- | Academic & Student Programs Academic & Student Programs

- | Regulation Regulation

- | Federal Testimonies Federal Testimonies

- |

The Effects of Regulation on Low-Income Households

Testimony before the House Committee on the Judiciary

The best way to avoid forcing low-income households to pay for the preferences of high-income households is to allow them to make their own choices when it comes to the mitigation of risks they experience. Unintended consequences of regulation, like the regressive effect identified here, will often result in greater harm than the harm the regulation seeks to avoid in the first place. Regulators should heed the medical ethics maxim “first, do no harm” and at a minimum subject all regulation to a cost-benefit test that considers potential regressive effects.

Chairman Goodlatte, Ranking Member Conyers, Subcommittee Chairman Bachus, Subcommittee Ranking Member Cohen, and members of the committee, thank you for the chance to discuss the regressive effects of regulation on low-income households. I appreciate the opportunity to testify today.

In the following, I will argue that regulation has unintended consequences that are particularly detrimental to low-income households. Because of these unintended consequences, at a minimum all regulation should be subjected to a cost-benefit test that considers potential regressive effects.

More specifically, I will make the following three points:

- Regulation of health, safety, and the environment often represents the preferences of high-income households but increases prices and reduces wages for all households.

- Low-income households cannot spend as much on the private mitigation of risks that are of greater severity and probability than some regulated risks because they are forced to pay for regulation that represents the preferences of high-income households.

- Because regulation often represents the preferences of high-income households and reduces the disposable income of low-income households, regulation has a regressive effect.

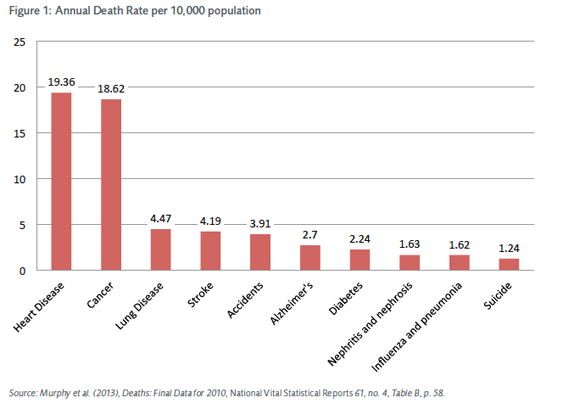

We spend billions of dollars every year to reduce life-threatening risks that arise from everyday activities such auto travel, air travel, diet, drugs, construction, and many other potential perils of modern life. We do this privately through our dietary, exercise, housing, and transportation choices. We do it publicly through regulation. Both private risk mitigation and public risk mitigation through regulation seek to lower health, safety, and mortality risks. Regulation often addresses low probability risks, while many of the risks we manage privately are significantly larger. For example, people make private decisions determining their diets and exercise routines, which have significant effects on their private risks of heart disease or cancer. Heart disease and cancer were the top two causes of mortality in 2010, with 19.36 in 10,000 people dying from heart disease and 18.62 in 10,000 people dying from cancer. Individuals determine how safe of a car to buy, whether to install smoke detectors in their home, or the type of neighborhood in which to live, which all affect various injury and accident risks. Accidents were the 5th leading cause of death in the United States in 2010, with a mortality risk of 3.9 in 10,000 of population. Regulation, on the other hand, often addresses risks that are much less probable. Work-related fatalities, for example, happen with an annual frequency of 0.36 in 10,000,[1] but there are innumerable OSHA rules that address occupational safety.

Chart 1 lists the major causes of death from various activities and events and their annual fatality rate per 10,000 people for 2009.[2] Overall, Americans faced about an 80 in 10,000 chance of dying in 2010. The major causes of death were heart disease (19.36 in 10,000), cancer (18.62 in 10,000), lung disease (4.47 in 10,000), stroke (4.19 in 10,000), accidents (3.91 in 10,000), and Alzheimer’s (2.7 in 10,000). Among the accidents or unintentional causes of death, motor-vehicle accidents lead (1.14 deaths in 10,000 of population). Following motor-vehicle fatalities are poisoning, at 1 death per 10,000, and falls, at 0.8 deaths per 10,000. Many of these risks, including heart disease, cancer, and accidents, are the result primarily of private choices and expenditures (diet, transportation choices, etc.).

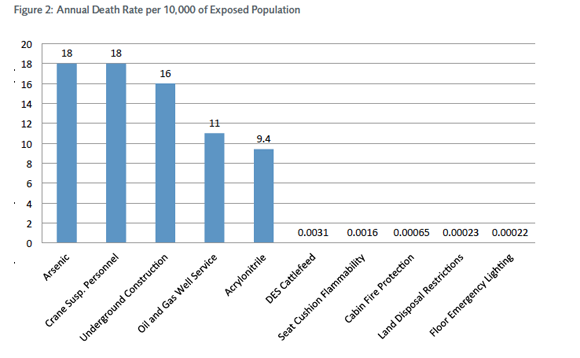

In comparison, the initial death rates for risks mitigated by regulation are much lower than risks individuals face from activities they personally control. As mentioned above, work-related fatalities, which are often the target of regulation, happen with an annual frequency of only 0.36 in 10,000 people. Some types of occupational health and safety regulation seem to target greater probability risks: regulation of occupational arsenic exposure, for example, mitigates an initial annual risk of death of 18 in 10,000.[3] This risk applies only to the exposed population, however; the risk to the general population is much lower and is due primarily to arsenic in drinking water. Two examples of regulation that target even lower initial annual risks are floor emergency lighting on airplanes and regulations regarding seat-cushion flammability. Chart 2 lists the top and the bottom five types of regulation in order of associated initial annual risk of death.[4]

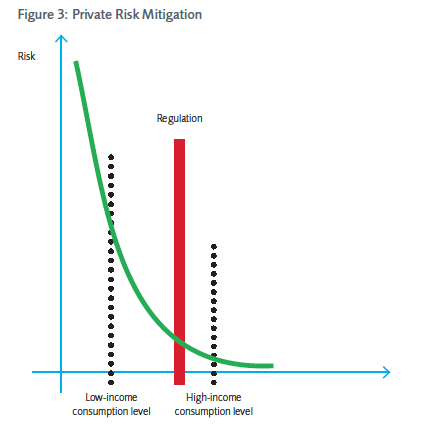

Empirical evidence suggests that people spend additional income in ways that lower their private mortality risk. With increasing income, individuals will spend greater amounts of money to mitigate risks privately. Wealthier households, therefore, spend more money on health and safety, while low-income households spend less. In addition, the marginal benefit of increasing expenditures on health and safety has to be decreasing, as households address high-probability, high-severity risks first (taking costs of risk mitigation into account), before addressing lower-probability and lower-severity risks, for which the benefit of risk reduction to the households is lower. This suggests that low-income households will focus on the mitigation of high-probability, high-severity risks that deliver the greatest reduction in risk per dollar spent. They are less likely to pay to reduce small-probability risks with higher costs per unit of risk because their budgets are limited. Higher-income households, on the other hand, have sufficient resources to eliminate lower-level risks that are more expensive to mitigate. Graph 1 illustrates these different risk mitigation preferences.

Public risk reduction through regulation often involves the mitigation of low-probability risks that are more costly to mitigate. It therefore represents the preferences of the wealthy. For example, many states require childcare providers to install child-size lavatories and outdoor playground equipment. In addition, strict child-staff ratios limit the size of childcare groups. While such requirements may lead to slight improvements in childcare quality, they do not seem to have a significant effect on long-term childcare outcomes. They do significantly drive up the price of childcare services, however, which has particularly negative consequences for low-income households. For example, for a family with less than $1,500 monthly income, the cost of childcare makes up 30 percent of the family budget. The same cost of childcare represents only 7 percent of the budget of a family with a monthly income of $4,500 or more.[5]

When higher prices do not preclude consumption, public risk-reduction strategies crowd out private risk-mitigation strategies of low-income households. This is the case when there are no cheap substitutes for regulated goods and poor households have no choice but to pay the higher price. As regulatory agencies address smaller and smaller risks, they drive up the prices of many consumer goods. Consequently, households have to spend more on consumables than they otherwise would have. This expenditure on public risk mitigation crowds out private risk mitigation expenditure, which can address larger risks that are particular to the individual consumer. Low-income households will remain exposed to relatively high-probability, high-severity risks that they cannot afford to mitigate privately, because they are forced to pay for the mitigation of low-probability, low-severity risks through regulation.

Take for example the 2005 removal of the essential-use designation for ozone-depleting substances (ODS) by the FDA.[6] This rule banned the use of ozone-depleting chlorofluorocarbons (CFC) as propellants in medical inhalers, which had previously been exempted from the 1987 Montreal protocol rules which were intended to limit ODS emissions. The Montreal protocol was overall successful in reducing ODS emissions and the World Meteorological Organization estimated in a research report published in 2002 that the Ozone layer was expected to return to pre-1980 levels by the middle of the 21st century. The same research report also indicated that additional reductions in ODS emissions would produce only “small improvements.”[7] It furthermore concluded that nonindustrial sources of ODS emissions were “insignificant.”[8] The FDA did not estimate the benefits of its 2005 removal of the essential-use designation. While the benefits of this removal of the essential-use designation for medical inhalers are uncertain and at best negligible, the cost of the rule for consumers of medical inhalers were certain and significant. The average price of asthma inhalers, which are used by several million Americans, has tripled since the implementation of the ban.[9]

In this sense, regulation of health and safety risks, particularly regulation of small risks that are expensive to mitigate, can have a regressive effect on household income. By driving up the prices of the goods and services people consume and by lowering wages, such regulation forces low-income households to contribute financially to the mitigation of risks they would not choose to mitigate privately. This implies that low-income households are essentially subsidizing the risk-reduction preferences of the wealthy. Put differently, regulation has a regressive effect: it redistributes wealth from lower-income households to higher-income households by forcing lower-income households to pay for risk reduction efforts that are worth more to the wealthy.

Consider the example of the recently delayed rearview camera mandate. In December of 2010, the National Highway Traffic Safety Administration (NHTSA) proposed a mandate requiring all automakers to put rearview cameras in all passenger vehicles by 2014. Currently, such features can be found only in luxury models or as a part of an upgrade package, suggesting that the demand for them is limited to higher-income households. The expected benefit of this particular regulation would have been a reduction in the number of fatalities resulting from drivers backing up and hitting pedestrians. Approximately 228 individuals die annually in such accidents (44 percent are under age five). This particular regulation was expected to reduce the number of fatalities to between 133 and 116 individuals per year.[10] This would have been equivalent to a reduction in the risk of being a victim of a backover accident from 1 in every 200,000 children under age five to roughly 1 in every 400,000 children under age five. For the overall number of fatalities without consideration of age, it would have represented a reduction in the risk of being a victim of a backover accident from currently roughly 1 in every 1.5 million people to 1 in every 3 million people. In comparison, the mortality risk associated with pregnancy is roughly 1 in every 300,000. The risk of being in a backover accident is much smaller.

While such accidents are certainly terrible, it is questionable whether efforts to mitigate them through regulation are socially desirable. As long as the unintended consequences of rules like this one cause greater harm than the rules themselves avoid, it seems reasonable to refrain from intervening. In the example of rearview cameras, the cost per life saved would have be roughly $24 million.[11] The NHTSA estimates the total cost of the measure for the auto industry at roughly $2.7 billion, or $200 per vehicle. These costs would have been passed on to consumers,[12] and low-income households would have had the least resources to absorb and manage them. The decision by the DOT to delay this mandate provides an opportunity to mitigate or avoid foreseeable but unintended regressive effects.

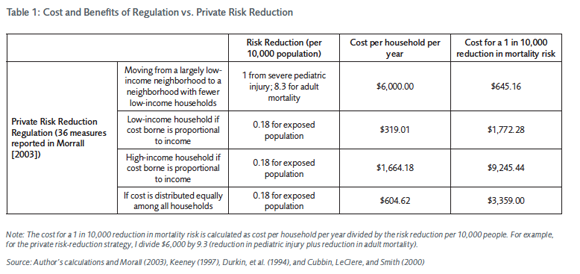

In my study, I estimate the costs and benefits of 36 different kinds of regulation per household to illustrate how costly regulation actually is. I compare these costs of regulation to the cost of privately mitigating mortality risk by moving to a higher-income neighborhood (Table 1 summarizes the results of my study). Many low-income households could significantly reduce the probability of several injury and mortality risks they are exposed to by moving to a slightly higher-income neighborhood. They are often unable to do so for financial reasons, however.

The rough estimation of the benefits of these 36 different kinds of regulation suggests that they result in a total reduction in the risk of a fatality of 0.18 in 10,000 of population. The total cost of the 36 regulation is approximately $604 per household. Together, these numbers translate to a cost of $3,359 for a 1 in 10,000 reduction in mortality through regulation. Privately reducing risks by moving to a higher-income neighborhood,[13] by comparison, would result in a reduction of adult mortality risk of roughly 8.3 in 10,000 of population and a reduction of 1 in 10,000 of pediatric injury risk at a total cost of $6,000 per household. Together, these numbers translate into a cost of $645.16 for a 1 in 10,000 of population reduction in mortality risk. It is immediately obvious that the private risk-mitigation strategy of moving is much more cost-effective than public risk mitigation through regulation.

In summary, regulation often represents the preferences of high-income households. All households, whether poor or wealthy, pay for regulation through higher prices and lower wages, however. Having to pay for small risk reductions through regulation may prevent low-income households from taking more beneficial, private risk-reduction strategies that would result in a greater reduction in mortality. Regulation therefore often has a regressive effect on the income of poor households.

The best way to avoid forcing low-income households to pay for the preferences of high-income households is to allow them to make their own choices when it comes to the mitigation of risks they experience. Unintended consequences of regulation, like the regressive effect identified here, will often result in greater harm than the harm the regulation seeks to avoid in the first place. Regulators should heed the medical ethics maxim “first, do no harm” and at a minimum subject all regulation to a cost-benefit test that considers potential regressive effects.

Footnotes

1. United States Census, 2010.

2. K. M. Murphy and R. H. Topel, “The Value of Health and Longevity,” Journal of Political Economy 114, no. 5 (2006): 871–904.

3. J. F. Morrall, “Savings Lives: A Review of the Record” (Office of Management and Budget Working Paper 03-6, Washington, DC, 2003)

4. Ibid.

5. ”Low Income and Impoverished Families Pay More Disproportionately for Child Care,” Carsey Institute: Policy Brief 16 (2010): 2.

6. See Federal Register 70 (63), 17168, http://www.fda.gov/OHRMS/DOCKETS/98fr/05-6599.pdf.

7. Ibid., 17180 as well as National Oceanic and Atmospheric Administration, “Executive Summary - Scientific Assessment of Ozone Depeletion: 2002,” 5, http://www.esrl.noaa.gov/csd/assessments/ozone/2002/ExecSum02.pdf

8. Ibid, 1.

9. Laurie Tarkan, “Rough Transition to New Asthma Inhalers,” New York Times, May 13 2008, http://www.nytimes.com/2008/05/13 /health/13asth.html?_r=0.

10. 10.US Department of Transportation, Rearview Mirrors; Federal Motor Vehicle Safety Standard, Low-Speed Vehicle Phase-In Reporting Requirements. Federal Register, 75 (234), 76186-76250. Washington DC.

11. This is roughly four times the value that DOT uses to calculate the average benefit on ex ante lives saved, $5.8 million.

12. bid.

13. The data used in this study control for individual level characteristics and therefore give us an indication of how much an individual’s mortality and injury risks could be reduced by moving to a different neighborhood without changing any of their private choices.

To speak with a scholar or learn more on this topic, visit our contact page.