- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

Cronyism: Green Car Edition

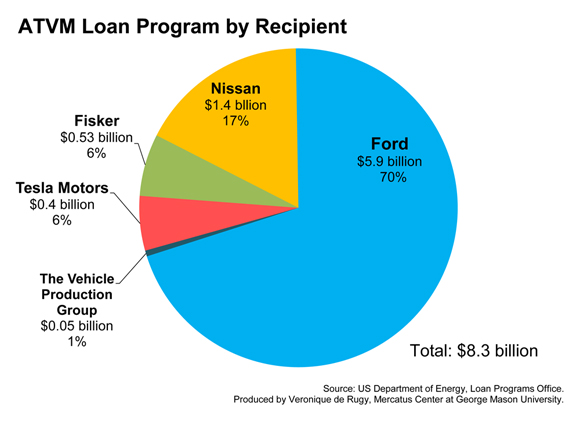

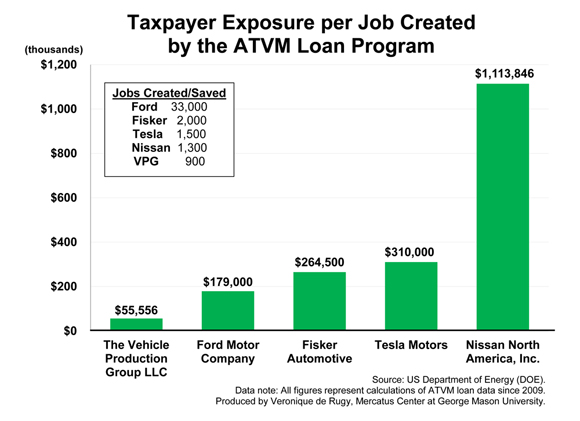

Since 2009, the Department of Energy (DOE) provided guaranteed loans through its Advanced Technology Vehicles Manufacturing (ATVM) loan program valued at approximately $8.4 billion to Ford, Nissan, Fisker Automotive, and other car manufacturers. The DOE touted the ATVM loan program as a tool for boosting America’s “clean energy economy” by adding nearly 38,700 jobs. Far less attention was paid to how the loan commitments exposed taxpayers to excessive risk, to the tune of about $217,028 per job “created or saved.”

Since 2009, the Department of Energy (DOE) provided guaranteed loans through its Advanced Technology Vehicles Manufacturing (ATVM) loan program valued at approximately $8.4 billion to Ford, Nissan, Fisker Automotive, and other car manufacturers. The DOE touted the ATVM loan program as a tool for boosting America’s “clean energy economy” by adding nearly 38,700 jobs. Far less attention was paid to how the loan commitments exposed taxpayers to excessive risk, to the tune of about $217,028 per job “created or saved.”

The first chart breaks down the distribution of ATVM loans. The second chart presents estimates of total taxpayer exposure for every job “created or saved” by recipients, as reported by the DOE. The DOE’s job numbers include jobs that were created as a result of the loan guarantee; jobs that once existed but have since been eliminated; jobs that exist independent of the loan program; and jobs that already existed but are now considered “green jobs.” For example, the DOE reports that the loan “converted” nearly 33,000 existing Ford jobs to green manufacturing jobs. Also, it is worth noting that DOE still attributes 2,000 jobs to Fisker, even though the company’s workforce shrank to 50 following the latest round of firings.

Many are referring to Fisker Automotive a $529 million recipient of ATVM loans hovering at the brink of bankruptcy as the Solyndra of the electric car industry. The worst part of this story, once again, is that most of the money guaranteed by the Department of Energy went to companies that should have borrowed money on their own. Instead, the government played venture capitalist with our money, causing systemic and unintended distortions to the market.

Data note: Calculations are based on data from the US Department of Energy’s Loan Programs Office. The figures in the chart represent the total loan amounts received by a recipient, divided by the reported number of jobs “created or saved.”