- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

Student Loan Debt Increases by 281 Percent Over 10 Years

Congress is debating how to resettle student loan interest rates, which doubled for certain new student loans from 3.4 percent to 6.8 percent on July 1, 2013. If we are truly worried about the growth of student loan debt, lowering the interest rate is not likely to improve the situation.

Congress is debating how to resettle student loan interest rates, which doubled for certain new student loans from 3.4 percent to 6.8 percent on July 1, 2013. If we are truly worried about the growth of student loan debt, lowering the interest rate is not likely to improve the situation.

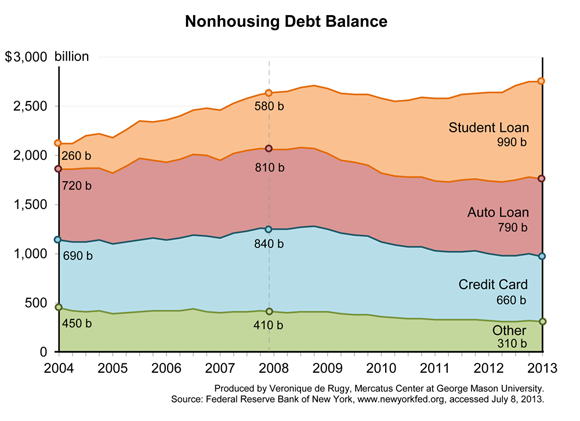

This week’s chart uses data from the Federal Reserve Bank of New York to examine trends in indebtedness at the household level.

Here are some key findings:

- In 2008 the interest rate on student loans was 6.8 percent. This was reduced in stages over the next four years to 3.4 percent. The data show a notable rise in student loan debt as interest rates fell between 2009 and today.

- Over the past decade, student loan debt has increased by 281 percent, from about $260 billion in the first quarter of 2004 to $990 billion in the first quarter of 2013.

- In the past year, nonhousing debt balances increased in auto and student loans, by $11 billion and $20 billion, respectively.

- Even so, student loan debt now comprises the largest share of total nonhousing debt at nearly 36 percent, four times its share of total nonhousing debt in the first quarter of 2004.

By keeping student loan rates artificially low, the federal government is contributing to the rapid increase in college tuition and forcing today’s workers to subsidize the educational choices of big earners.

For more on the issues surrounding the federal student loan program, see Veronique de Rugy’s article in Reason.