- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

US Corporate Income Tax Now the Highest Among Advanced Economies

This week’s charts use data from the OECD and the Tax Foundation to show that the United States continues to lag far behind other developed countries in corporate income tax reform.

This week’s charts use data from the OECD and the Tax Foundation to show that the United States continues to lag far behind other developed countries in corporate income tax reform.

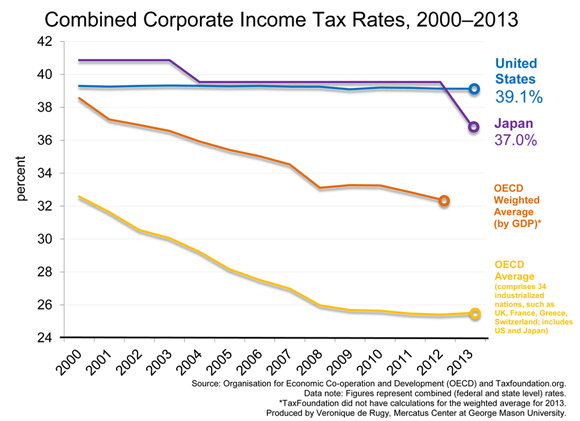

As the most recent data show, the United States has inherited from Japan the dubious distinction of imposing the highest corporate income tax rate (39.1 percent) in 2013. This year also marks the 15th consecutive year in which the U.S. corporate tax rate has exceeded the average OECD rate.

The first chart highlights that the US tax rate hovers far above the overall OECD average (yellow line). This disparity holds true even when the OECD average accounts for country size (orange line).

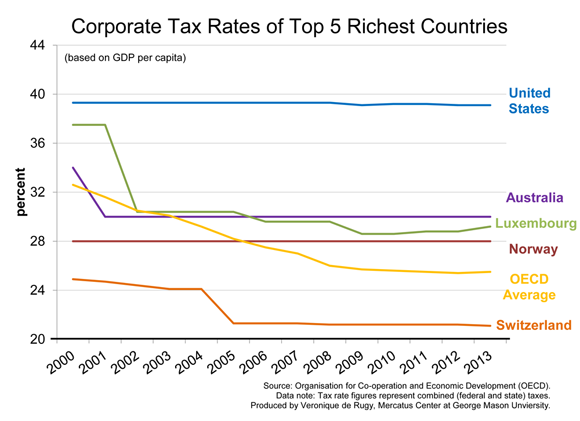

The second chart shows that the US corporate tax rate remains far above the top five richest countries based on GDP per person, which includes Australia, Luxembourg, Norway, and Switzerland. The United States is the third richest—and it is the only country in the top five that has not adjusted its corporate tax rates below 32.0 percent.

High corporate tax rates are a drag on the US economy and encourage companies to shift investments and jobs abroad to lower-tax jurisdictions. The combination of high-rates and a worldwide tax system makes the US corporate tax system even more punishing than it seems.

Data note: These tax rate figures represent combined corporate tax rates, which accounts for tax rates from the national or federal and sub-national or state-and-local levels. These charts were inspired by this Heritage Foundation chart from 2011.