- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

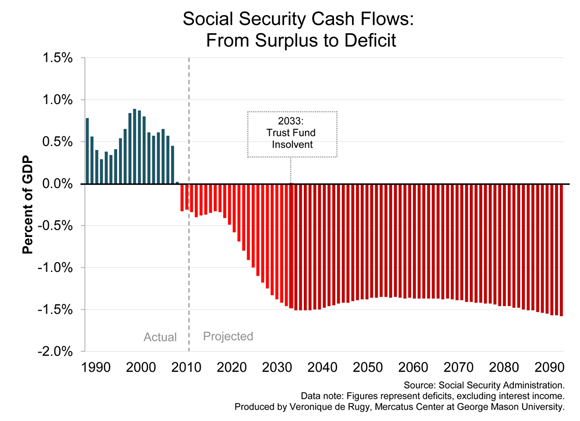

Social Security Running a Permanent Cash-flow Deficit

Spending on Social Security is now at untenable levels, as this chart, using annual data from the Social Security Administration (SSA) 2012 Trustees Report, illustrates.

Spending on Social Security is now at untenable levels, as this chart, using annual data from the Social Security Administration (SSA) 2012 Trustees Report, illustrates.

As we see in the blue section, the program was running a surplus until 2010, meaning that it was collecting more taxes each year than it needed to pay for benefits. However, since 2010, Social Security has been running a permanent cash-flow deficit. That means that taxes collected for the program aren’t enough to cover the benefits paid to retirees.

In 2010, the deficit was $46 billion, and in 2012 the deficits amounted to $49 billion. To fill the gap, the program is drawing from the trust-fund balances (first using interest, then the principal) to keep payments to retirees going (light red section).

The Obama administration recently expressed support for changing the way inflation (or the growth in consumer prices) is measured in order to lower future Social Security payments. However, this little fix is wholly inadequate to address the long-term insolvency problem faced by the program.

Starting in 2033, the trust funds will run out of assets (darker red section). At that time the program will revert to pay-as-you-go, i.e. benefits will be paid only by the taxes collected. That means that benefits will have to be cut across the board by roughly 25 percent. Cuts of that size will be extremely painful. Unfortunately, the president’s reform doesn’t do much to address this situation.