- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

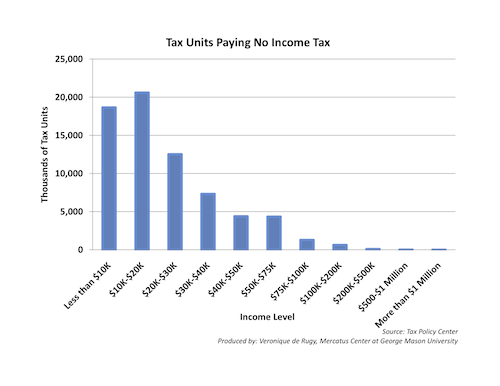

Tax Units Paying No Income Tax

This chart by Mercatus Center Senior Research Fellow Veronique de Rugy looks at the number of tax units who did not pay the federal income tax in 2009 using data from the Tax Policy Center (TPC).

This chart by Mercatus Center Senior Research Fellow Veronique de Rugy looks at the number of tax units who did not pay the federal income tax in 2009 using data from the Tax Policy Center (TPC). These statistics include the roughly 19 million people who are not required to file income taxes because their earnings are too low or because they do not claim tax credits.

In 2009, federal income tax non-payers were distributed throughout the earnings spectrum, with 26.3% of tax returns reporting less than $10,000 paying no income tax, and 29.1% of those making between $10,000 and $20,000 paying no income tax; the remaining 44.6% of Americans not paying income taxes were distributed throughout all income levels.

According to the TPC, this tax season an estimated 45% of tax units will pay no federal income taxes.

Note that not paying income taxes is distinct from paying no taxes at all. Most tax units pay the sales tax, and only 14% of tax units pay no federal income tax and no payroll tax. However, income taxes comprise a huge component of taxation in this country and remain the single largest source of revenue for the federal government (estimated by the Office of Management and Budget to constitute 44 % of federal tax revenues this year).

These trends in income taxation have been caused by a Congressional legacy of using the tax system not only to collect revenue but also to deliver a large array of social benefits in the form of exemptions, deductions, and credits that reward people for government-favored behavior. This social welfare function explains why so many people end up off of income tax rolls.

Veronique de Rugy debunks tax myths on Bloomberg TV.