- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

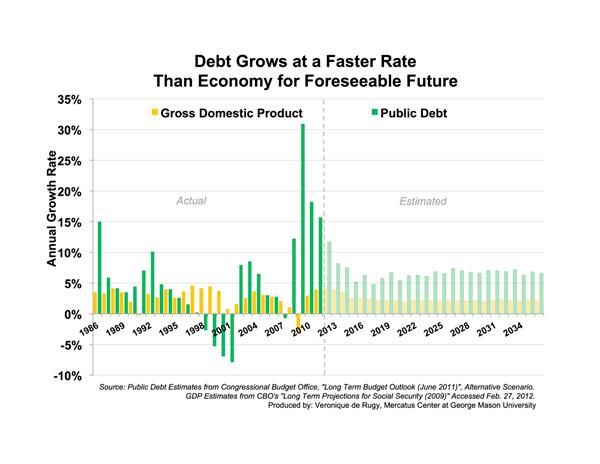

Debt Grows at a Faster Rate Than Economy for Foreseeable Future

For the first time in U.S. history, the annual growth rate of debt is projected to remain above the growth of the economy for more than a decade.

This week Mercatus Center senior research fellow Veronique de Rugy examines the annual rates of growth in U.S. public debt and the economy (measured as gross domestic product). Drawing on data from the Congressional Budget Office’s long-term alternative budget scenario and historical estimates, she calculates fifty years of changes in debt held by the public and economic growth.

Each bar in the chart represents the rate of growth in debt or GDP relative to the previous year. The bar in 2009, for instance, shows a 31 percent growth in debt (green) and 3% decline in GDP (yellow), each representing the year-to- year percentage change since 2008. It is important to note that the data do not represent the total amount of debt or GDP for the given years. In 2011, debt grew by 16 percent and GDP by 4 percent.

For the first time in U.S. history, the annual growth rate of debt is projected to remain above the growth of the economy for more than a decade. The longest periods of growth in debt above economic growth have typically come in 2- to 5-year increments: 1986–1987, 1990–1993, and 2002-2003. These periodic fluctuations before 2009 reflect a normal trend of the economy adjusting to changes in government fiscal and economic policies.

For the foreseeable future, the economy is projected to grow at a rate below 4 percent while growth in the public debt will hover around 7 percent. Clearly, this trend is not sustainable.

Veronique de Rugy provides evidence of how to improve the debt-to-GDP ratio at the Mercatus Center.