- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

The IRS Puts America on Hold

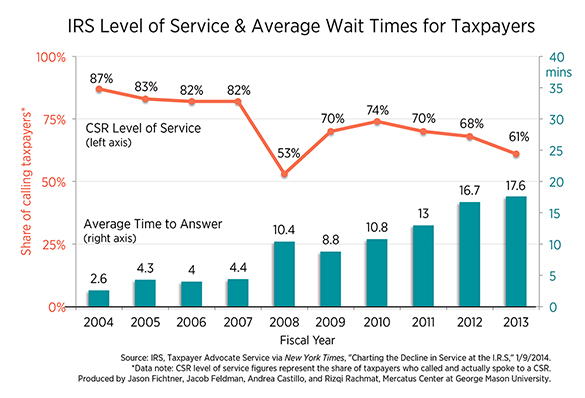

The IRS’s mission statement is to “provide America's taxpayers top quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.” Yet the Economix blog of the New York Times recently posted the following graph on declining performance of IRS customer service representatives (CSR). The data come from a series of annual reports released by Taxpayer Advocate Service—an independent organization within the IRS.

The IRS’s mission statement is to “provide America's taxpayers top quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.” Yet the Economix blog of the New York Times recently posted the following graph on declining performance of IRS customer service representatives (CSR). The data come from a series of annual reports released by Taxpayer Advocate Service—an independent organization within the IRS.

The “CSR Level of Service” line shows the percentage of taxpayers who succeeded in speaking with an IRS representative when they called. The “Average Time to Answer” bars reveal that taxpayers are waiting longer for an IRS representative to answer the phone even as a decreasing percentage of calls are answered. The chart suggests that Americans are increasingly looking for more help with a complex tax code–and getting less assistance in “helping them understand and meet their tax responsibilities.”

In response to the declining service, the IRS has decided to stop answering “more detailed” questions until April and then stop answering all legal questions thereafter. Nina Olson, the ombudswoman of the Taxpayer Advocate Service, writes, “At the risk of a vast understatement, it is a sad state of affairs when the government writes tax laws as complex as ours—and then is unable to answer any questions beyond ‘basic’ ones from baffled citizens who are doing their best to comply.”

In response to the declining service, the IRS has decided to stop answering “more detailed” questions until April and then stop answering all legal questions thereafter. Nina Olson, the ombudswoman of the Taxpayer Advocate Service, writes, “At the risk of a vast understatement, it is a sad state of affairs when the government writes tax laws as complex as ours—and then is unable to answer any questions beyond ‘basic’ ones from baffled citizens who are doing their best to comply.”

But the US tax code’s complexity creates many more problems than just unanswered phone calls. According to a 2013 Mercatus study, the Treasury fails to collect approximately $450 billion per year in unreported taxes even after IRS enforcement efforts. Because the tax code primarily relies on voluntary reporting of income with only a few enforcement efforts, an unanswered phone call can mean uncollected revenues. Economic literature suggests that simplification of the tax code by eliminating complex provisions and lowering marginal tax rates would increase income reporting.

Simplification of the tax code isn’t just about improving income reporting. Perhaps more than forgone revenues, tax code complexity costs Americans anywhere between $215 billion and $987 billion in accounting and economic costs.

As of 2011, Americans spent 6 billion hours filing taxes. This is equivalent to an annual workforce of 3.4 million, a population that could be the third largest city in the United States. Summing the costs of paying accountants and the monetary value of time spent filing taxes, the total is estimated between $67 billion to $378 billion per year. The economic costs of taxation are still larger. $148 billion to $609 billion of economic growth cannot occur as a result of tax disincentives from tax provisions and marginal rates.

The Tax Reform Act of 1986 demonstrates that these economic costs can be lowered by reducing the number of tax expenditures and lowering marginal rates. A simplified tax code yields greater equity among similar households, increases federal revenues, and increases economic growth—all while cutting back on the hours wasted on hold with the IRS.