- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

President Obama's Fiscal Year 2016 Budget: Tax and Spend

While the president’s budget proposal is unlikely to go anywhere because Republicans control Congress, it doesn’t change the underlying reality that the long-term budget picture remains bleak because spending will outstrip revenues unless policymakers change course. That means cutting the size and scope of the federal government—not increasing taxes.

President Obama’s proposed budget for fiscal year 2016 envisions the federal government collecting and spending an increasing amount of taxpayer money over the next ten years. For the upcoming fiscal year, the president expects to spend a tick under $4 trillion while hoping to collect revenues worth $3.525 trillion. The resulting deficit of $475 billion in 2016 would be smaller than the projected deficit for fiscal 2015, but deficits would soon begin to climb again under the president’s policies.

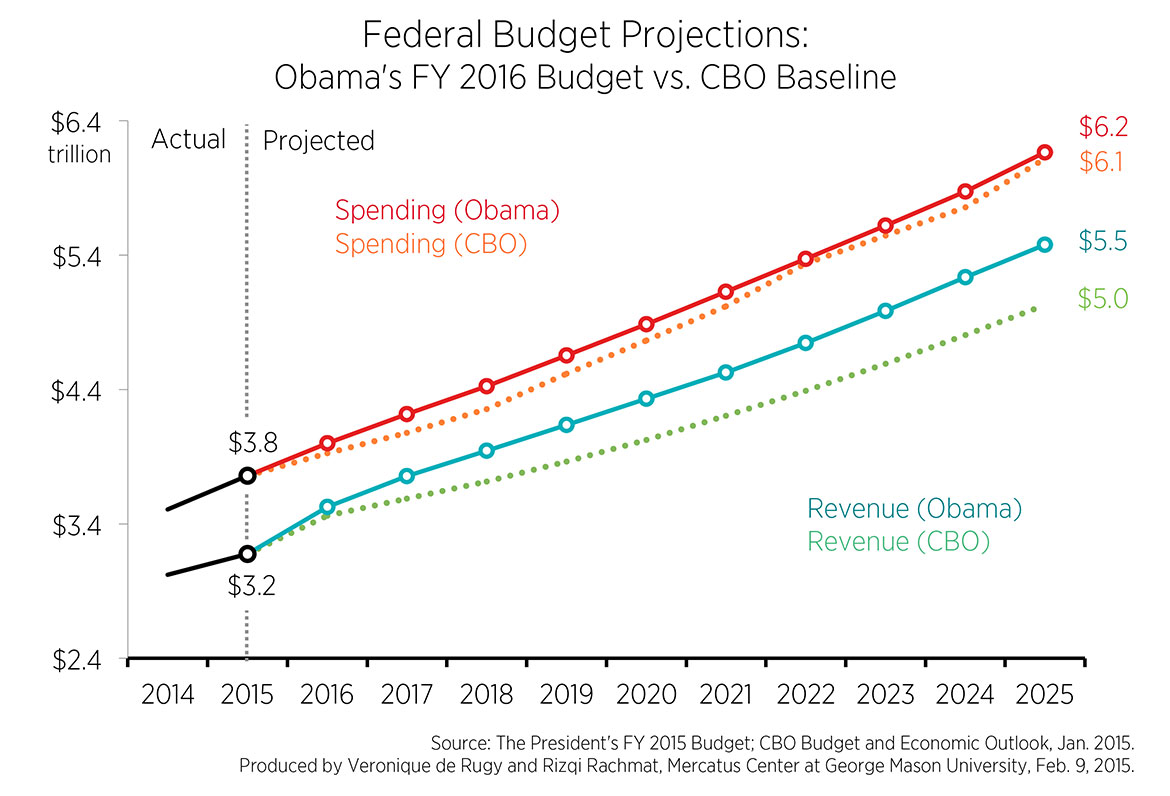

The following chart compares projected outlays and revenues under the president’s proposed budget to the Congressional Budget Office’s (CBO) latest baseline, which are budget projections based on current law adjusted for inflation and population growth. In fiscal 2025, spending under the president’s policies would reach $6.2 trillion, compared to $6.1 trillion under the CBO’s baseline. The difference on revenues is larger, with a higher projection of $5.5 trillion under the president’s proposal, compared to $5 trillion under the CBO baseline.

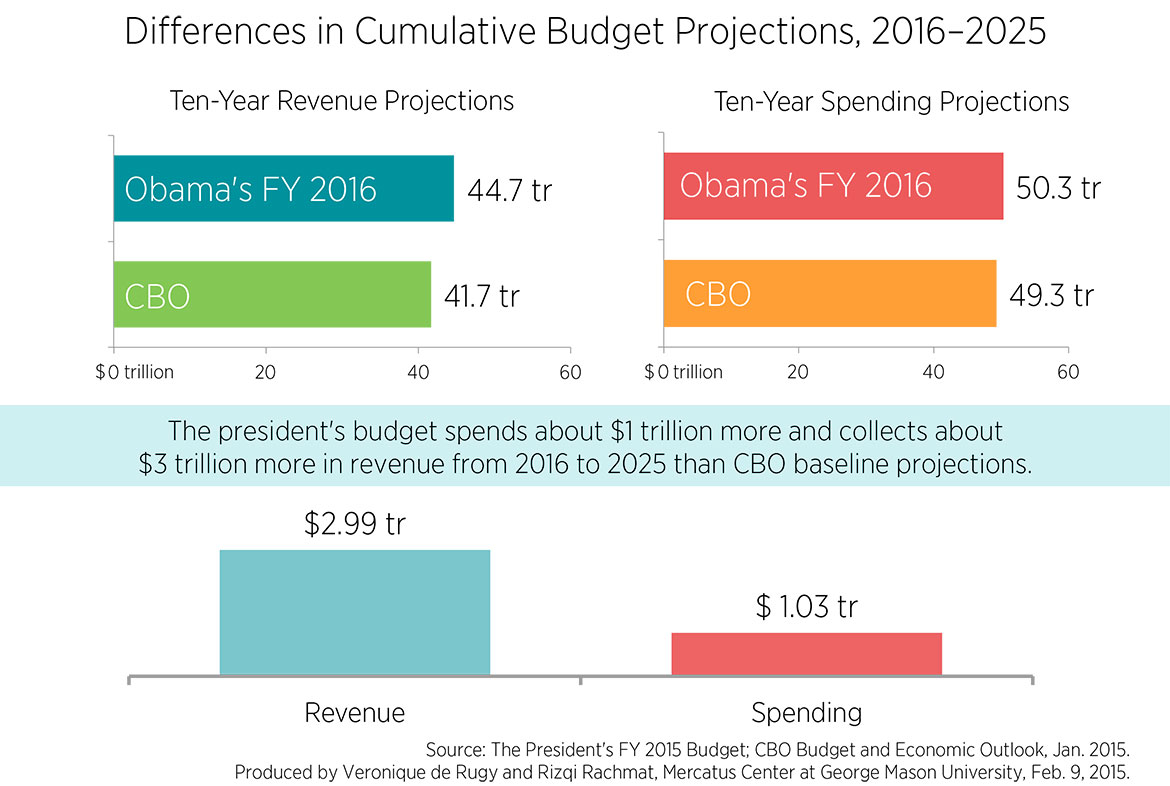

The cumulative effect of the president’s projections would be $3 trillion more in revenue versus the CBO’s baseline from fiscal years 2016 to 2025 ($44.7 trillion versus $41.7 trillion). During that span, the president expects to spend just over $50 trillion, which is $1 trillion more than cumulative spending under the CBO baseline. This difference between revenue and spending under both projections means that the federal debt will continue to grow.

These long-term budget figures are projections and are far from being etched in stone for a variety of reasons, including changes in the economy and the political landscape. Indeed, policymakers have used the economic downturn, wars in the Middle East, and natural disasters to justify higher than originally projected spending in recent years.

What is certain is that federal entitlement programs are fueling an unsustainable growth in spending, which is reflected in both projections. The president’s budget, however, does almost nothing to address this situation, focusing instead on tax increases to fuel more spending. For example, his budget’s fact sheet promises to “create the infrastructure that allows businesses to thrive and create good, high-paying jobs” by using more revenue taxed from businesses to spend $478 billion on infrastructure spending over the next six years. As I discussed in a recent piece on the gas tax and infrastructure spending, the federal government should actually be devolving responsibility for infrastructure to the states and private sector.

While the president’s budget proposal is unlikely to go anywhere because Republicans control Congress, it doesn’t change the underlying reality that the long-term budget picture remains bleak because spending will outstrip revenues unless policymakers change course. That means cutting the size and scope of the federal government—not increasing taxes.