- | Academic & Student Programs Academic & Student Programs

- | Regulation Regulation

- | Working Papers Working Papers

- |

How Are Small Banks Faring under Dodd-Frank?

This paper presents the results of the Mercatus Center’s Small Bank Survey, which include responses from approximately 200 banks across 41 states with less than $10 billion in assets each, serving mostly rural and small metropolitan markets.For the complete study, see “How Are Small Banks Faring Under Dodd-Frank?”

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) was passed in 2010 as a response to the recent financial crisis. The purpose of the law, as policymakers argued, was to rein in large Wall Street firms that contributed to the crisis in order to prevent future financial crises. After 850 pages of legislative text and nearly 19,000 pages of regulatory text, the impact of Dodd-Frank is much broader than originally anticipated. New rules and regulations aimed at larger banks and financial institutions are affecting smaller banks, which were not a principal regulatory target of Dodd-Frank.

In a study conducted for the Mercatus Center at George Mason University, scholars Hester Peirce, Ian Robinson, and Thomas Stratmann present the results of a summer 2013 survey that asked small banks how they and their customers were being affected by Dodd-Frank. With a sample of approximately 200 small banks, the study indicates Dodd-Frank regulations are adversely affecting them.

THE SMALL BANK SURVEY

In four sections, the 96-question survey gathered responses from more than 200 small banks across 41 states. The survey defined small banks as those with less than $10 billion in assets—the threshold used by several regulators. Reflective of the general population of small banks, the majority of the surveyed banks held under $1 billion in assets.

Participating banks remained anonymous, but provided characteristics about their geographic location, charter type, and size, as well as the products and services they offered. The survey included questions about specific regulatory and compliance activities, interactions with regulators, effects of particular regulations, changes in fees and revenue, and business strategy decisions since the passage of Dodd-Frank. The breadth and depth of the questions make the survey unique among similar surveys by regulators, consultants, and trade associations.

PRINCIPAL FINDINGS

Increased Compliance Costs

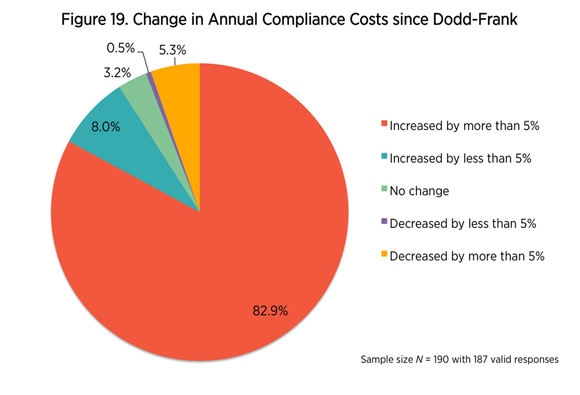

- 90 percent of responding banks state that compliance costs increased since the passage of Dodd-Frank, with nearly 83 percent reporting increases of more than 5 percent.

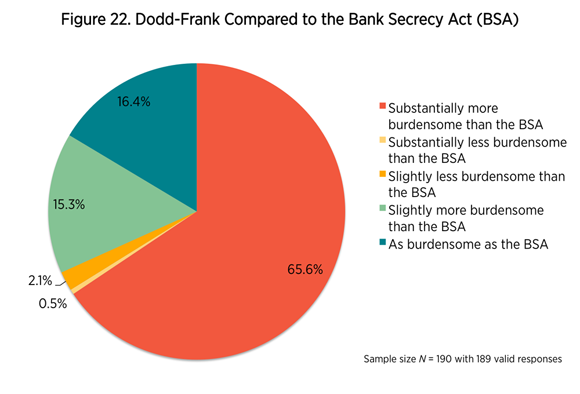

- Roughly 81 percent of respondents view Dodd-Frank as more burdensome than the Bank Secrecy Act, a notoriously onerous regulatory regime.

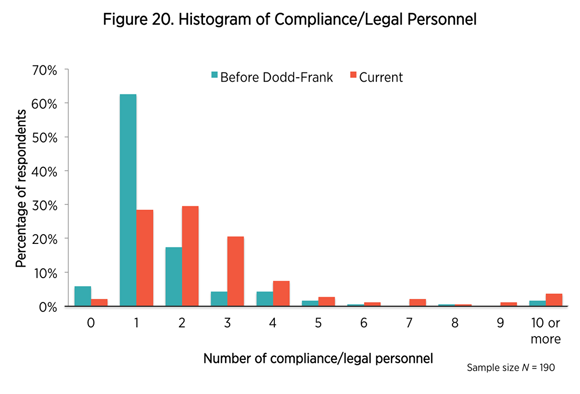

- The median number of compliance staff for the small banks participating in the survey increased from one to two employees.

- More than a quarter of the banks anticipated hiring additional compliance personnel in the next year.

Limited Customer Access

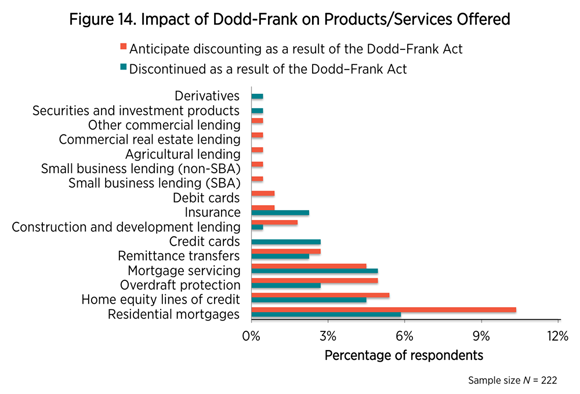

- Small banks report having eliminated or planning to discontinue certain products and services as a result of Dodd-Frank.

- Residential mortgages, mortgage servicing, home equity lines of credit, and overdraft protection are among the most likely products and services to be cut.

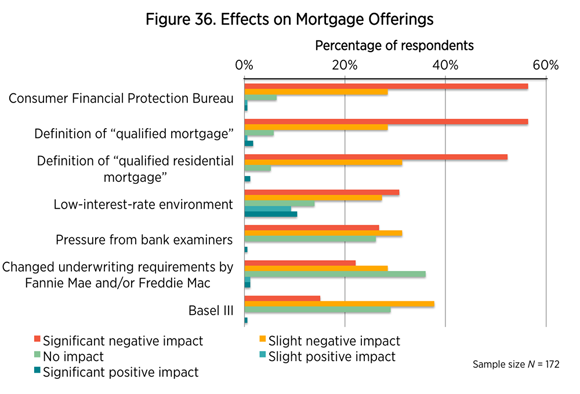

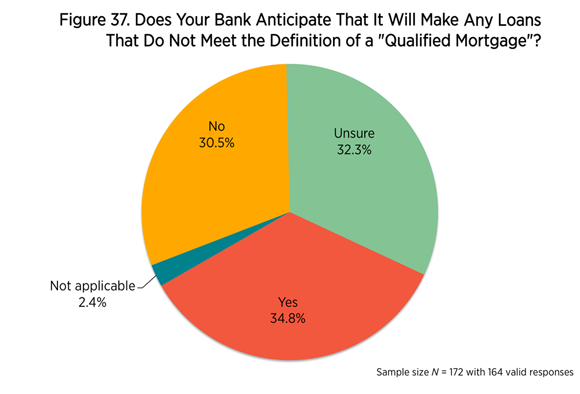

- Nearly 64 percent of the banks surveyed anticipate making changes to the nature, mix, and volume of mortgage products and services as a result of new regulations.

- Roughly 10 percent anticipate discontinuing residential mortgages due to Dodd-Frank and approximately 5 percent have already done so.

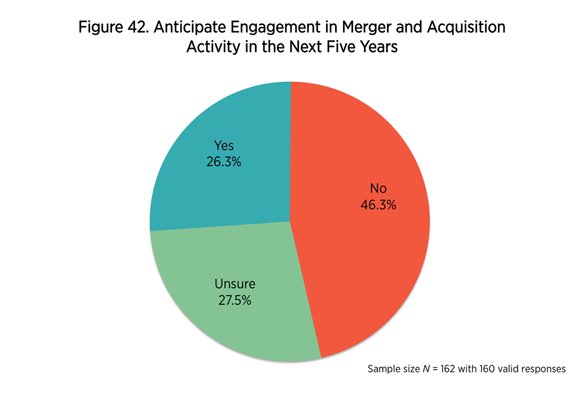

- More than a quarter of respondents anticipate engaging in a merger or acquisition in the near future, which would reduce the number of small banks.

Concerns with the Consumer Financial Protection Bureau (CFPB)

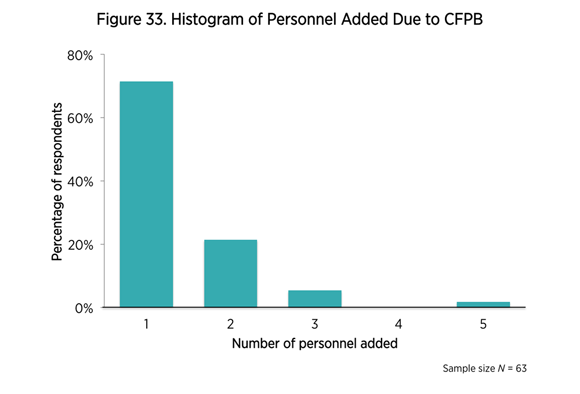

- Narrative responses throughout the survey show that the CFPB’s activities and mortgage regulations are of great concern to small banks, despite the CFPB having no direct supervisory authority over small banks.

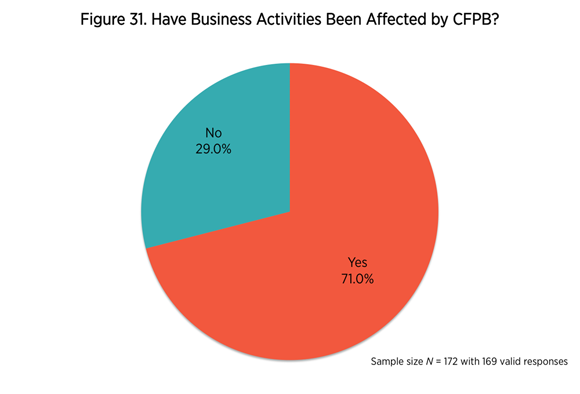

- 71 percent of surveyed banks said the CFPB is affecting their business activities.

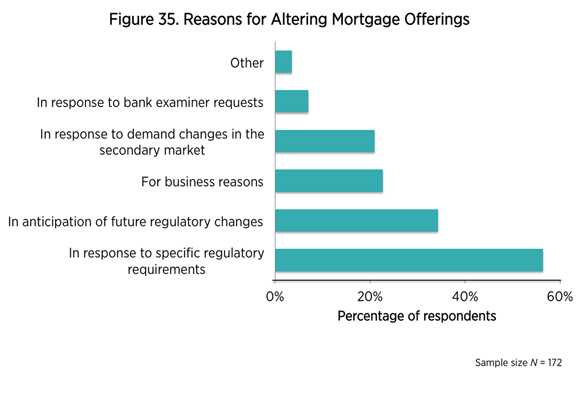

- The CFPB was a frequently cited factor affecting small banks’ mortgage offerings.

Diminished Community Relationships

- Narrative responses revealed a belief that Dodd-Frank challenges an essential feature of small banks. This is their ability to develop and cultivate customer relationships in the communities they serve by gathering “soft information” about customers and the surrounding community, enabling them to lend to nontraditional customers and small businesses.

- A commonly expressed view is that the customer-tailored approach to banking is not consistent with the Dodd-Frank regulatory framework, which favors the standardized lending criteria often employed by larger banks.

- Respondents expressed frustration that the new regulatory costs, rather than helping bank customers, make it harder for customers to get the products and services they need.

CONCLUSION

Dodd-Frank has proved burdensome to small banks, and customers are seeing the effects of the increased regulatory burden through reduced product and service offerings as small banks rethink their lines of business and consider consolidation activity. The survey data illustrate these adverse impacts and should help policymakers better understand how to achieve their policy objectives without unduly adding to the already substantial regulatory burdens on small banks. Small banks play an important role in serving small communities, small businesses, and borrowers with unique needs. Regulatory policy that allows small banks to serve their communities rather than diverting resources from customer service to regulatory compliance checklists will be critical to these banks’ continued survival.

Click here for the full survey analysis