The Volcker Rule prohibits financial institutions reliant on deposit insurance from engaging in proprietary trading and limits their relationships with hedge funds and other private funds. These activities were not central to the most recent financial crisis,[1] but former Federal Reserve chairman Paul Volcker championed the rule’s inclusion in the Dodd- Frank Act in response to legitimate concerns that the federal deposit insurance umbrella was being stretched beyond its intended purpose. Bad trading bets by these financial institutions could cause losses for which the deposit insurance fund (and ultimately taxpayers) would be on the hook.

The Volcker Rule prohibits financial institutions reliant on deposit insurance from engaging in proprietary trading and limits their relationships with hedge funds and other private funds. These activities were not central to the most recent financial crisis,[1] but former Federal Reserve chairman Paul Volcker championed the rule’s inclusion in the Dodd- Frank Act in response to legitimate concerns that the federal deposit insurance umbrella was being stretched beyond its intended purpose. Bad trading bets by these financial institutions could cause losses for which the deposit insurance fund (and ultimately taxpayers) would be on the hook.

Because the distinction between permissible and impermissible activities under the rule is ambiguous and hard to administer, the Volcker Rule will not work effectively and could do more harm than good. Instead, the legitimate concerns underlying the Volcker Rule should be addressed through enhanced monitoring of financial companies’ activities by shareholders and creditors. Furthermore, the nature and scope of federal deposit insurance coverage, which incentivizes high-risk financial activities, should be revisited.

THE GROWTH OF FEDERAL DEPOSIT INSURANCE: INCREASING INSTABILITY AND ENCOURAGING RISKS

Deposit insurance was introduced on the national level in response to widespread bank failures, panics, and closures during the Depression. Depositors would have been less likely to panic and withdraw funds from their banks if an insurance system had been in place as a backstop in the event of losses.[3] However, as prior state deposit insurance systems had illustrated, deposit insurance also raises a moral hazard concern.[4] Depositors are less likely to monitor their banks if they know their losses are insured. Banks are less likely to be careful if they are not being monitored. Along with others who had concerns about deposit insurance, President Franklin Roosevelt worried about making “the United States Government liable for the mistakes and errors of individual banks” and putting “a premium on unsound banking in the future.”[5]

Moral hazard concerns ultimately gave way to the desire to calm depositors, and a program was implemented. It has since ballooned. Deposit insurance started out in 1934 insuring deposits of up to $2,500 per account and was raised that same year to $5,000. Most recently, the Dodd-Frank Act set the level at $250,000. This means that, in 2008 dollars, deposit insurance has increased from $40,168 per account in 1934 to $246,706 in 2010, while the percentage of insured domestic deposits has increased from 45.12 percent in 1934 to 78.87 percent in 2010.[6]

Federal deposit insurance has likely increased risk-taking by banks. Thomas Hoenig, now vice chairman of the Federal Deposit Insurance Corporation (FDIC), remarked that deposit insurance is an “enormous subsidy” that “facilitates the use of leverage and provides an incentive toward higher risks that are hidden in opaque instruments, in trading activities, and in derivatives.”[7] The 1980s, with its hundreds of savings and loan failures, painfully illustrated that “no longer does it appear that those who warned of moral hazard were crying wolf.”[8] Economists looking at deposit insurance in other countries have found that deposit insurance fosters greater risk-taking by banks[9] and that, as the level of deposit coverage rises, bank stability decreases.[10] Deposit insurance may also increase total losses and, because mismanaged banks’ losses are absorbed by all depositors, the true cost of federal deposit insurance is hid- den to depositors.[11]

DRAWBACKS OF THE VOLCKER RULE

Although the Volcker Rule—which is intended to mitigate the economic instability and risk-taking that federal deposit insurance precipitates—appears to be an attractive solution, it has three distinct drawbacks. First, the rule relies heavily on regulatory interpretation and an ambiguous separation of permitted and prohibited trading activities. Unsure of what the legal line is, banks may avoid appropriately hedging risks. Second, restricting bank activities can increase bank fragility by impeding diversification. Less diverse banks may be less stable.[12] Finally, the Volcker Rule, by restricting proprietary trading, may harm market liquidity. Liquid markets support economic growth by making prices transparent and decreasing the cost of capital.

BETTER APPROACHES FOR ENHANCING FINANCIAL STABILITY

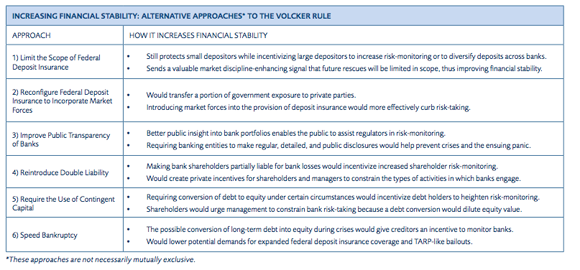

Alternative approaches that focus on forcing shareholders and creditors of financial institutions to monitor and absorb the risks of those institutions’ activities are preferable to the regulator-centric approach embodied in the Volcker Rule. Several such approaches, which are not mutually exclusive, are described briefly below.

1: Limit the Scope of Federal Deposit Insurance

In order to accomplish the Volcker Rule’s goal of mitigating financial instability, Congress could limit federal deposit insurance coverage. A scaled-back deposit insurance system would protect small depositors that lack the means to monitor their banks and would give larger depositors an incentive to monitor their banks or diversify their deposits across multiple banks.

A still-generous $50,000 limit, for example, would protect most retail customers but encourage large depositors to monitor their banks. At this level, deposit insurance coverage would be higher than its original inflation-adjusted level,[13] 2011 per capita GDP,[14] and the combined 2010 values of American families’ median holdings in transaction accounts and certificates of deposit—approximately $23,500.[15] The ratio of deposit insurance to per capita GDP, a standard measure for deposit insurance, is currently over 5-to-1 in the United States.[16] This is far outside the range of 2-to-1 to 1-to-1 recommended by the International Monetary Fund.[17] A legislative determination to reverse the trend of ever-increasing deposit insurance levels would represent a strong congressional stand against universal depositor bailouts. Reducing the cap would counteract the notion that there is unlimited implicit insurance and send a valuable market-discipline-enhancing signal that future rescues would be limited in scope.

2: Reconfigure Federal Deposit Insurance

Deposit insurance could be reconfigured in a way that would continue to offer security to retail depositors while causing less harm to financial stability. Bruce Tuckman suggested limiting deposit insurance by auctioning a finite quantity of federal deposit insurance to eligible banks that choose to bid for it.[18] Another option is co-insurance, under which a depositor would pay a deductible in the event the depositor’s bank fails. This approach would embody a common moral-hazard- fighting feature of medical, property, and automobile insurance. A cross-country econometric analysis found that, holding other variables constant, a co-insurance system decreases the likelihood of a financial crisis in countries where this system is in place.[19] Alternatively, there are various methods by which the first loss could be outsourced to private insurers or a special set of uninsured bondholders.[20] A more fundamental change would replace federal deposit insurance with a mandatory system of cross-guarantee contracts, in which banks would pay a market-based premium to a syndicate of private deposit guarantors and would be subject to activity limitations and compliance monitoring.[21]

3: Improve Public Transparency of Banks

Throughout the financial crisis, a lack of information about financial companies compounded already difficult conditions in the market. For example, government officials masked their concerns in official statements about the health of some of the TARP’s recipients.[22] More generally, bank regulators have an incentive—preservation of their regulatory reputation—to portray the entities they regulate as being healthy.

Facilitating better public insight into bank portfolios would enable the public to assist regulators in holding banks accountable and thus help foster increased financial stability. A 2005 study found that “the benefits of transparency for bank stability outweigh its costs” and that “banks that disclose more information are less at risk of falling into crisis.”[23] Requirements that banking entities make regular, detailed disclosures to the public would help prevent crises and the ensuing panic. Regulators could also be required to publish their supervisory ratings of banks, which are now confidential.

4: Reintroduce Double Liability

Bank shareholders used to be subject to double liability, meaning that they could be called upon in times of crisis to provide additional capital up to the par value (typically a small fraction of what is paid per share upon purchase by an investor) of the shares they held. This regulatory model existed in the United States until the Glass-Steagall Act, which created federal deposit insurance and ended the double liability regime. Jonathan Macey and Geoffrey Miller, who have written extensively on the subject, have demonstrated that the “double liability system was remarkably effective at protecting bank creditors, including depositors” and that “depositors lost very little money due to bank failure during the double liability era.”[24] In fact, during the first four full years of the Depression, with double liability in place, average annual losses from national bank failures amounted to only 77 cents for every $1,000 in deposits.[25]

Reintroducing double liability for financial firms’ shares would incentivize increased risk-monitoring by bank shareholders and managers. Shareholders—not federal deposit insurance—would be the primary bearers of losses resulting from poor risk- management.

5: Require the Use of Contingent Capital

Shareholder and creditor risk-monitoring could be encouraged by the required use of contingent capital—bank- issued debt that would convert to equity under specified circumstances. The Financial Stability Oversight Council, which studied this approach,[26] found that it would encourage creditors to be better monitors and would heighten risk-monitoring by shareholders who risk the dilution of their investment value.[27]

The effectiveness of a contingent convertible capital scheme depends on its details. Numerous proposals exist.28 Richard Herring and Charles Calomiris proposed that firms hold contingent capital worth 10 percent of the book value of assets. It would convert to equity at a fraction of face value in order to finance the firm’s recapitalization when the ratio of average common stock market value to equity value reached 8 per- cent. [29] An approach like this, through the threat of shareholder dilution and with an appropriate trigger, would be especially effective at encouraging monitoring by shareholders and creditors. It would also incentivize managers to raise additional equity well before the conversion is triggered.[30]

6: Speed Bankruptcy

Another approach would be to allow courts or regulators to force a troubled firm to undergo “speed bankruptcy,” pursuant to which tradable long-term debt would convert to equity.[31] This approach would shorten bankruptcy proceedings, increase monitoring by bondholders, and enable firms to recapitalize in times of crisis. Bank holding companies could be forced to convert debt into equity in order to recapitalize troubled insured subsidiaries rather than relying on the FDIC to negotiate a sale of the insured depository.

CONCLUSION

The Volcker Rule, although rooted in legitimate concerns about taxpayer-funded risk-taking, relies on clumsy regulatory constraints on bank activities and unworkable regulatory monitoring to address those concerns. Its goals could be achieved by strong measures designed both to limit the risk that taxpayers bear and to force shareholders and creditors to take responsibility for the risks undertaken by banking entities. Options include a lower cap on federal deposit insurance, a reconfiguration of deposit insurance, increased public transparency about banks, and greater shareholder and creditor exposure to the downside of bank risk-taking.