- | Government Spending Government Spending

- | Policy Briefs Policy Briefs

- |

The Effects of Dedicating Tax Revenues

Dedicating tax revenues to specific expenditures can be used by policymakers to mask increases in total government spending. Our empirical results show that dedicated tax revenues tend to result in an increase in total government size but have little effect on the expenditures to which they are tied.[

The practice of earmarking, or dedicating a portion of tax revenue to a specific expenditure category, is a popular fiscal tool for state governments. Theoretically, the process of dedicating tax revenues to specific expenditures should have no impact on the composition of expenditures, because one dollar from one tax is perfectly substitutable for one dollar from another. Nevertheless, previous studies have found a range of effects of dedicating revenue on expenditures, and this process remains a popular policy option for state governments. We find support for the hypothesis that dedicating tax revenues to specific expenditures can be used by policymakers to mask increases in total government spending. Our empirical results show that dedicated tax revenues tend to result in an increase in total government size but have little effect on the expenditures to which they are tied.[1]

DEDICATING TAX REVENUES: PRACTICE, THEORY, AND EVIDENCE

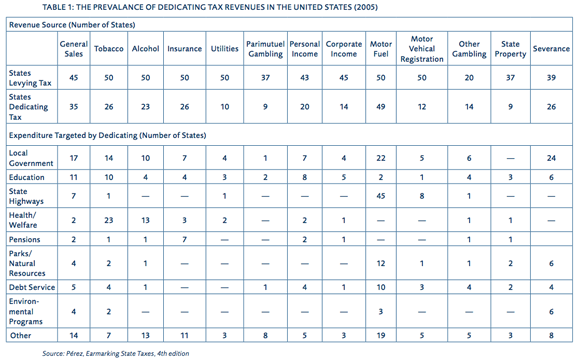

Every state in the United States dedicates a percentage of its tax revenue for specific expenditures. In 2005, states on average dedicated 24 percent of tax revenues to specific expenditure categories. At the extremes, Alabama dedicated 84 percent of its total state tax revenue, while Rhode Island dedicated only 4 percent.[2] The most common targets of dedicated revenue are roads, schools, and local governments. Table 1 displays the prevalence of dedicating tax revenues for some of the most popular revenue sources and targeted expenditure categories.

Dedicated tax and other revenues are typically justified by legislators for several reasons. A specific source of revenue may be assigned as a means of guaranteeing funding for a particular government-expenditure category. For example, many states dedicate state lottery proceeds to fund programs such as education. Another justification is to deter consumption of certain goods or services—including alcohol and tobacco— that may create negative spillovers. Alternatively, certain taxes may function as a type of payment for the use of public goods, and the revenues can be used to provide such public goods. The classic example of this justification is dedicating gasoline tax revenue for expenditures on highway maintenance and construction. Recent research, however, has shown that these justifications are problematic.[3]

MASKING INCREASES IN GOVERNMENT SPENDING

Regardless of the stated justification, the practice of dedi- cating certain tax revenue to specific expenditures should, according to standard economic theory, have an effect on spending no different than a similar increase in undedicated revenue.[4] Since tax revenues are fungible—or perfectly substitutable for one another—there is no reason to expect that raising an additional dollar of revenue targeted to a specific expenditure category should have any effect other than adding an untargeted dollar to the general fund. In other words, the fungibility of tax revenue means that if a dedicated dollar is spent on its targeted expenditure, it frees a previously used general-fund dollar for use on other programs.

Suppose, for example, that a state government currently spends $100 from the general fund on education. Assume further that the legislature passes a new, special sales tax on the basis of its revenue being earmarked for education spend- ing, and this new tax brings in $50 in revenue. Although it may seem natural to assume education spending will increase by $50 as a result of the dedicated revenue (to $150), policymakers actually have the option to decrease spending on education out of the general fund. Even if the $50 earmarked to education spending is spent on education, total education expenditures may remain unchanged if the legislature decides to decrease general-fund spending from $100 to $50 (thus maintaining total spending on education at $100). Doing so allows policymakers to spend the $50 of revenue previously dedicated to education elsewhere.

Nevertheless, the practice remains popular. One possible explanation follows from the “Leviathan” model of government, which claims that government seeks to maximize its power and size.[5] Under this theory, the fungibility of dedicated tax revenues provides policymakers with a way to increase government size without resorting to unpopular increases in rates on general-fund taxation sources. Specifically, by dedicating tax revenues to a specific expenditure, policymakers are able to advocate for increases in the earmarked tax on the basis of benefitting the targeted expenditure category. Should the tax increase be approved, the dedicated revenues may be used in place of previously used general-fund revenues. The result may or may not affect the targeted expenditure but will increase total government size.

We tested this hypothesis using data from 49 states over a period of three years.[6] Our analysis focused on the most commonly employed revenue sources and the primary targets of dedicated tax revenues: education, roads, and local governments.

Of the 15 cases we examined of specific tax revenues dedicated to certain expenditures, only tobacco tax revenue and personal-income tax revenue earmarked to education, along with sales tax revenue and vehicle registration revenue earmarked to local governments, unambiguously led to increases in expenditures on the targeted category. In nearly every case where an earmark fails to increase targeted expenditures (either partially or at all), nontargeted spending increased, suggesting that earmarks make for an effective means of indi- rectly increasing general-fund revenues.

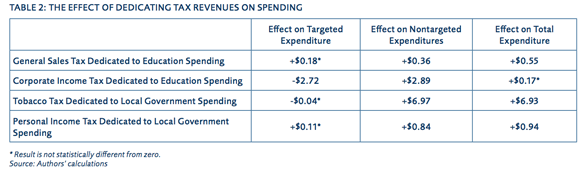

Table 2 summarizes some of the most egregious examples of dedicated revenues being used to increase the overall size of government rather than to increase spending in the targeted expenditure category. For each dollar of general sales tax revenue earmarked to education spending, no significant increase in education spending was observed, but an increase of $0.55 in total government expenditure was found. A similar effect was observed in corporate income tax revenue dedicated to education: each dollar of revenue dedicated to education was ssociated with a decrease of roughly $2.72 in spending on education and a similarly sized increase in spending on other programs. Tobacco tax revenue dedicated to spending on local governments was also effective only at increasing overall government size with no effect on spending in the targeted category evident. For each dollar of personal income tax revenue dedicated to local governments, expenditures in other areas increased by roughly $0.84 and total spending by $0.94.

POLICY IMPLICATIONS

Our results indicate that policymakers’ use the practice of earmarking tax revenue to increase the total size of government without resorting to the implementation of unpopular general tax rate increases. The revenue raised from earmarks does not go primarily to its intended expenditure category. Instead, it is used as fungible revenue to be spent at the government’s discretion. From a voter’s perspective, these increases in total expenditures are inefficient. Therefore, the elimination of earmarking, at the very least in those cases where it cannot be shown to benefit its intended target, would likely be in the public interest. While it may seem counterintuitive to give more discretion to policymakers, the research presented here shows that dedicating tax revenues already gives them that discretion but does so covertly. If policymakers choose to raise taxes to increase the overall size of government, it must be done as transparently as possible so that voters can respond appropriately.

The practice of dedicating tax revenues to specific expen- diture categories has remained popular in state governments despite empirical evidence that only a small proportion of dedicated revenues actually stick to intended expenditures. We propose the hypothesis that governments are aware of earmarked revenues’ fungibility and exploit this opportunity to increase total government size. Our empirical analysis provides two main results: (1) the majority of dedicated tax revenues are ineffective at increasing spending on their targeted expenditure category, and (2) the majority of those earmarks that fail to stick are, in fact, effective at increasing both spending on other expenditure categories—ones not related to their intended target—and overall government size. These results are consistent with a theory of “Leviathan” government and imply that policymakers use tax revenues dedicated to politically popular programs to increase overall government size.

Endnotes

1. See George R. Crowley and Adam J. Hoffer, “Dedicating Tax Revenues: Constraining Government or Masking Its Growth?” (working paper, Mer- catus Center at George Mason University, Arlington, VA, 2012) for a full description of the empirical approach and complete listing of results. This Mercatus on Policy summarizes the main arguments and findings in the working paper.

2. Arturo Pérez, Earmarking State Taxes, 4th edition (Washington, DC: National Conference of State Legislatures, 2008).

3. Thomas Stratmann and William Bruntrager, “Excise Taxes in the States” (working paper, Mercatus Center at George Mason University, Arling- ton, VA, 2011).

4. James M. Buchanan, “The Economics of Earmarked Taxes,” Journal of Political Economy 71, no. 5 (1963):457–569. The Mercatus Center at George Mason University

5. For an overview, see Geoffrey Brennan and James Buchanan, “Towards is a research, education, and outreach organization a Tax Constitution for Leviathan,” Journal of Public Economics 8 (1977): 255–74; Brennan and Buchanan, “Tax Instruments as Constraints on the Disposition of Public Revenues,” Journal of Public Economics 9 (1978): 301–18; and Brennan and Buchanan, The Power to Tax: Analytical Foun- dations of a Fiscal Constitution (Cambridge, UK: Cambridge University Press, 1980). 6. We drop Alaska from the analysis, as is standard practice in state fiscal policy studies.