- | Regulation Regulation

- | Data Visualizations Data Visualizations

- |

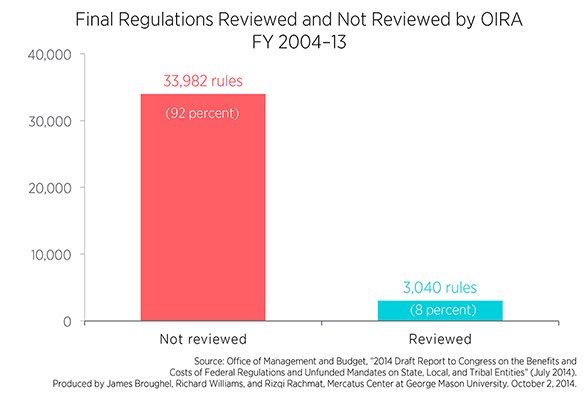

OIRA Quality Control Is Missing for Most Regulations

Over the last decade, federal regulatory agencies finalized more than 37,000 regulations, yet 92 percent of rules escaped review by the Office of Information and Regulatory Affairs (OIRA), a small office tasked with reviewing significant regulatory actions promulgated by such agencies.

Over the last decade, federal regulatory agencies finalized more than 37,000 regulations, yet 92 percent of rules escaped review by the Office of Information and Regulatory Affairs (OIRA), a small office tasked with reviewing significant regulatory actions promulgated by such agencies. Of the roughly 3,000 rules OIRA did review, only 116 have estimates of both benefits and costs appearing in OIRA’s annual report. Relative to the cost of many of these regulations, expecting agencies to analyze benefits and costs before issuing a rule is a fairly low bar to set.

The numbers suggest that the analysis of rules reviewed by OIRA is severely lacking in most cases. Of roughly 3,600 rules finalized last fiscal year, only seven had estimates of both benefits and costs appearing in OIRA’s report.

By confirming that agency actions are consistent with executive orders that set standards for regulatory analysis, OIRA is charged with ensuring that analysis meets minimal levels of quality and that agency rules are informed by those analyses. Each year OIRA puts out a report with details on the costs and benefits of the US regulatory system, but the report provides little insight because so many regulations escape review by OIRA. These missing rules also lack OIRA’s critical quality control check.

Most rules that avoid OIRA review are not deemed “significant,” meaning they aren’t expected to have large economic impacts, raise novel legal issues, or meet certain other criteria signifying the importance of a regulation. Yet, even if any of these rules by themselves might be small, cumulatively their effects can be large. Even worse, the rules that have estimates of both benefits and costs in OIRA’s report are not necessarily the ones that are most important to the American public. Of fiscal year 2013 rules, OIRA reports benefits and costs for a rule that defined “gluten-free” for the purposes of labeling foods that are gluten-free, but four major regulations emanating from the Affordable Care Act do not have any benefit or cost information, and none of the regulations implementing the Dodd-Frank Act have estimates of both benefits and costs. This last point is not surprising, as independent agencies (including most financial regulators) do not have to comply with executive orders setting regulatory analysis standards. Still, these examples suggest the true costs to the public are simply not captured in OIRA’s report.

OIRA performs an important role, but its staff is too small (38 at the end of 2013) relative to the hundreds of thousands of employees working in regulatory agencies to provide effective oversight. This means that there is no effective check on the vast majority of regulations, where there is often a total absence of analysis, analysis is ignored in the decision-making, or analysis is made to conform with a predetermined decision.