- | Corporate Welfare Corporate Welfare

- | Data Visualizations Data Visualizations

- |

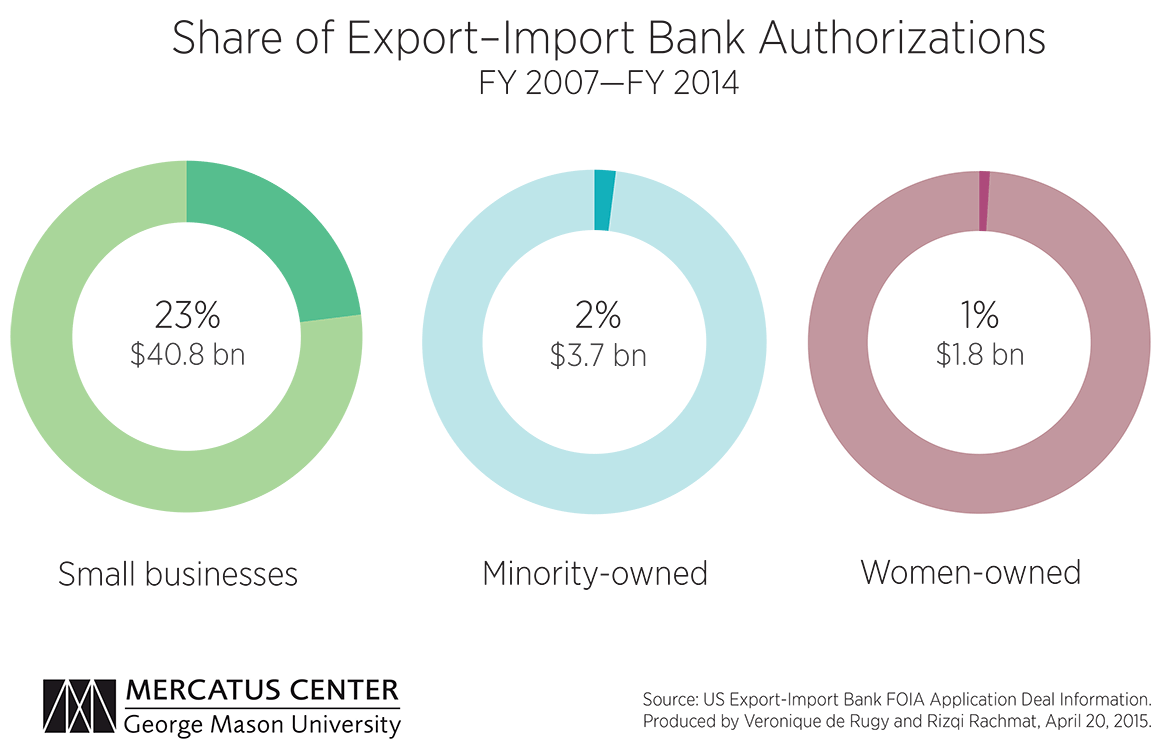

Ex-Im Bank of Little Value to Small, Minority-owned, and Women-owned Businesses

Using the bank’s own data, the chart shows that, of the total amount of financing authorized by the Ex-Im Bank from FY 2007 to FY 2014, only 23 percent benefitted small businesses. Minority-owned and women-owned firms received a paltry 2 percent and 1 percent, respectively. While government programs should operate on the principle that everyone is “equal under the law,” it would seem that this principle does not apply to the Ex-Im Bank’s export subsidies.

Supporters of the Export-Import Bank claim that it is a critical resource for the nation’s exporters. However, as I demonstrated in a previous chart, the federal agency mainly serves the interests of the large, politically connected businesses, in particular Boeing. This week’s chart looks at the share of Ex-Im Bank–backed financing that went to small, minority-owned, and women-owned firms in recent years. It provides further evidence that larger companies, which do not need government-granted advantages, are the primary beneficiaries of the bank’s largesse.

Using the bank’s own data, the chart shows that, of the total amount of financing authorized by the Ex-Im Bank from FY 2007 to FY 2014, only 23 percent benefitted small businesses. Minority-owned and women-owned firms received a paltry 2 percent and 1 percent, respectively. While government programs should operate on the principle that everyone is “equal under the law,” it would seem that this principle does not apply to the Ex-Im Bank’s export subsidies. This failure to meet its own stated purpose is one more reason why the Ex-Im Bank should not be reauthorized.