- | Technology and Innovation Technology and Innovation

- | Data Visualizations Data Visualizations

- |

Taxicab Cartels Restrict Entry into Market at the Expense of Consumers

As the debate continues about how sharing economy service providers such as Uber, Lyft, and Sidecar should be regulated, this week’s chart shows why this is such a hotly contested issue.

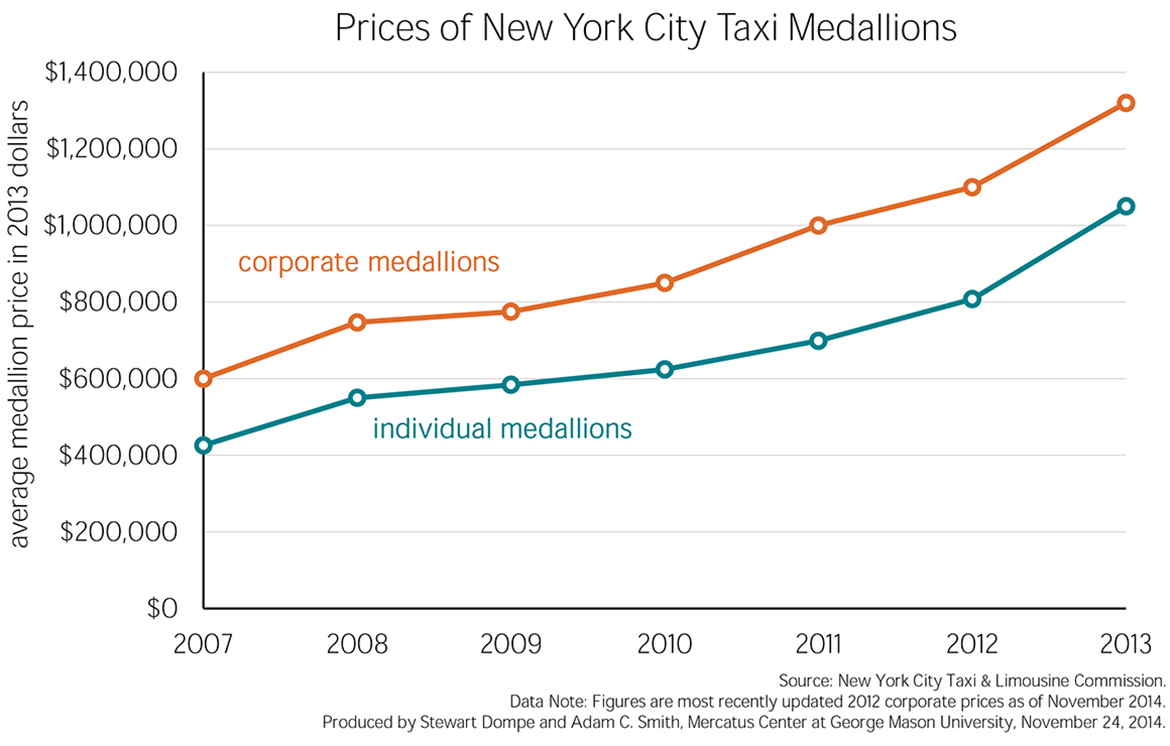

As the debate continues about how sharing economy service providers such as Uber, Lyft, and Sidecar should be regulated, this week’s chart shows why this is such a hotly contested issue. In New York City, taxi cabs can legally operate only if they have a taxicab medallion. The inflation-adjusted prices for NYC taxicab medallions rose 133 percent, on average, from 2007 to 2013, with prices for both corporate medallions and individual medallions increasing.

Despite the fact that the population of New York City grew roughly 12 percent over the last 70 years, the number of taxicab licenses has actually decreased since 1937, when the Haas Act, which regulated taxis, limited the number of cab licenses in New York City to 16,900. In 2004 only 12,187 medallion cabs operated in the city. Unsurprisingly, the price of medallions has increased dramatically since then. Indeed, over the last 80 years, taxi medallions have generated an annualized 15.5 percent rate of return. Put another way, the value of a medallion doubled, on average, every four and a half years.

These are staggering returns for this particular type of rent-seeking.

The bulk of this windfall goes to the medallion owners and is used to pay the up-front costs of procuring new licenses. Under such a system, current operators gain little from increasing total production; in fact, they gain by lowering it. Limiting the supply of medallions allows the taxi cartel to maintain high fares by preventing entrepreneurs from entering the market.

The result is lower income for cab drivers, higher fares for consumers, and worse coverage in poor and minority communities. For more on this issue, see our recent Mercatus on Policy piece, “Regulation of Platform Markets in Transportation.”