- | Government Spending Government Spending

- | Policy Briefs Policy Briefs

- |

Does Government Spending Stimulate Economies?

In response to the financial crisis, Congress passed the American Recovery and Reinvestment Act(ARRA) in February 2009, which totaled $789 billion in government spending. President Obama reassured

In response to the financial crisis, Congress passed the American Recovery and Reinvestment Act (ARRA) in February 2009, which totaled $789 billion in government spending. President Obama reassured anxious Americans that this spending would "revive our economy" and "create 3.5 million jobs" over the next two years.1

A new study by Harvard professor Dr. Robert Barro and Charles Redlick tests this claim and the economic theory that underlies it by using defense spending as a proxy for overall government spending.2 Their research finds that greater government spending does not aid the economy; in fact, it causes decreased consumption and investment.

THE THEORY OF MULTIPLIERS

It is difficult to get solid evidence on the economy's response to changes in government spending. Direct reporting measures—such as those employed by Recovery.gov, the U.S. government's website for tracking stimulus spending—capture the direct and observable effects of government spending on economic activity. These measures can be helpful, but they fail to account for the indirect, less-easily observable effects of government spending. To capture the big-picture effect of government spending, economists turn to the spending multiplier.

The multiplier effect or spending multiplier refers to the idea that an initial amount of government spending leads to a change in the activity of the larger economy. In other words, an initial change in the total demand for goods and services (what economists term aggregate demand) causes a change in total output for the economy that is a multiple of the initial change. For example, if the government spends one dollar and, as a result of this spending, the economy (as expressed by the Gross Domestic Product, or GDP) grows by $2, the spending multiplier is 2. If the economy grows by $1.50, the spending multiplier is 1.5. However, if the economy only grows by 50 cents (a loss from the original $1 spent), the spending multiplier is 0.5.

THE SPENDING MULTIPLIER DEBATES

The theory sounds pat, but economists have been debating aspects of government spending multipliers for years. One crucial debate centers on how to measure a multiplier's value. Some economists find spending multipliers that are smaller than 1.3 Other economists, however, assert that spending multipliers are much larger.4 Still others argue that multipliers can't even be credibly measured.5

Another debate surrounds the implications of spending multipliers. For Keynesians, consumption is the ultimate goal of government spending, and even with a multiplier smaller than 1, spending can still increase GDP. Thus Keynesians argue that, during a recession, when people tend to save their money rather than investing it in the private market,6 a small increase in GDP is better than nothing.

Simple Keynesian macroeconomics assumes that in times of high unemployment, the government is better than the private market at guiding idle resources to create economic output. Government spending puts unemployed labor and capital to work at zero social cost.7 When the government puts this previously unemployed labor and capital to work, the mobilized labor and capital produce added goods and services that private sector was unable to create.

A New Classical understanding of the multiplier starts with the idea that government spending has some social cost (i.e. a rise in government spending requires a fall in other parts of GDP, such as consumption and investment.) As such, the value of the public projects (bridge construction or roads) needs to justify that social cost. This view doesn't assume that an increase in consumption at any cost is a good thing: if the multiplier's value is less than 1, then government spending has crowded out the private investment and spending that would have otherwise happened.

Even government spending where the multiplier is higher than 1 could still be a poor use of taxpayer dollars. For instance, though $1 in government spending could lead to a GDP boost of $1.50 in the short run, it could also make it harder to solve the longer-term-debt problem.

THE DATA OF DEFENSE

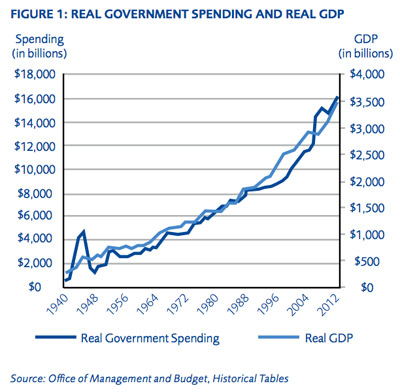

So what is the historical value of the multiplier in the United States? Barro and Redlick examine this question in detail. They explain that in order to understand the effects of government spending on the economy, one must know how much of the economic change is due to government spending and how much is due to other factors. Unfortunately, it is impossible to figure this out with general government spending, since the level of government spending often expands and contracts along with the economy.8 When the economy grows, income and tax receipts increase. This, in turn, leads to increased government spending (see figure 1).

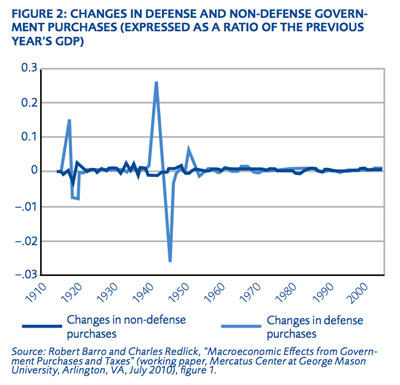

However, they argue that there is a useful, much more isolated proxy for overall government spending: defense spending. Using defense spending as a proxy has several advantages.9 First, government does not set defense spending levels based on the state of the economy. Non-economic factors drive defense spending. Second, changes in defense spending are very large and include sharply positive and negative values (see figure 2).

Finally, the historical data on defense spending covers periods of high unemployment. Thus this data set should reveal whether government spending creates increased economic growth in a slack economy.

Moreover, studying the effects of defense spending on the economy gives the best-case scenario of the spending multiplier effect of government spending on the economy because defense spending leads to economic growth in ways that general government spending does not. For example, in times of war, the government mandates the increased production of particular goods, and the scarcity of domestic labor due to military enlistment and resources also forces economic resources to go to innovative and productive uses that did not exist before the war.10

Barro and Redlick's research estimates that the multiplier for changes in defense spending that people think will be temporary—spending for the Iraq war for example—is between 0.4 and 0.5 at the time of the spending and between 0.6 and 0.7 over two years. If the change in defense spending becomes permanent, then these multipliers increase by 0.1 to 0.2.11 Over time, this is a maximum multiplier of 0.9. Thus even in the government's best-case spending scenario, all of the estimated multipliers are significantly less than one. This means greater government spending crowds out other components of GDP, particularly investment.

In addition, they calculate the impact on the economy if the government funds the spending with taxes. They find that the tax multiplier—the effect on GDP of an increase in taxes—is -1.1. This means that if the government raises taxes by $1, the economy will shrink by $1.1. When this tax multiplier is combined with the effects of the spending multiplier, the overall effect is negative. Barro and Redlick write that, "Since the tax multiplier is larger in magnitude than the spending multipliers, our estimates imply that GDP declines in response to higher defense spending and correspondingly higher tax revenue."12 Thus, they conclude that greater government spending financed by tax increases hurts the economy.

Other economist have also calculated defense spending multipliers of less than or equal to 1.13 Economists Bob Hall and Susan Woodward recently examined spending increases from World War II and the Korean War and found that the government spending multiplier is about 1.14 Economist Valerie Ramey's work on how U.S. military spending influences GDP gives a multiplier estimate of 1.2 in the short term, but in the long term, she finds that consumer and business spending fall after a rise in government purchases, offsetting the initial effect of the government spending.15

WHY DOES IT MATTER?

Getting the multiplier wrong has big consequences when understanding the effects of fiscal stimulus on the economy. The government uses multipliers to estimate the widely cited projections of unemployment, job creation, and economic output. In the time leading up to the passage of the ARRA, Council of Economic Advisors (CEA) economists Christina Romer and Jared Bernstein used spending multipliers greater than 1 to promote the economic effects of the fiscal stimulus package.16 In the months following the implementation of this package, the Congressional Budget Office (CBO) used estimates of a spending multiplier between 1.0 and 2.5,17 relying on macroeconomic models that ignore the possibility that the growth of the economy may be affecting the level of government spending and not the reverse.18 By extrapolating from these multipliers, CBO and CEA have made important projections about the effects of fiscal stimulus on the economy. These projections, however, have been largely wrong.

For example, in their January 2009 report,19 Romer and Bernstein used multipliers of between 1.0 and 1.55 to determine the effect of the proposed stimulus spending (then $775 billion) would have on GDP and job creation. They assumed that each 1 percent increase in real GDP would create an additional 1 million jobs. Based on that assumption and their estimated spending multiplier, they estimated that the fiscal stimulus would create 3.5 million jobs by the end of 2010. While we cannot be certain how many jobs would have been lost or created without a stimulus package, we do know that since January 2009, 3.8 million jobs have been lost.20

CONCLUSION

The understandable temptation to take action in time of recession should not lead lawmakers to take counterproductive actions. Barro and Redlick's data show that the CBO's multiplier overestimates the return on government spending almost by a factor of two. Thus, while the stimulus may appear to be a wise investment, it is really no wiser than a junk-rated mortgage-backed security; though the investment claims a good rate of return, in reality the return isn't worth it because money is lost.

If stimulus funds are a bad investment, is there anything Congress can do to help the economy? Perhaps. In their recent research, Christina and David Romer look at the impact of tax cuts on the economy and conclude that the tax multiplier is about 3: $1 of tax cuts raises GDP by about $3.21 This finding suggests that the economy might get more bang for the buck with tax cuts rather than spending hikes.

ENDNOTES

1. Barack Obama, "Address to Joint Session of Congress" (speech, The United States Capitol, Washington, D.C., February 24, 2009), http://www.whitehouse.gov/the_press_office/remarks-of-president-barack-….

2. Robert Barro and Charles Redlick, "Macroeconomic Effects from Government Purchases and Taxes" (working paper, Mercatus Center at George Mason University, Arlington, VA, July 2010).

3. Robert Barro, "Government Spending Is No Free Lunch," Wall Street Journal, January 22, 2009, http://online.wsj.com/article/SB123258618204604599.html.

4. For estimates of multipliers greater than 1, see Marianne Baxter and Robert G. King, "Fiscal Policy in General Equilibrium," American Economic Review 83, no. 3 (1993): 315-334; Christina Romer, Jared Bernstein, "The Job Impact of the American Recovery and Reinvestment Plan," January 10, 2009, http://otrans.3cdn.net/45593e8ecbd339d074_l3m6bt1te.pdf; and Andrew Mountford and Harald Uhlig, "What are the Effects of Fiscal Policy Shocks?" (working paper no. 14551, National Bureau of Economic Research, December 2008).

5. Murray Rothbard, "Money and Its Purchasing Power," in Man, Economy and State, With Power and Market, http://mises.org/rothbard/mes/chap11a.asp.

6. Michael Woodford, "Simple Analytics of the Government Expenditure Multiplier" (working paper, Columbia University, January 27, 2010), 43, http://www.columbia.edu/~mw2230/G_ASSA.pdf.

7. Another way to think of this is that there is something wrong with the price system. To learn more about why this is not the case in a world with rational actors, see Robert Barro, "Long-term contracting, sticky prices, and monetary policy," Journal of Monetary Economics 3, no. 3 (July 1977): 305-316.

8. Zvi Hercowitz and Michel Strawczynski, "Cyclical Ratcheting in Government Spending: Evidence from the OECD," The Review of Economics and Statistics 86, no. 1 (February 2004): 353-361; and Graciela L. Kaminsky, Carmen M. Reinhart, and Carlos A. Vegh, "When It Rains, It Pours: Procyclical Capital Flows and Macroeconomic Policies," NBER Macroeconomics Annual 19, (2004): 11-53.

9. The use of defense spending as an exogenous shock to study the effect of government spending has been explored in-depth in Roberto Perrotti, "In Search of the Transmission Mechanism of Fiscal Policy" (working paper 13143, National Bureau of Economic Research). In addition, it has been used as an econometric tool to study the effects of fiscal stimulus on the economy in a number of studies, including Olivier Blanchard and Roberto Perotti, "An Empirical Characterization of the Dynamic Effects of Changes in Government Spending," Quarterly Journal of Economics 107, no. 4 (November 2002): 1329-1368; and Miguel Almunia and others, "From Great Depression to Great Credit Crisis: similarities, differences and lessons" Economic Policy 25, no. 62 (2010): 219-265; among others.

10. Barro and Redlick, "Macroeconomic Effects from Government Purchases and Taxes," 32.

11. Ibid, 44.

12. Ibid, 29.

13. See Blanchard and Perotti, "An Empirical Characterization of the Dynamic Effects of Changes in Government Spending and Taxes on Output" and Robert E. Hall, "By How Much Does GDP Rise If the Government Buys More Output?" Brookings Papers on Economic Activity (Washington, DC: Brookings Institute, forthcoming).

14. Robert Hall and Susan Woodward, "Measuring the Effect of Infrastructure Spending on GDP," in Financial Crisis and Recession, December 11, 2008, http://woodwardhall.wordpress.com/2008/12/11/measuring-the-effect-of-in….

15. Valerie Ramey, "Identifying Government Spending Shocks: It's All in the Timing" (unpublished, University of California-San Diego, October 2009).

16. Romer and Bernstein, "The Job Impact of the American Recovery and Reinvestment Plan," 12.

17. Congressional Budget Office, Estimated Impact of the American Recovery and Reinvestment Act, January 2010 through March 2010 (Washington, DC: Congressional Budget Office, May 2010), http://www.cbo.gov/ftpdocs/115xx/doc11525/05-25-ARRA.pdf.

18. Ibid, appendix. For an example of models operating under similar assumptions, see R. C. Fair, "Estimated Macroeconomic Effects of the U.S. Stimulus Bill," unpublished, Yale University, March 2010.

19. Romer and Bernstein, The Job Impact of the American Recovery and Reinvestment Plan.

20. Authors' calculations using data from the Bureau of Labor Statistics, Employment, Hours, and Earnings from the Current Employment Statistics Survey, total change in nonfarm payroll employment, January 2009 to May 2010.

21. Christina D. Romer and David H. Romer, "The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks" (working paper, University of California-Berkeley, March 2007), http://www.econ.berkeley.edu/~cromer/RomerDraft307.pdf.