- | Financial Markets Financial Markets

- | Federal Testimonies Federal Testimonies

- |

Preserving and Expanding Consumer Access to Credit Products along the Nonbank-Supplied Small-Dollar Loan Landscape

Testimony before the House Committee on Financial Services, Subcommittee on Financial Institutions and Consumer Credit

Conversations about consumer credit often reflect utopian visions of the world. Many people imagine that a few tweaks to regulations can ensure that everyone has the money needed to feed, clothe, and shelter the family. According to this logic, if households need to borrow money, lenders will treat them fairly, charge little, and always be repaid. But no matter how hard we all try, a well-crafted regulatory framework cannot bring us this utopia. Deliberate, empirically informed regulators, however, can do much to preserve and expand consumers’ options along the nonbank-supplied small-dollar loan landscape.

Chairman Neugebauer, Ranking Member Clay, and members of the subcommittee—thank you for the opportunity to appear before you today. Consumer credit has been a hotly debated topic for decades, if not centuries. Historically, banks do not fulfill small-dollar credit needs of subprime borrowers. As a result, the marketplace has responded with an array, or landscape, of nonbank-supplied small-dollar credit. Americans who rely on nonbank-supplied small-dollar loans are not wealthy, and many live from uncertain paycheck to uncertain paycheck. Today, few Americans have rainy day funds big enough to cover unexpected bills, paycheck shortfalls, or unplanned work absences. People who make regulatory decisions on behalf of these borrowers are well intentioned. In many cases, however, they do not fully understand how small-dollar credit products help subprime borrowers who are in difficult financial circumstances.

In my scholarly work on consumer credit, I seek to understand how small-dollar loan markets work and how best to restructure regulation to improve borrower welfare. Access to credit is a fundamental freedom for all Americans. The research that I and others have done shows that regulation along the consumer credit landscape often impinges upon this freedom.

My testimony contains three main points:

A. The small-dollar credit market is diverse because consumers’ needs are diverse.

B. Eliminating credit supply does not eliminate credit demand.

C. States have a long experience regulating small-dollar credit products—enabling us to judge the performance of regulatory restrictions.

A. The Small-Dollar Loan Market Is Diverse Because Consumers’ Needs Are Diverse

A common form of consumer credit is the personal credit card. Both prime and subprime borrowers use credit cards. Policymakers are likely less familiar with other common small-dollar consumer credit products, which I will focus on. These products have different loan structures in terms of size, length, cost, and repayment.

It is incumbent on anyone legislating, regulating, advocating, or studying any small-dollar credit product to know the differences among these products. There are significant differences among nonbank-supplied consumer credit products. Differences in their structure and underwriting processes mean that these products are not perfect substitutes for one another.

Nonrecourse Credit Products

1. Pawnbroker loans “are among the oldest forms of credit, stretching back to antiquity.” To my knowledge, pawnbrokers operate in every state. Their products have a simple structure. A consumer who owns something of value, say a stuffed moose head, exchanges the moose head for cash. At the end of the term, generally 30 days, the consumer has three options: a) extend for another term by paying a fee, generally 20–25 percent; b) reclaim the moose head by repaying the loan and the fee; or c) walk away and abandon the property. If the consumer chooses the third option, the pawnbroker has no recourse—the borrower owes nothing and the pawnbroker now owns the moose head. Accordingly, the only thing that matters to the pawnshop is the value of the object presented and the borrower’s legitimate ownership of the item.

2. Vehicle title loans operate in a manner nearly identical to pawn loans. To my knowledge, these loans emerged in the 1990s and, by law, title lenders operate in only 17 states. In these transactions, a consumer uses a clear car title as collateral. Importantly, the consumer keeps possession of the vehicle during the term of the loan—generally 30 days. The title lender places a lien on the car. The lender may also ask the borrower to provide references and proof of income. At the end of the term, the consumer has the same three options as the consumer who borrows from a pawnbroker. If the consumer chooses to abandon the car, which happens only about 8 percent of the time, the title lender sells the car and keeps the proceeds, but may not pursue the borrower for the difference if the loan exceeds the proceeds from selling the car. State laws governing vehicle title loans vary, but typically govern the maximum amount that can be borrowed and the maximum interest rate.

Recourse Credit Products

3. Payday loans, available at brick-and-mortar stores and online, are lump sum loans with interest and principal due at the end of the term, generally 14 days. To my knowledge, these loans emerged in the 1990s and these lenders operate legally in 33 states. These loans have a simple form. Payday lenders typically require the borrower to have a checking account, provide proof of income, show identification, and be at least 18 years old. About 80 percent of those who apply for a loan receive one. Payday lenders collect a signed Automated Clearing House authorization or a postdated check from the borrower in the amount of the principal plus interest. States limit the values of these loans and the fees a lender may charge, and they regulate other aspects of the loans. Although regulations vary, a typical maximum amount lent is $500, with a typical fee of about $20 per $100 borrowed.

4. Traditional installment loans are available through finance companies. The history of these loans stretches to the Uniform Small Loan Law of 1916—a model law that emerged from extensive study of small-dollar lending in the early 1900s. To my knowledge, no state bans this credit product, but because of laws capping interest rates, installment lenders only operate in about 32 states. There is a wide range of allowable interest rates. Consumers pay back installment loans with equal payments over time. Each payment consists of principal and interest. These loans amortize; that is, the amount owed decreases over time. Depending on the size of the loan, a typical term is 6 to 24 months. Due in part to this structure, installment lenders must conduct extensive underwriting—that is, assess the borrower’s financial condition and gauge their ability to repay the loan. Depending on overall economic conditions, installment lenders turn down 40 to 60 percent of loan applicants.

Consumers generally know how to navigate the small-dollar landscape. I recently surveyed 400 randomly chosen Mississippians. In my study, I asked two questions. The first was, “Do you know where to go to get a loan to suit your needs?,” and 53 percent of the respondents strongly agreed, while 11.5 percent strongly disagreed. The second question was, “Do you understand the terms of the loans you have taken out?,” and 60.5 percent of the respondents strongly agreed, while 8.3 percent strongly disagreed.

B. Eliminating Credit Supply Does Not Eliminate Credit Demand

Economic research shows that in American history, banning products outright, or effectively banning them through regulatory restrictions, does not eliminate the demand for these products. Instead, the effect is a restriction in the honest supply of these products. The 18th Amendment to the US Constitution is an instructive example of the unintended effects of banning legitimate businesses. Banning the production, sale, and transportation of alcohol drove those businesses underground. People were still (illegally) making and transporting alcohol, but buyers paid a premium to cover the added legal risk that producers and transporters faced.

Recent rigorous academic research documents the importance of keeping nonbank-supplied credit products available to consumers. For example, Zywicki and Okolski conclude: “The bottom line is that restrictions on auto title lending will eliminate an important funding option for many consumers, especially those of lower income, and will incentivize the use of more risky or dangerous credit channels.” In addition, Fritzdixon, Hawkins, and Skiba conclude: “Instead of banning title lending, policymakers should foster a market with information that will help customers understand the true cost of title loans.” Morse studies the payday loan market and finds that “communities with payday lenders show greater resiliency to natural disasters,” and her estimates of welfare measures “suggest that payday lending enhances the welfare of communities.”

The Consumer Financial Protection Bureau (CFPB), armed with five years of experience, stands ready to make new consumer credit rules. The CFPB has the power to distort or destroy consumer credit markets under the guise of protecting consumers from “unfair, deceptive, or abusive acts or practices.” For example, based only on established patterns of use, the CFPB is currently exploring new restrictions on payday loans. Observing that some payday loan customers use payday loan products frequently, the CFPB seemingly concludes that payday loans are “unaffordable.” Without exploring other possible reasons why some payday borrowers use the product, or documenting harm to consumers, the CFPB is seeking to limit the number of payday loans made to any consumer in a year to six. My preliminary investigation into this matter suggests that such a limit could eliminate 60 percent of the payday loans made each year. Other research suggests that the comprehensive CFPB proposal will eliminate 80 percent of the number of payday loans made in a year. Where will these borrowers go for credit?

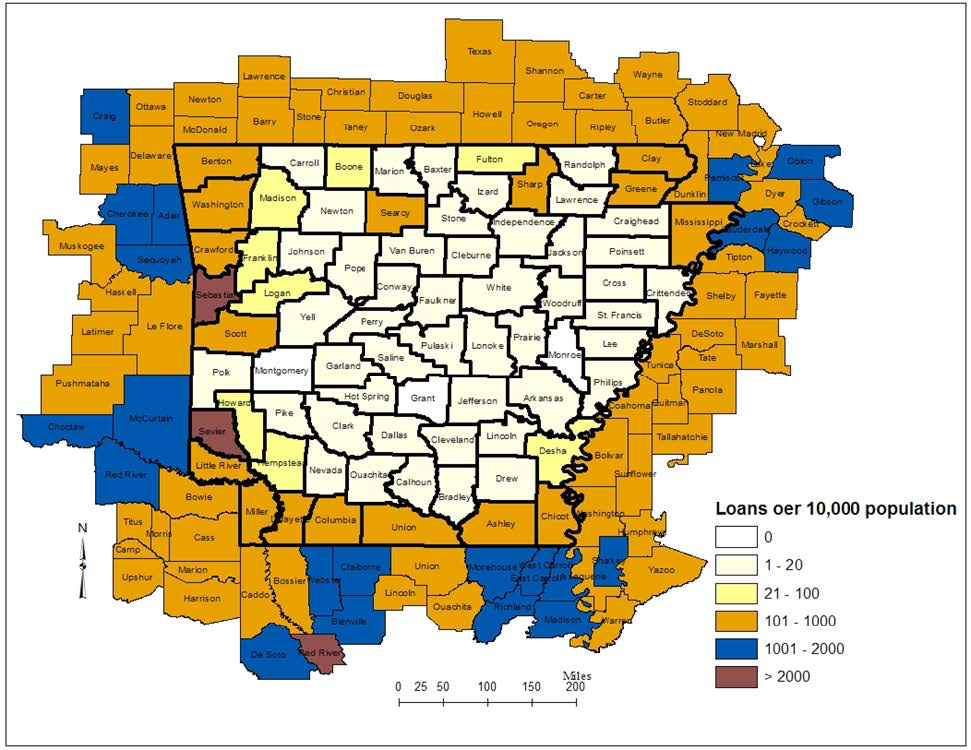

Eliminating payday loans does not mean that borrowers will magically stop borrowing or simply begin to borrow from other legal lenders. Director Richard Cordray has testified to the effect that the CFPB plans to preserve access to some small-dollar loan products. In my opinion, the traditional installment loan makes a good candidate because it has a long history of being a safe and affordable pathway out of debt. Traditional installment lenders, however, do not and will not loan to everyone. Such regulation could force some consumers, already in desperate situations, into the arms of illegal lenders. Loan sharks love credit deserts—places that are uninhabited by legitimate lenders because of ill-considered regulation (see attached figure 1).

Rather than conducting careful research of its own and drawing from the research others have done, the CFPB appears poised to act without adequate independent empirical support. If so, the CFPB could radically alter the small-dollar loan landscape to the detriment of consumers. The CFPB would be wise to base its decisions on compelling academic research—and the CFPB should be actively encouraging such research. These decisions could include leaving regulation entirely to the states. As an academic, I believe in conducting thorough and extensive research before making public policy decisions. In the example above, I want to see considerable rigorous empirical evidence that: a) repeated payday borrowing is, in fact, harmful to consumer welfare, b) such a proposed limit of six loans in a year will do more good than harm, and c) no existing state regulatory structure is adequate to address the perceived overuse problem.

C. The Performance of State Regulatory Restrictions on Small-Dollar Loans

The CFPB cannot impose interest rate caps. This power belongs to the states. The various states have made many regulatory choices along the landscape for the last century and have been setting interest rate caps since colonial times. Binding usury laws, since colonial times, reduce credit and economic activity.

The Progressive Era of the early 20th century brought many social reform movements, including efforts focused on temperance, women’s suffrage, child labor laws, and credit reform. The credit reform movement, spearheaded by Arthur Hamm of the Russell Sage Foundation, sought to expand credit for workers. Credit reformers understood that the needs of borrowers and lenders had to be satisfied to create a sustainable market-based alternative to illegal loan sharks. These reformers sought to pass state laws allowing licensed lenders to make small-dollar loans at rates above state-imposed interest rate ceilings, which were then typically 6 percent. Loan sharks have no respect for interest rate caps or sometimes, more disturbingly, for kneecaps.

In partnership with lenders willing to risk capital by making loans repaid in equal installment payments, reformers framed the model Uniform Small Loan Law of 1916. Through rigorous studies, the reformers determined that the costs and risks of small-dollar lending merited an annual interest rate of about 36 percent. The reformers set this rate to spur “aggressive competition by licensed lenders” and thus “to drive unlicensed lenders out of business.”

A traditional installment lender can make money at a 36 percent APR—if the dollar amount borrowed is large enough to generate enough interest income to cover the costs and risks of making the loan. In 1916, regulators declared a small-dollar loan to be $300 or less (about $6,900 in 2015 dollars). A $300, 12-month, 36 percent APR installment loan generates $61.66 in interest income. A $300 installment loan might have been profitable in 1916, but the loan production costs, including wages, benefits, rent, insurance, and utilities have dramatically increased over the past 100 years.

The consumer price index is about 20 times higher in 2015 than it was in 1916 (see attached figure 2). Today, a $300 installment loan is simply not profitable at a 36 percent interest rate. A recent study showed that a $2,100 (in 2013 dollars) loan has a break-even of 42 percent APR. Thirty-seven states currently have rate caps at or below 36 percent (see attached figure 3).

Numbers like 36 percent and 42 percent sound jarring, so it helps to put them into a dollar context. If you go to an ATM that is not connected to your bank on Friday and withdraw $50 for a $3 charge, you are effectively borrowing $50 (of your own money) until Monday, when your transaction and fee hits your account. Your cost is $1 per day, but your APR is a whopper: 730 percent. Now, would you be happy if a well-meaning regulator prohibited you from paying such an exorbitant APR and you were cashless for the weekend?

Consider a 12-month $1,000 installment loan. At a 36 percent APR, the borrower’s monthly payment is $100.46. At a 72 percent APR, the payment is $119.28. The difference is $18.82 per month, or about $4.70 per week. This weekly cost is less than the cost of one pack of cigarettes. A two-pack-per-day smoker can finance this higher rate by smoking 13 instead of 14 packs of cigarettes per week. Installment lenders would likely be willing to make loans of this size under this higher rate. More importantly, a would-be borrower might gladly pay an interest rate above any existing interest rate cap if the alternative were no loan at all.

The result of outdated interest rate caps is that legal loan deserts exist in the small-dollar loan landscape. There is demand, but no supply. Policymakers 100 years ago recognized that they might need to update the interest rate cap. The Uniform Small Loan Law of 1916 states that a rate established by legislators “should be reconsidered after a reasonable period of experience with it.” Clearly, the succeeding 100 years exceeds “a reasonable period.” Policymakers of today would be wise to follow the lead of reformers in the early 1900s and reconsider the outdated 36 percent interest rate cap.

D. Concluding Thoughts

Conversations about consumer credit often reflect utopian visions of the world. Many people imagine that a few tweaks to regulations can ensure that everyone has the money needed to feed, clothe, and shelter the family. According to this logic, if households need to borrow money, lenders will treat them fairly, charge little, and always be repaid. But no matter how hard we all try, a well-crafted regulatory framework cannot bring us this utopia. Deliberate, empirically informed regulators, however, can do much to preserve and expand consumers’ options along the nonbank-supplied small-dollar loan landscape.

Thank you. I am ready to answer any questions.

Figure 1. A Loan Desert Example

Source: Lukongo and Miller, “Some Consequences of the Constitutional Interest Rate Cap in the State of Arkansas.”

Note: Arkansas has a 17 percent interest rate cap. Loan production costs exceed revenue. No traditional installment lenders operate in Arkansas. Arkansas residents have to go to other states to obtain a traditional installment loan. It is too far to go for most Arkansas residents. Number of traditional installment loans (in sample) per 10,000 population, in Arkansas and border counties, September 2013.

Figure 2. Some Representative Prices, 1913 vs. 2013

Sources: Tim McMahon, “Food Price Inflation Since 1913,” InflationData.com, March 21, 2013; Rick Suttle, “Union Truck Driver Pay Scales,” Houston Chronicle, accessed February 8, 2016.

Figure 3. State Interest Rate Caps by Size for Traditional Installment Loans, 2016

Source: Black and Miller, “Examining Some Arguments Made by Interest Rate Cap Advocates.”