- | Academic & Student Programs Academic & Student Programs

- | Government Spending Government Spending

- | Policy Briefs Policy Briefs

- |

Don’t Put American Innovation in a Patent Box: Tax Policy, Intellectual Property, and the Future of R&D

In an increasingly global economy, national governments are searching for ways to keep corporations from moving highly valuable intellectual property and associated economic activity to lower tax jurisdictions. In particular, governments are concerned with losing jobs, investment that fosters innovation, and the tax base attributable to income arising from intellectual property. One proposed solution is a patent box, also called an innovation box. A patent box lowers the rate of corporate income taxes paid on income originating from targeted intellectual property.

Key Findings

- A patent box is not a solution to the many problems facing the US corporate income tax system.

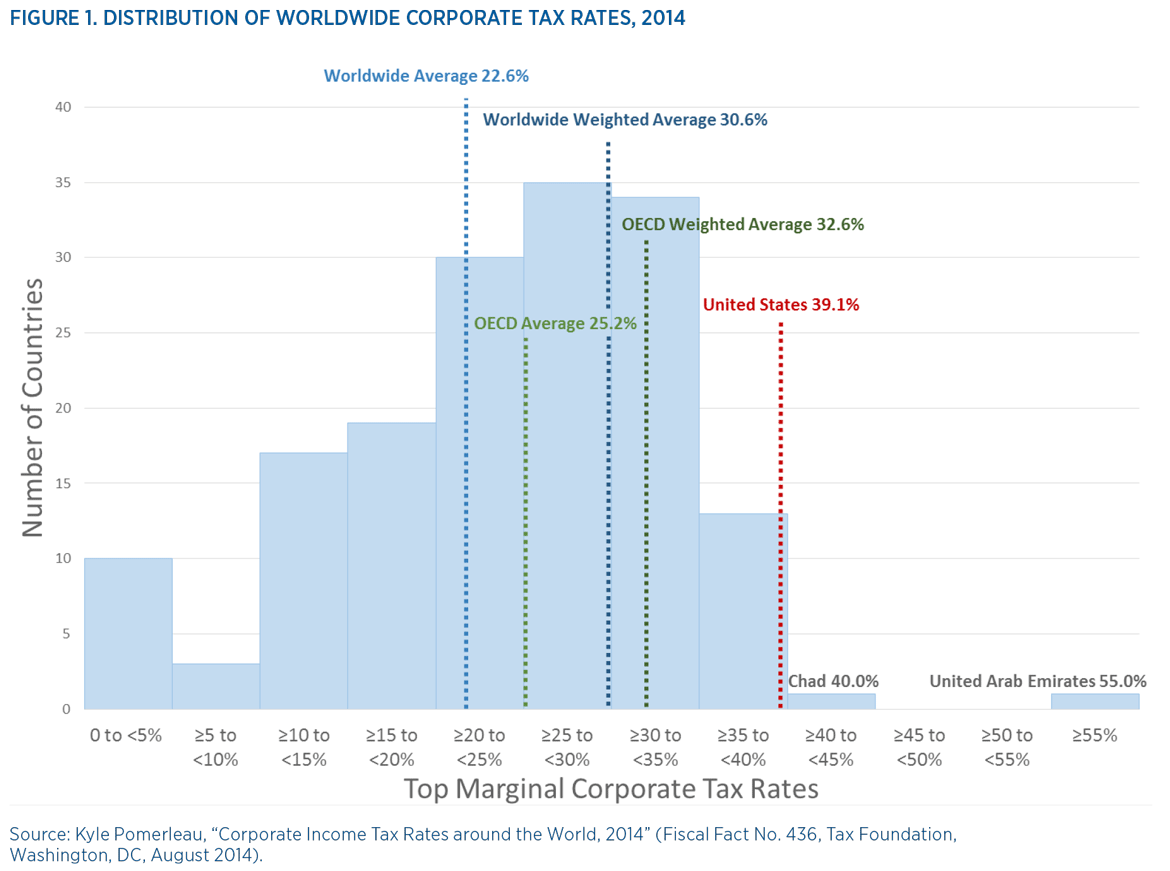

- The United States has a 39.1 percent combined state and federal corporate tax rate—the highest rate in the developed world and well above the Organisation for Economic Co-operation and Development (OECD) average of 25.2 percent.

- A patent box increases tax code complexity, but will not increase innovation, job creation, or tax revenue.

- The proper policy to retain and attract business investment and encourage innovation, research, and development is to lower the corporate tax rate for all US businesses.

In an increasingly global economy, national governments are searching for ways to keep corporations from moving highly valuable intellectual property and associated economic activity to lower tax jurisdictions. In particular, governments are concerned with losing jobs, investment that fosters innovation, and the tax base attributable to income arising from intellectual property. One proposed solution is a patent box, also called an innovation box. A patent box lowers the rate of corporate income taxes paid on income originating from targeted intellectual property.

Congress is considering adding a patent box to the US corporate tax code to keep mobile intellectual property from leaving the United States and to further support domestic innovation. Rather than a solution to the problem, the patent box is a poor substitute for much needed holistic corporate income tax reform. International experiences with patent boxes have not demonstrated they are able to remedy any of the problems they aim to fix. The academic literature suggests that a patent box will not improve measures of job creation, innovation, or tax revenue. A better approach to encourage innovation, research, and development would be to lower the corporate tax rate for all businesses.

Profit Shifting: the Result of Systemic Problems

The United States has the single highest combined corporate tax rate in the Organisation for Economic Co-operation and Development (OECD) and the third-highest rate in the world (behind the United Arab Emirates and the Republic of Chad). As shown in figure 1, the average top combined US corporate tax rate is 39.1 percent, higher than the worldwide and OECD averages. The United States is one of just three OECD countries that have not lowered their corporate tax rates in the past 15 years. Furthermore, the United States is one of only six OECD countries that still attempts to tax the global income of multinationals headquartered domestically (offering a credit for foreign taxes paid when profits are brought back into the United States). Worldwide taxation at high rates has led to over $2 trillion in US corporate profits being kept out of the US economy.

Because of high corporate tax rates, US corporations face some of the world’s strongest financial incentives to move overseas. Rather than physically relocate as a way to lower tax burdens, it is often easier for corporations to move intellectual property or just the profits associated with the intellectual property. Pejoratively described as “profit shifting,” firms design elaborate tax strategies to lower US tax bills in order to compete in global markets where competitors are taxed at lower rates.

Profit shifting is a central issue in the taxation of multinational corporations. Leveraging the differences between tax systems will always result in corporate tax planning. Global fears of tax-base erosion caused by profit shifting have increased the perceived need for a patent box to incentivize domestic intellectual property ownership. The OECD’s base erosion and profit shifting project has popularized the idea that high-tax welfare states are losing their tax base to low-tax counties.

Patent Box Design and Complexity

Patent boxes have been described as a “Pandora's box of complexity.” Increased tax code complexity has been shown to slow economic growth. The United States has the eighth most complex tax code of 34 OECD peer countries. According to PricewaterhouseCoopers it takes 40 percent more time to comply with the corporate tax code in the United States (a total of 87 hours each year) than the 52-hour OECD average.

A patent box requires certain income to fit a specified definition of income eligible for the lower tax rate. Two members of the House Ways and Means Committee, Charles W. Boustany Jr. (R-LA) and Richard E. Neal (D-MA), have introduced patent box legislation that allows corporations to deduct 71 percent of qualified profits. Qualified profits are “tentative innovation profits” multiplied by the corporation’s research and development (R&D) intensity (the past five years of R&D expenditures divided by past operating expenses). The legislation defines innovation profits as profits from “patents, inventions, formulas, processes, knowhow, computer software, and other similar intellectual property, as well as property produced using such IP.” The 71 percent deduction results in a 10.15 percent tax rate on patent box profits.

A 10.15 percent tax rate on certain profits—a reduction of 24.85 percentage points for US firms—will place strong incentives on firms to manipulate the definitions of qualified profits to maximize tax savings by taking advantage of the lower rate. Similar definitions used by current US R&D incentives have been manipulated to increase tax savings. For example, the amount of claimed R&D spending significantly increased after the favored tax status was introduced in 1981. In a process known as relabeling, firms hire armies of lawyers to relabel profits on their income statement and tax returns, without changing any real investments.

The proposed Boustany–Neal definition of qualified profits is not fully fleshed out, as the Ways and Means Committee itself recognizes in its request for feedback. Even with fully developed definitions, the Internal Revenue Service (IRS), which will ultimately be tasked with writing legal definitions, has struggled in the past to define qualified research. When the IRS issued its first regulatory interpretation of qualified R&D in 1998, it had to withdraw multiple consecutive versions of its definition following harsh criticism from both taxpayers and Congress. The research credit’s definition of qualified research continuously evolves through legal challenges, with significant reinterpretation of the law happening as recently as January 2015.

The world of intellectual property has no bright lines. Similar to IRS definitions of qualified research, following implementation, each minutia of the qualified profits definition will need to be litigated, reinterpreted, and litigated again. Under the US proposal it is hard to conceive of a service or good that does not use a “design” or “knowhow" in its production. Tax expert Martin Sullivan notes that it is “likely that nearly all profits from manufacturing would qualify” for the lower tax rate. Policymakers should be concerned that resources spent interpreting, litigating, and following the law will divert resources away from real economic innovation.

Patent boxes introduce arbitrary distortions into the tax code. The tax benefits to the Boustany–Neal plan vary widely based on a corporation’s R&D intensity and profitability. The disparate incentive will drive many firms to reorganize to maximize the tax benefits available. Tax distortions of this type inefficiently change the allocation of real resources, often causing unintended consequences. The asymmetric subsidy from a patent box will inadvertently distort investments further. Anytime distortions are introduced into the tax system policymakers must weigh the benefits against the often high and uncertain costs.

Common Justifications for Patent Boxes

The patent box is a powerful tax incentive that will undoubtedly change corporate behavior. But policymakers’ statements are unclear as to what exactly they hope the patent box will encourage. Some common justifications include intervening in the market to subsidize a positive externality, protecting US jobs from overseas competition, and increasing tax revenue.

Subsidizing Positive Externalities

There are few economic justifications for subsidizing profits from intellectual property. Economic intervention is usually justified when there is a market failure—or, in this case, when the returns to new ideas (R&D) cannot be fully captured in private profits. For example, inventors are granted exclusive rights to new ideas through patents so they can make profits on their investments. Economic theory suggests that an inventor would be reluctant to spend 10 years developing a new vaccine if a competitor could use the inventor’s idea without spending the same 10 years of research, time, and money.

Contrary to sound economic policy, a patent box explicitly subsidizes corporate profits that are captured by the private firm. Rather than incentivizing private investment in technologies that are under-explored (those with large and hard-to-capture benefits), a patent box incentivizes firms to invest in new technologies that return the largest private profits with the fewest externalities. Subsidizing profits also precludes start-ups from gaining any benefit. Patent boxes are poorly targeted to incentivize innovative research.

Patent boxes could also subsidize the positive externalities some economists predict from complimentary and geographically proximate manufacturing. Still, policymakers need to show that a patent box is the best way to target manufacturing. The United States federal government currently offers eight separate tax subsidies to manufacturing and at least six other direct subsidy programs administered through various agencies. The patent box might not even subsidize manufacturing at all if its design follows that of the United Kingdom and does not tie physical activity to income.

Keeping Jobs in the United States

Patent boxes have not been shown to increase employment or manufacturing. A 10 percent tax rate on intellectual property profits is a strong incentive for multinationals to relocate patents and other knowhow to the United States. However, more American-owned intellectual property does not mean more jobs, innovation, or economic growth.

Whether a patent box succeeds in increasing employment depends wholly on the extent to which firms locate real activity alongside the income stream. A 2015 European Commission working paper on patent boxes corroborated an emerging body of research, finding that patent boxes decrease measures of innovation and real activity (the probability of companies’ research activities and inventors moving to a patent box country). This finding is less robust when patent boxes have strong rules that tie real activity to intellectual property. Forcing multinationals to bind income and real activity has proven to be a difficult task, as evidenced by the OECD base erosion and profit shifting project, which has spent the past two years studying the issue. Global tax incentives to shift intellectual property independent of real activity are strong and ever present.

Increasing Taxable Income and Tax Revenue

Patent boxes decrease tax revenue unequally and distort the tax base. Estimates suggest that the lower tax rate results in “substantial falls in tax revenue,” despite a modest increase in taxable income. The loss of tax revenue increases as more counties introduce similar tax privileges, diminishing the incentive to remain in the United States for tax reasons. Additionally, larger countries like the United States are even less likely to benefit from a patent box because of size and geographic isolation (compared to EU counterparts).

Carving out special tax privileges for certain types of income places undue burden on the rest of the tax system. As more of the tax burden falls on a smaller portion of income, the tax system is made less efficient and less equitable. If policymakers are able to lower corporate tax rates (which is a necessary reform), they should do so for all businesses equally.

Policy Recommendations for Reform

The system for US corporate income taxation is broken and should be repealed or replaced. If they are unable to fundamentally overhaul the corporate tax system, policymakers should follow two simple guidelines for reform: lower the statutory rate to reduce inefficient incentives, and work to remove additional complexity.

The corporate income tax should be lowered for all profits, not just those attributable to qualified intellectual property. Lower rates reduce a variety of incentives that cause businesses to shift assets overseas. Lower corporate tax rates have been shown to significantly grow the economy, increasing investment, output and real wages. Lowering tax rates is the most direct way policymakers can encourage innovation and growth. Economists consistently find that lower tax rates increase measures of innovation and R&D spending.

Modest simplifications of the tax code include implementing territorial taxation, allowing full expensing, and rejecting the OECD’s plan to further impose global tax rules on sovereign countries. Territorial taxation is an alternative to the worldwide system described above. A territorial system only taxes income earned in the United States and would allow the return of the $2 trillion of US profits parked overseas to be reinvested domestically. Full expensing simply lets firms deduct all expenses when they are incurred, shifting taxes into the future to simplify accounting procedures and lower the after-tax cost of capital. The OECD base erosion and profit shifting project is an attempt by high-tax OECD countries to impose more burdensome taxes on global business by harmonizing diverse international tax rules. The United States should resist the OECD’s proposal.

A patent box is not a desirable remedy to the perceived problem of profit shifting, it is merely a Band-Aid for the broken US tax code. The proper policy to retain and attract business investment in the United States is to lower the corporate tax rate and move toward a territorial tax system. The economic literature shows that a patent box will not increase innovation, job creation, or tax revenue. If anything, the patent box proposal will make it harder to reform the tax code in the future. The introduction of any new tax privilege creates a constituency that becomes invested in the status quo and reliant on the new tax subsidy. Rather than make reform harder in the future, Congress should start by reducing the corporate tax rate.

To speak with a scholar or learn more on this topic, visit our contact page.