- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

Portfolio Breakdown of Projects Assisted by the Export-Import Bank

As the official export credit corporation of the US federal government, the Export-Import Bank is tasked with the mission of “assist[ing] in financing the export of US goods and services to international markets.” So what kinds of goods and services do the Bank primarily assist in financing?

As the official export credit corporation of the US federal government, the Export-Import Bank is tasked with the mission of “assist[ing] in financing the export of US goods and services to international markets.” So what kinds of goods and services do the Bank primarily assist in financing?

This week’s charts use data from the Export-Import Bank’s data on project applications from FY 2007 to FY 2014 to display the Bank’s top ten portfolio items by project type, along with the proportion of assistance allotted to all other product types. The data show that while aircraft manufacturing is the largest concern of the Export-Import Bank, it also funds many other surprising projects.

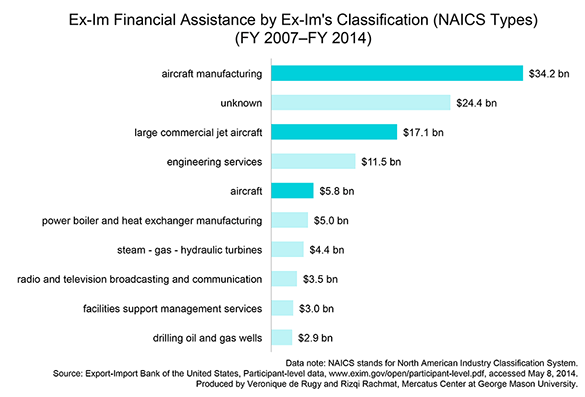

The first chart displays the top ten project types that were approved for Export-Import assistance from FY 2007 to FY 2014 according to the Bank’s unedited data set. We summed the approved exposure provided for each project type and ranked them from the largest amounts to the smallest. The Bank’s unedited data shows that aircraft manufacturing wins big, taking up three of the top ten funded categories for a combined total of $57.1 billion, or 33 percent of all assistance.

Other big winners are: “Engineering Services” (some of which is related to the aircraft industry), enjoying $11.4 billion in assistance, or 6.6 percent of all assistance; green energy, as represented by categories like “Power Boiler and Heat Exchange Manufacturing” with $5 billion in assistance and “Steam – Gas – Hydraulic Turbines” with $4.4 billion in assistance. In a troubling trend, the Export-Import Bank’s second-most-supported industry over the past seven years is simply labeled “Unknown.” This means that 14 percent of the Bank’s total assistance since 2007 cannot be accounted for in the Bank’s own public records. That the Bank is so cavalier about documenting how it extended $24.3 billion in assistance using the taxpayers’ credit should be a matter of grave concern.

As is typical of the Export-Import Bank’s public datasets, the unedited dataset provides an incomplete picture. The Export-Import Bank employs the Census Bureau’s North American Industry Classification System (NAICS) to categorize their product types. The decision to use NAICS, while superficially reasonable, presents two problems.

For one, the use of NAICS conflates the industries that the Bank supports. In the first chart, three different product types in the top ten supported categories are related to the aircraft industry: “Aircraft and Manufacturing” takes the top spot with $34.3 billion in assistance, or almost 20 percent of all assistance; “Large Commercial Jet Aircraft” comes in third with $17.1 billion, or almost 10 percent of all assistance; and “Aircraft” is the fifth-most-supported category with $5.7 billion in assistance, or 3.3 percent of all funding. The NAICS is an appropriate tool to provide precise measurements for subcategories, but it is not the optimal choice in conveying a broad picture of portfolio activity.

Second, human error or shorthand data entry can unintentionally understate the total assistance given to certain project categories. For instance, some projects may be categorized as “Other Miscellaneous Aircraft and Parts” while others will be categorized as “Other Miscellaneous Aircraft and Pa [sic].” Other times, the category will simply be misspelled, as was the unfortunate case with the many “Semicinductors” that the Export-Import Bank reported. Only by carefully combing through the data will these small errors become apparent.

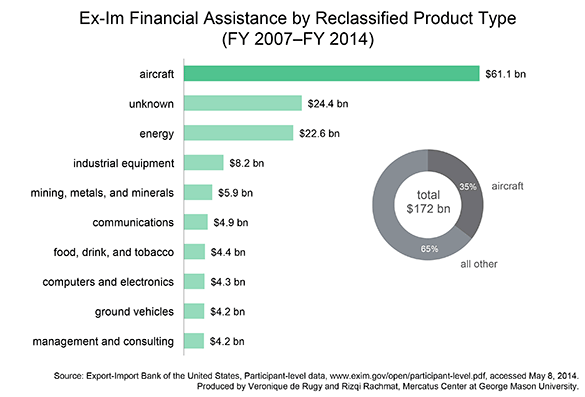

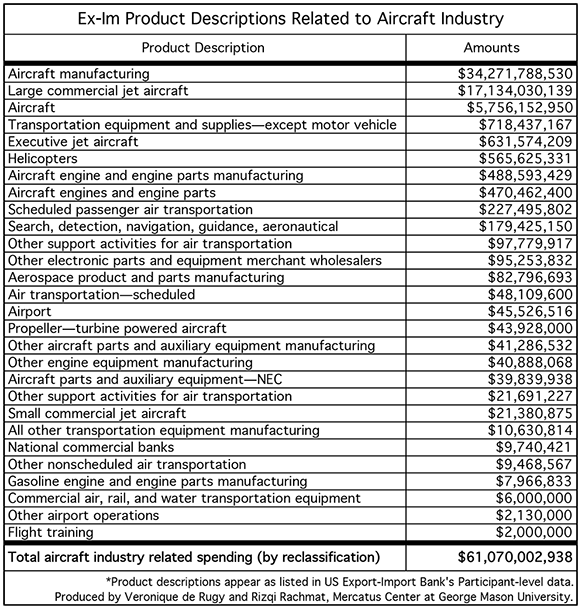

To correct for these errors, we recategorized the Export-Import Bank’s dataset into broader project types. Any project type that relates to the aircraft industry—including, for instance, parts, engines, airport subsidies, and manufacturing inputs—were categorized as “aircraft.” The final table below provides an illustration of how we combined the aircraft industry. We used the same method to combine other broad areas, like energy, management and consulting, industrial equipment, and communications, into their own categories as well. The original classifications and our new categories can be accessed in our attached data set at the top of this webpage. While any such exercise is necessarily subjective and fair arguments can be made that certain projects belong in different categories, or more than one category, we believe that this classification provides a better picture of the Bank’s broader portfolio. In any case, the need for reclassification underscores the inconsistent and poorly formatted nature of the Bank’s public data. Having more transparent data sets would eradicate any need for subjective reclassification—and would ultimately benefit the Bank itself.

The second chart displays the reclassified top ten project areas supported by Export-Import Bank assistance since FY 2007. After combining projects by industry rather than NAICS code, the top ten project types receive a much larger proportion of total assistance (84 percent) than the 64 percent suggested by the Bank’s original dataset. The aircraft industry receives 35 percent of total assistance, enjoying roughly $61.5 billion in support over the past seven years. “Unknown” projects still take the second spot with $24.4 billion. The energy sector wins big as well, raking in $22.6 billion in assistance, or 13 percent of the total. The next lower ranked industries receive substantial but considerably less assistance than the top three.

The presence of “Communications” and “Management and Consulting” on the top ten list might be surprising. The communications industry, which includes projects like telecommunications manufacturing, installation, and even publishing houses and media services, received almost $5 billion in assistance since 2007. Management and consulting, which includes a variety of nonmanufacturing services like process improvements, law services, and even advertising and design services, enjoyed $4.1 billion in assistance. Many people might consider these activities to not be “exports” per se, and it is hard to determine why these projects received assistance by simply looking at the Bank’s records. The public must simply take it on good faith that these communications and consulting projects are related to US exports in some way.

For the sake of the Bank’s own credibility, its data reporting must improve. It is inexcusable that the Bank reports $24.4 billion in “Unknown” projects. Regardless of how the data are formatted, it is clear that the aircraft industry wins big—and that the Export-Import Bank has some explaining to do.