- | Regulation Regulation

- | Policy Briefs Policy Briefs

- |

Confronting the Problem of Stealth Regulation

While agencies must have some leeway to carry out their missions and prioritize activities, agencies have many opportunities to evade checks and balances altogether via an array of mechanisms that circumvent the traditional rulemaking process. Congress and the president have many options available to strike a better balance between agency discretion and agency evasion of notice-and-comment and economic analysis requirements.

The federal regulatory system includes two important components, each designed to ensure that the regulatory process works to advance the interests of the American people. First, the Administrative Procedure Act of 1946 (APA) compels regulatory agencies to consider the wishes of the American public via a process of public participation in rulemaking. Second, regulatory review by the Office of Information and Regulatory Affairs (OIRA), in place since the early 1980s, provides assurance that a minimal level of evidence, especially economic evidence, is supplied to support agency decisions. Along with judicial review and congressional oversight, these components provide the checks and balances that are the foundation of the modern regulatory state.

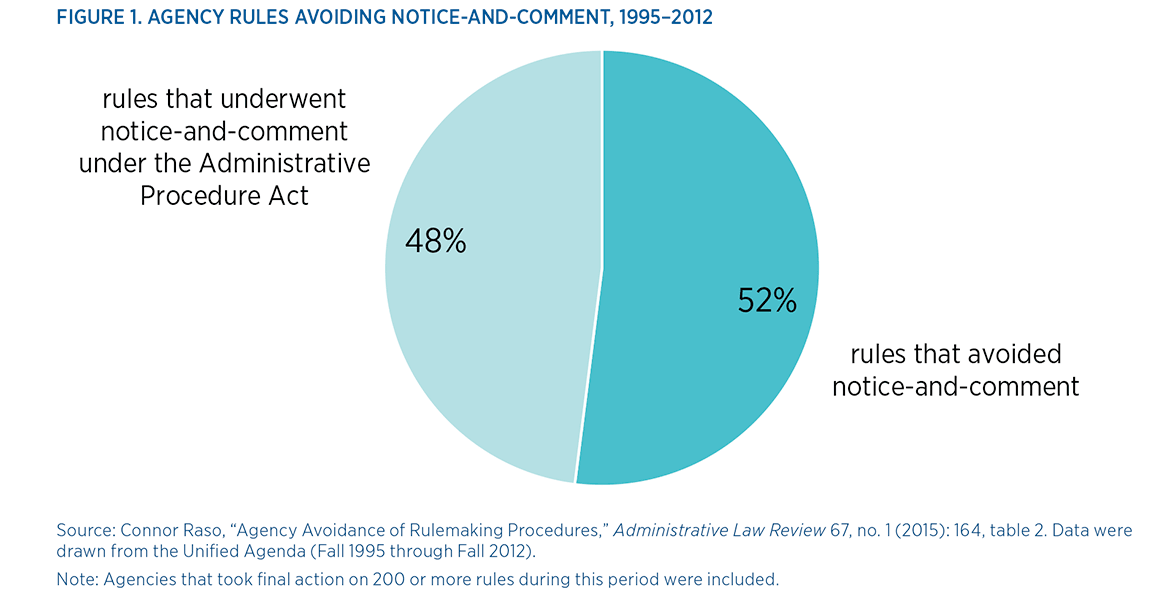

Whether intentionally or not, agencies often avoid these procedural requirements. A recent study finds that agencies avoided the notice-and-comment process, which facilitates public participation in rulemaking, in almost 52 percent of regulations finalized from 1995 to 2012. Meanwhile, only about 8 percent of final regulations underwent OIRA scrutiny between fiscal years 2004 and 2013. More troubling, however, is the fact that agencies can evade checks and balances altogether via an array of mechanisms that circumvent or bypass the traditional rulemaking process. This type of under-the-radar rulemaking is known as stealth regulation.

COMMON EXAMPLES OF STEALTH REGULATION

A nonexhaustive list of stealth regulatory activities is presented here.

Guidance Documents and Policy Memoranda

Guidance documents and policy memoranda are sets of instructions or announcements written by agencies to inform regulated parties how to comply with a statute or a regulation. Providing guidance to industry can be helpful, and some of these documents serve a useful purpose. Agencies can also use guidance documents to control staff activities and provide clarity about the agency’s regulatory approach. However, agencies may also use these documents to avoid the scrutiny of public debate aroused by the notice-and-comment process.

Guidance documents can have the same effects as a regulation adopted under the APA if regulated entities have no realistic choice but to comply with these agency directives. Moreover, agencies can change these directives without notice-and-comment, and because these documents are generally not published in the Code of Federal Regulations, compliance is more costly for firms that must survey an array of sources to determine how to maintain compliance. For example, in July 2013 the IRS delayed implementing employer reporting requirements and employer responsibility payments under the Affordable Care Act by issuing a bulletin to businesses. The bulletin outlined how businesses could stay in compliance during the transition period before reporting requirements and fines would fully kick in. No public feedback was solicited on the bulletin, nor was the bulletin accompanied by an economic analysis (known as a regulatory impact analysis or RIA), even though the policy had large economic effects.

In some cases, OIRA reviews significant guidance and policy documents issued by agencies. However, evidence suggests many of these documents are escaping OIRA’s watchful eye. For instance, the FDA’s online guidance database lists 421 final guidance documents issued since President George W. Bush’s executive order requiring significant guidance documents to undergo OIRA review. At the same time, OIRA lists only one FDA notice as having been reviewed during this period. The OIRA website is vague about what constitutes a notice, and the FDA guidance database does not allow for sorting of documents by their economic impacts. More clarity about what constitutes guidance notices worthy of review by OIRA would be valuable for determining whether the hundreds of FDA documents avoiding OIRA oversight deserve more scrutiny.

Rule Interpretations

In June 2014, the Federal Aviation Administration (FAA) issued a rule interpretation that effectively outlawed commercial use of unmanned aircraft systems (UAS for short, often referred to as drones). The rule interpretation built on previous informal regulatory mechanisms, including a 1981 FAA advisory circular on model aircraft and a 2007 UAS policy statement. The FAA’s action extended definitions from these older documents to a 2012 special rule that exempted model (toy) aircraft from more burdensome aspects of FAA regulation. Specifically, the FAA’s rule interpretation excluded commercial UASs from qualifying for exemptions afforded to model aircraft, effectively outlawing commercial activities, at least temporarily. While the FAA did take comments from the public in this case, no RIA accompanied the interpretive rule despite the large economic ramifications of the policy.

Agencies’ Collaboration with State-Level Authorities and Nongovernmental Interest Groups

In some instances, federal regulators collaborate with key state regulators to set standards that have national implications. In 2009, the EPA granted a waiver to California to set its own standards, in excess of federal standards, for greenhouse gas emissions from automobiles. Given that California is a large part of the US car market, this change had major implications for the entire market. This policy was not accompanied by a national benefit-cost analysis.

Similarly, states and nonprofit organizations sometimes sue federal regulatory agencies and then settle by entering into a consent decree that requires a regulation. This is troubling when the interests of the regulatory agency and the plaintiff are aligned, and other actors are shut out of the process. This phenomenon appears to be specific to certain offices within regulatory agencies rather than widespread throughout the government. Still, the consequences of such activities can be large, even if infrequent. The sue-and-settle approach, by speeding regulations through the rulemaking process in response to judicially imposed deadlines, limits OIRA’s ability to inform regulatory decisions.

Failure to Enforce Existing Rules

Agencies must have some leeway to set their own agendas and prioritize enforcement activities, given their limited resources. However, at times agencies simply choose not to enforce existing laws and regulations, and such discretion can create new policy. For example, in 2014 the Department of Homeland Security issued a series of memoranda related to immigration enforcement in the United States. Among other things, these memos expanded a program that limited deportation of illegal immigrants who came to the US as children and extended protections to certain relatives of such individuals. Neither these memos nor a previous memorandum that first ordered the new deportation policy in 2012 underwent OIRA review, was accompanied by a regulatory impact analysis, or allowed public participation through notice-and-comment.

Agency Threats

Threats by agency officials, ad hoc enforcement, informal threats by compliance inspectors, and warning letters are some of the methods most available to agencies to influence firms’ behavior, as well as some of the most difficult to monitor. In 2013, the FDA issued a warning letter to 23andMe Inc., a company that sold home genetic tests, including disease-risk analyses. The letter directed the company to cease offering its personal genome services until it received further approval from the FDA. 23andMe responded by ceasing its disease-risk analysis services, although it continued its genetic testing services. Warning letters such as this clearly elicit responses from regulated firms, although the letters are not technically binding like statutes or regulations are.

Solutions

Many options exist for Congress or the president to address agency evasion of notice-and-comment and economic analysis requirements. Some of these options are presented here.

Improve Tracking of Agency Evasion Tactics

The lack of systematic tracking of stealth regulation activities makes the extent of the problem hard to measure. Agencies should be required to post guidance documents and policy memos online in a central location, much as the FDA does through its guidance database. A central guidance website for all government guidance, like regulations.gov for regulations, might also help measure and track.

Increase OIRA Resources

OIRA’s staff has shrunk considerably since its creation, from a peak of about 90 employees to fewer than 50 at the start of the Obama administration and to a low of 38 at the end of 2013. Meanwhile, regulatory agencies have roughly doubled in size during that period, with more than 200,000 people now employed at rule-writing agencies. Regulatory agencies outspend OIRA by a factor of 7,000 to 1, while the small staff at OIRA is charged with overseeing roughly 3,000 regulations finalized each year. OIRA’s budget and staffing levels should be increased.

Require Regulatory Impact Analysis and OIRA Review for Significant Guidance Documents

A president could require agencies to conduct an RIA for significant guidance documents, policy memos, and rule interpretations. Congress could also impose such a requirement via legislation. Alternatively, the OIRA administrator could be empowered to require an RIA from agencies on a case-by-case basis.

Allow Judicial Review of Significant Guidance Documents

Evidence suggests that agencies are more likely to evade rulemaking procedures when they face little litigation risk. Allowing judges to review significant guidance documents could raise the cost to agencies of evading notice-and-comment rulemaking and encourage a return to more traditional rulemaking channels.

More Specific Instructions from Congress

Congress is often vague about what it is authorizing an agency to do, and it sets unrealistic deadlines that force agencies to improvise policy responses on the fly. Going forward, Congress should be as specific as possible about what it is authorizing an agency to do when legislation is written, and should give agencies ample time to write regulations when setting statutory deadlines. These principles will limit agencies’ ability to expand their regulatory domains, while also giving regulators the flexibility to write rules according to a realistic timetable.

Conclusion

While agencies must have some leeway to carry out their missions and prioritize activities, agencies have many opportunities to evade checks and balances altogether via an array of mechanisms that circumvent the traditional rulemaking process. Congress and the president have many options available to strike a better balance between agency discretion and agency evasion of notice-and-comment and economic analysis requirements.