, Medicare, and (in some cases) Medicaid benefits.

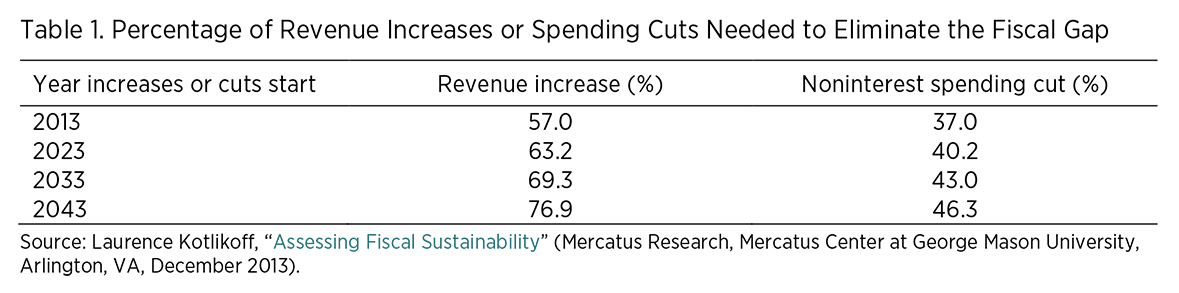

- As shown in table 1, the tax burden grows each year policymakers delay taking action. Just 10 years after 2013, the necessary increase will have swollen to more than 63 percent, and in 20 years to nearly 70 percent. Table 1 also shows that closing the gap through spending cuts would entail a less severe, but still substantial, change in fiscal policy.

THE IMPACT ON FIVE STYLIZED HOUSEHOLDS

- Evaluating the household impact of these tax changes is done by modeling married couples in three different age groups—30, 45, and 60 years old—at five different income levels (four levels of inflation-adjusted annual household labor income—$12,500, $50,000, $250,000, and $1 million—and one non-working couple with $25 million in assets).

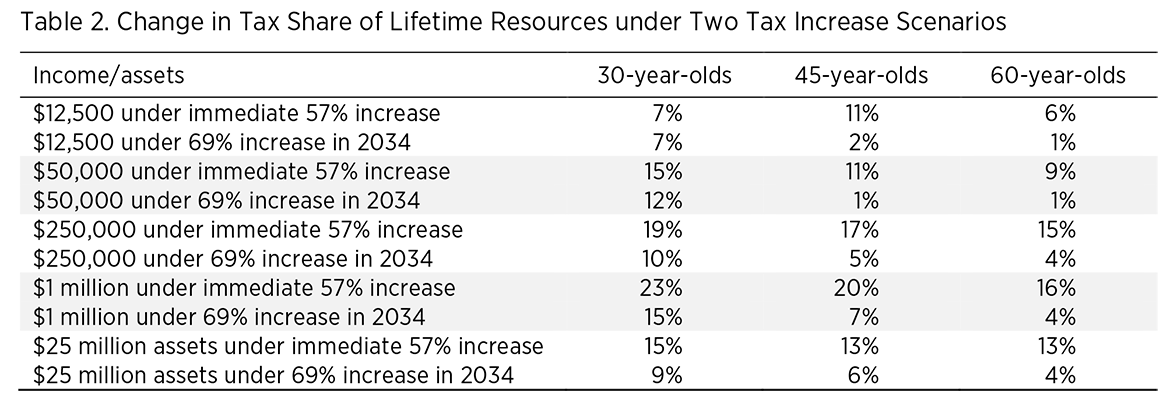

- Under the two tax increases studied, all five households in each of the three age groups face an increase in lifetime tax rates—the share of lifetime taxes paid as a percentage of the couples’ total lifetime resources.

- A 57 percent tax hike would raise lifetime taxes by 7 percentage points for 30-year-olds making $12,500 per year (see table 2). Couples of the same age making $50,000 a year would face a 15 percentage point lifetime tax increase.

- Although delaying the tax increase would increase the percentage by which the tax must increase (as shown in table 1), it would reduce the lifetime ratio of taxes to income or assets (see table 2) because the households would be paying the higher taxes for fewer years. But the remaining burden would then fall more heavily on the children of these taxpayers.

- Tax hikes lower household standards of living by reducing potential lifetime spending. A 30-year-old working couple making $250,000 a year will have almost $700,000 less to spend, in today’s dollars, over its lifetime—nearly three times the workers’ annual income. Even a family making $50,000 will have its lifetime spending reduced by more than a full year’s salary.

CONCLUSION

- No adjustment that sufficiently addresses the US government’s enormous fiscal gap will be small.

- Different households will be affected differently by the adjustment, but all will see an increase in their lifetime tax burdens if the gap is closed solely through tax increases—and even a 6 percentage point tax hike would materially reduce a household’s welfare.

- Delaying the adjustment only increases the magnitude of the burden and shifts more of it onto future generations.