- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

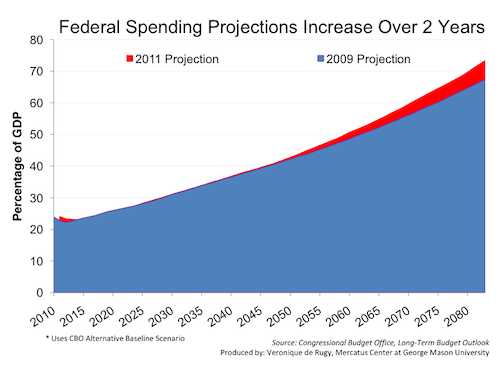

Federal Spending Projections Increase Over 2 Years

This chart compares federal spending projections using the Congressional Budget Office’s (CBO) Long-Term Budget Outlook from 2011 and 2009.

This chart compares federal spending projections using the Congressional Budget Office’s (CBO) Long-Term Budget Outlook from 2011 and 2009. Spending estimates in this chart account for net interest and total primary spending.

CBO’s alternative scenario is a more realistic picture than its baseline scenario. The alternative scenario considers the budgetary consequences of maintaining certain tax and spending policies that have recently been in effect. It accounts for the expiration of provisions like the Bush tax cuts, Medicare’s payment rates for physicians, and Alternative Minimum Tax (AMT) patch.

As the data show, 2011 federal spending is projected to grow at a far more increasing rate than the 2009 projection. The rates of growth in federal spending after 2050 differ drastically in the two budget projections; spending grows by about 80% between 2050 and 2085 in the 2009 projection, while spending between 2050 and 2085 is projected to grow at a 90% rate of increase.

By 2060, the CBO projected that federal spending would reach over 50 percent of GDP in their 2011 projection. On the other hand, CBO’s 2009 projections reach 50 percent three years later in 2063.

The projections of federal spending that CBO highlighted for the alternative fiscal scenario do not include the harmful effects of rising debt on economic growth and interest rates. If those effects were taken into account, projected spending would increase even more rapidly. As federal spending grows, budget deficits and increasing debt would reduce national savings, and further hinder economic growth.

As CBO correctly warns, “The explosive path of federal debt under the alternative fiscal scenario shows that the combination of policies that underlie that scenario cannot be continued for the next several decades.” It is no mystery that the fiscal outlook will worsen beyond the coming decade if we continue to turn a blind eye to fundamental tax reform and entitlement reform.