- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

The Export-Import Bank’s Green Portfolio Benefits Familiar Firms

The Export-Import Bank of the United States, the official export credit corporation of the federal government, is often criticized for favoring large, politically-connected corporations like Boeing and Caterpillar; for a lack of transparency and accuracy in their data reporting, job creation methodology, and risk calculations; and for unnecessarily tilting the scales of competition in the direction of favored industries.

The Export-Import Bank of the United States, the official export credit corporation of the federal government, is often criticized for favoring large, politically-connected corporations like Boeing and Caterpillar; for a lack of transparency and accuracy in their data reporting, job creation methodology, and risk calculations; and for unnecessarily tilting the scales of competition in the direction of favored industries.

One industry that has enjoyed considerable growth in Ex-Im assistance is the green energy and sustainability sector. Many of the green firms that receive Ex-Im benefits have enjoyed benefits from a number of other federal programs. A comparison of only a few of these programs shows that many firms “double dip” into Uncle Sam’s many corporate welfare programs funded by US taxpayers.

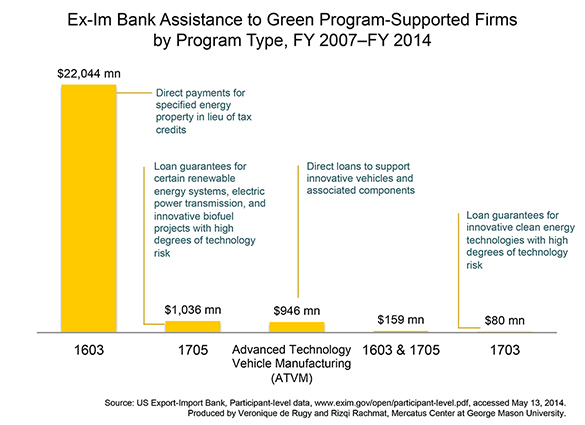

This week’s charts use data from the Export-Import Bank’s dataset on project applications and 1603, 1703, 1705, and ATVM (Advanced Technology Vehicles Manufacturing) loan programs to display green energy- and sustainability-related projects and firms that the Bank funded from FY 2007 to FY 2014, along with the firms that received funding in at least two programs during the same time.

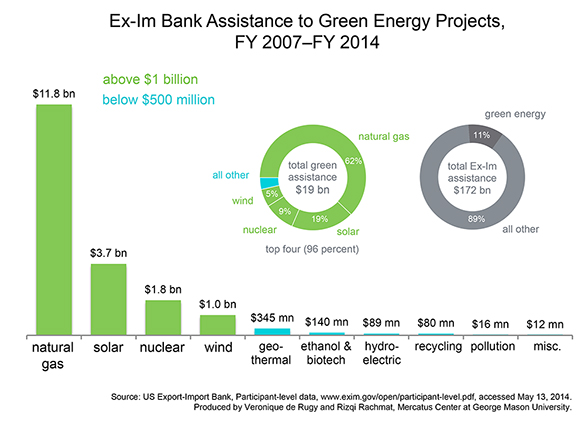

The first chart displays the total estimated Export-Import Bank assistance that was doled out to green energy- or sustainability-related firms and projects from FY 2007 and FY 2014. It shows that natural gas-related projects received the largest amounts in Export-Import Bank assistance of all green energy projects. Natural gas projects received $11.8 billion in assistance from FY 2007 to FY 2014, or 62 percent of the green portfolio. Solar energy comes in the second spot with $3.7 billion in assistance, or almost 20 percent of the portfolio. Nuclear projects received roughly $1.8 billion in assistance, or almost 10 percent of the portfolio, while wind projects received $1 billion in assistance, or 5.4 percent of the total. Geothermal, ethanol and biofuels, hydroelectric, recycling, pollution management and prevention, and miscellaneous projects all constitute less than 2 percent of the portfolio.

As we’ve noted before, the Export-Import Bank’s decision to use the Census Bureau’s North American Industry Classification System (NAICS) is predictable but problematic. For instance, green projects to fund solar panel manufacturing are at different times categorized as “All Other Miscellaneous Manufacturing,” “Commercial, Industrial, And Institutional Electri [sic],” or “Nonclassifiable Establishments,” depending on who inputs the data. Sometimes, the improper classification is also misspelled, as was the unfortunate case with the several solar projects classified as “Semicinductors [sic] and Related Devices.”

To provide a more accurate picture of the Export-Import Bank’s green energy and sustainability portfolio, we recategorized the Export-Import Bank’s dataset into broader project types. To determine whether a project was green energy or sustainability related, we scoured project descriptions and firm names to identify projects that were likely to meet the Bank’s criteria for its Environmental Export Financing portfolio. From there, we searched through Export-Import Bank press releases, company websites, and news stories to verify whether or not a project was part of the Environmental Export Financing portfolio. In cases where we were unable to confirm that a project or firm was primarily focused on green energy, we did not consider them to be “green,” even though that may have been the case. We then separated projects into subcategories within the green energy category; specifically, natural gas, solar, nuclear, wind, geothermal, ethanol and biofuels, hydroelectric, recycling, pollution management and prevention, and miscellaneous.

The Export-Import Bank is not the only federal body that distributes taxpayer funds to green energy and sustainability corporations. The second chart displays the amounts of Export-Import Bank assistance to firms that also received assistance under controversial green loans programs. Firms that benefited from the Section 1603 grant program, which offered renewable energy project developers cash payments rather than tax credits, also benefited considerably from Export-Import Bank assistance, enjoying $22 billion in benefits over the past seven years. Firms that received loan guarantees through the Section 1705 program, which “authorizes loan guarantees for . . . certain renewable energy systems, electric power transmission systems, and leading edge biofuels” also received $1 billion in Export-Import Bank assistance, while some firms enjoyed another $159 million from both the 1603 and the 1705 programs. Car manufacturers that received loans through the Advanced Technology Vehicles Manufacturing (ATVM) program enjoyed another almost $1 billion in Export-Import Bank assistance, while $80 million in Export-Import Bank assistance went to firms that had already benefited from the Section 1703 loan program, which “support[s] innovative clean energy technologies that are typically unable to obtain conventional private financing due to high technology risks.”

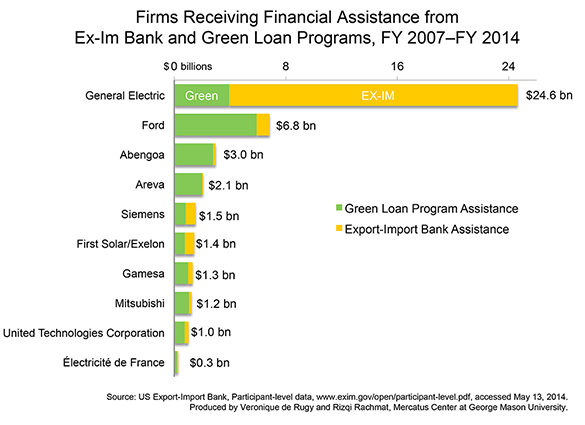

The third chart breaks down the information in the second chart by firm and displays the government assistance received through green loan programs and Export-Import Bank assistance. The chart shows that large corporations often double-dip into multiple federal programs at a time. General Electric received the highest amount of combined assistance, with $20.7 billion coming from the Export-Import Bank and $3.9 billion from the 1603 loan program for a total of $24.6 billion. Ford Motors comes in second, enjoying $942 million from the Export-Import Bank and $5.9 billion from the ATVM program for a combined $6.9 billion. A number of other primarily green energy-related firms also make the top ten, including: nuclear, hydro, solar, and wind conglomerate Exelon, which received $1.4 billion from both programs; Spanish wind energy giant Gamesa, which received a combined $1.3 billion; French nuclear conglomerate Areva, which received $2.1 billion through the 1703 program and the Export-Import Bank; and the Spanish energy corporation energy Abengoa, which received a combined total of $3 billion in federal assistance.

This double dipping is, however, only the tip of the iceberg since many of these firms also received other subsidies at the federal level (such as the Department of Treasury 1603 cash program) in addition to subsidies and tax credits at the state levels.