- | Government Spending Government Spending

- | Federal Testimonies Federal Testimonies

- |

What Can Government Do To Create Jobs?

Testimony Before the House Committee on Education and the Workforce

Matthew Mitchell testified before the House Committee on Education and the Workforce on what the government can do to create more jobs.

INTRODUCTION

The U.S. economy continues to show tentative signs of recovery. In December, nonfarm payroll employment rose by about 200,000 and the unemployment rate dipped to 8.5 percent, its lowest level in 35 months.1 This is good news. But it is cold comfort for the 13.1 million Americans who are still unemployed. It means nothing to the 5.6 million who have been without work for 27 weeks or more.2 And it does little to ease the pain of nearly 1 million who have become so discouraged that they have stopped looking for work altogether.3

So the natural question for both the economist and the well-intentioned policy maker is this: what can we do to get people back to well-paid and fulfilling employment? In this testimony, I review the economic evidence concerning the government’s ability to do this. I also describe the conditions that are necessary for long-run prosperity.

Unfortunately, economic understanding of how government can revive an ailing economy is quite limited. It is not unlike our knowledge of surgery in past centuries: the instruments are blunt, we’re not very adept at wielding them, and there’s a good chance the intervention will cause more harm than good.

This does not mean, however, that we know nothing about the causes of prosperity. We may not know how to instantly breathe life back into a sick economy, but economists do know a great deal about how government can create an environment which is conducive to growth.

WHAT WE DO (AND DON'T) KNOW ABOUT REVIVING AN AILING ECONOMY

There are many things on which economists agree (e.g., few dispute the merits of free trade or the longrun fiscal problems with our largest entitlement programs).4 Unfortunately, there is very little consensus among economists on government’s ability to jumpstart a sick economy: some believe that government interventions can restore growth and “create jobs”; others believe that interventions only make things worse, leading to stagnation and massive unemployment.

The lack of consensus is understandable. For perfectly sound reasons, policy makers will not allow macroeconomists to conduct controlled experiments with the economy. When a recession hits, we do not spend stimulus money in a random sample of states and compare the results with a control group. If we did, economists would have a better understanding of how stimulus works, but the policy makers who let us experiment would likely join the ranks of the unemployed.

As such, almost everything we know about stimulus comes from either theoretical models or from socalled “quasi-natural experiments” in which economists look at somewhat random changes in government spending to draw conclusions about its effects. From the perspective of a scientist, it would be handy if everything else that might affect the economy were held constant during these quasi-experiments. It would be nice if monetary policy, trade patterns, natural disasters, and credit conditions remained unchanged. But the world moves on, and these things do change. So macroeconomists must resort to econometric techniques that attempt to control for these factors after the fact. Economists try their best, but these techniques only tell us so much.

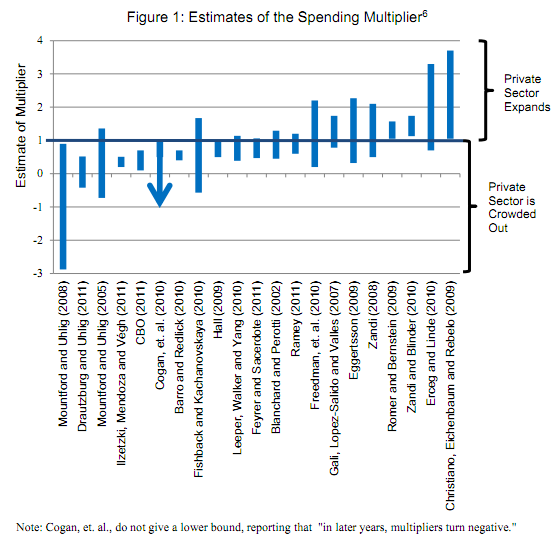

As a result, our understanding of government’s ability to revive an ailing economy is quite limited. This is evident in a sample of recent estimates of the government purchases multiplier. The multiplier measures the amount by which an economy expands when the government increases its purchases of goods and services by $1.00.5 It tells us, for example, how much of a return we can expect from public investments in infrastructure.

If the multiplier is larger than 1, then stimulus spending “multiplies,” or stimulates private sector economic activity. On the other hand, if the multiplier is between 0 and 1, then stimulus displaces or “crowds out” private sector economic activity, but not by enough to counteract the increase in public sector economic activity. Last, if the multiplier is less than 0, government purchases crowd out enough private sector activity to offset any increase in public sector activity. In this case, stimulus shrinks the entire economy.

Figure 1 depicts a sample of recent estimates of the government purchases multiplier. Each bar shows the high and low-end estimate of a particular study.

Note that there is a wide range in the estimates both across and within studies. If the optimistic scenarios are correct, an additional $1.00 in deficit-financed government spending spurs $2.70 in new private sector economic activity. But if the less-optimistic scenarios are correct, then an additional $1.00 in spending destroys $3.80 in private sector activity.7

The median estimate is 0.77. As I just noted, this implies that the only new economic activity that stimulus spurs is in the public sector; it actually crowds out economic activity in the private sector. One reason for the large range of estimates is that the effectiveness of stimulus may be highly dependent upon context. For example, economists have found that multipliers are small or zero when a nation is operating under a flexible exchange rate, is open to trade with other nations, and is highly indebted.8 All three conditions apply or soon will apply to the United States.

Others have found that multipliers are large when stimulus is relatively small, but that they quickly get smaller as more money is spent. Consider, for example, the second-largest estimate in table 1. The authors find that an additional dollar of stimulus may spur as much $2.30 in private sector activity, but only if the government has not already spent a lot of money on stimulus. They write:

[I]t is important to recognize that the marginal benefits of fiscal stimulus may drop substantially as spending rises, so that there is some risk that larger spending programs may have a low marginal payoff….“outsized” multipliers are only likely to apply to relatively small spending programs.9

This is especially relevant in today’s context when government has already undertaken multiple massive stimulus projects, including the Economic Stimulus Act of 2008 ($152 billion), the American Recovery and Reinvestment Act (ARRA) of 2009 ($862 billion), and the Hiring Incentives to Restore Employment Act of 2010 ($20 billion).

EXERCISE HUMILITY

Given the millions of Americans who remain unemployed, it may be tempting to look at some of the larger multiplier estimates and conclude that we ought to roll the dice and pursue further stimulus. Indeed, the president has recently called for $30 billion to modernize schools, $50 billion to improve surface transportation, $10 billion to establish and fund an infrastructure bank, and $15 billion to rehabilitate vacant property.10

I cannot tell you what level of risk is acceptable to take with the American economy. But further stimulus at this point is indeed risky. In fact, there are compelling reasons to expect it would do more harm than good.

These are not just theoretical concerns. Studying 91 countries, economists Antonio Fatás and Ilian Mihov have found that, “Governments that use fiscal policy aggressively induce significant macroeconomic instability,” and that, “The volatility of output caused by discretionary fiscal policy lowers economic growth by more than 0.8 percentage points for every percentage point increase in volatility.”11

One problem is that there is a wide gulf between the way stimulus advocates say stimulus ought to be implemented and the way it actually is implemented in practice. Keynesian economist and former presidential economic advisor Lawrence Summers has offered a widely accepted summary of how— ideally—fiscal stimulus ought to be applied.12 He notes that fiscal stimulus “can be counterproductive if it is not timely, targeted, and temporary.” In reality, however, it is very difficult to simultaneously meet all three criteria. Consider each in turn.

TIMELY

We now know that 18 months after the 2009 stimulus bill passed more than half of the $275 billion that was slated for investment had yet to be spent.13 It turned out that, as the president would later put it, “[T]here’s no such thing as shovel-ready projects.”14

In fact, the ARRA experience was not unique. In 1993, economist Bruce Bartlett reviewed four decades of stimulus efforts and found that, without exception, the funds were disbursed too late to make a difference.15 Economists Olivier Blanchard and Roberto Perotti undertook a more technical analysis in 2002 and concluded that most counter-cyclical changes in fiscal policy do not peak until several quarters after initiated.16

TARGETED

We also know that it is very difficult to effectively target stimulus funds where they can do the most good. For example, Keynesian theory tells us that the money that went to the state governments should have been used to increase government purchases. Instead, states used the vast majority of it (about 98 percent) to decrease their own borrowing.17

Keynesian theory also tells us that to be effective, stimulus funds should be directed toward those areas hardest hit by the recession. Unfortunately, numerous studies have found that the distribution of ARRA funds had no statistical relationship to local area unemployment rates.18

Worse still, even when ARRA money did manage to lead to new hiring, most of those hired had not been previously unemployed. 19

TEMPORARY

Last, we know it is very difficult to turn stimulus funding off once it has been turned on. Consider the closing remarks of the economists who produced the largest estimate in figure 1. Citing “political economy considerations,” they declare, “We are keenly aware that it is much easier to start new government programs than to end them.”20 For this reason, they note, “It remains very much an open question” whether an increase in government purchases is the best way to respond to a flagging economy, even when interest rates are near the zero bound.21 The data support their caution. In their study of historical stimulus efforts, Blanchard and Perotti found that in the typical case, 95 percent of a spending surge remains fully two years after an initial stimulus.22

Keynes himself shared these concerns. Toward the end of his life, he wrote:

Organized public works…may be the right cure for a chronic tendency to a deficiency of effective demand. But they are not capable of sufficiently rapid organization (and above all cannot be reversed or undone at a later date), to be the most serviceable instrument for the prevention of the trade cycle.23

But not all is lost. We may not know how to revive an ailing economy, but economists do know quite a bit about fostering an environment that is conducive to growth. That is, we may not know how to instantly revive the patient, but we do know what habits make for a healthy lifestyle.

FREE ECONOMIES ARE HEALTHY ECONOMIES

One of the most effective ways to foster widespread prosperity is to permit citizens a wide degree of what economists call “economic freedom.” That is, allow people to be free to choose and free to cooperate with others, provided they do not choose violence, theft, or fraud. Allow them to voluntarily exchange goods and services in a free and open market. Permit them to establish their own firms and compete with others on a level playing field. And—importantly—ensure that they are secure in their persons and their property.24

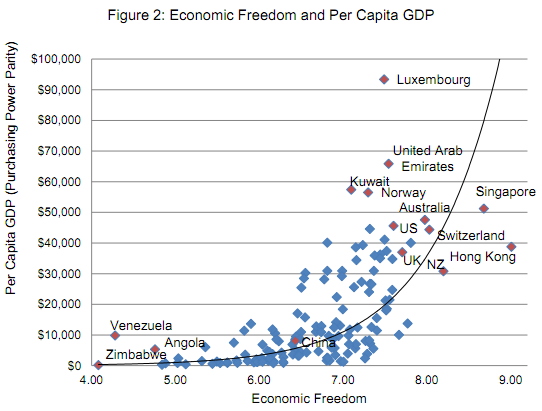

These ideas may sound vague, but thankfully, in the last several decades, a number of economists have attempted to put some rigor behind them by developing and testing objective measures of freedom. Gathering data across countries and across states, these economists have developed several indices of economic freedom. Professors James Gwartney, Robert Lawson, and Joshua Hall, for example, have developed a widely cited international index of economic freedom.25 Each year, the index rates 141 countries based on factors such as the size of government, the extent of regulation, the stability and prudence of monetary policy, the degree of openness to trade, and the protection of property rights.

Over the last decade and a half, scores of economists have used the economic freedom index to assess the impact of freedom on all sorts of measures of well-being, but especially on economic growth. Overwhelmingly, they have found that freedom makes a difference. Per capita GDP in the freest countries is more than 7 times that of the least free.26 Differences among low-income workers are even greater: the poorest 10 percent in the most-free nations earn 8 times that of the poorest 10 percent in the least-free.27 In marked contrast with the literature on stimulus, there is a remarkable degree of consensus in the studies of economic freedom. Economists Chris Doucouliagos and Mehmet Ali Ulubasoglu recently reviewed 45 studies examining the freedom-growth relationship and concluded that:

[R]egardless of the sample of countries, the measure of economic freedom and the level of aggregation, there is a solid finding of a direct positive association between economic freedom and economic growth.28

Figure 2 shows the relationship between freedom and per capita income. There is clearly a positive and statistically significant relationship. Moreover, because material wealth is positively associated with so many things that humans seem to care about—clean environments, quality health care, long life, and good education—economic freedom is also related to those things.29

The more freedom/more prosperity relationship doesn’t just hold at the international level. There are also a number of state-level indices of economic freedom, such as the annual Freedom in the 50 States index published by the Mercatus Center at George Mason University.30 In a recent review of several state-level indices, economists Jed Kolko, David Neumark, and Marisol Cuellar Mejia found that those states with greater degrees of economic freedom tend to experience larger gains in jobs, wages, and gross state product.31

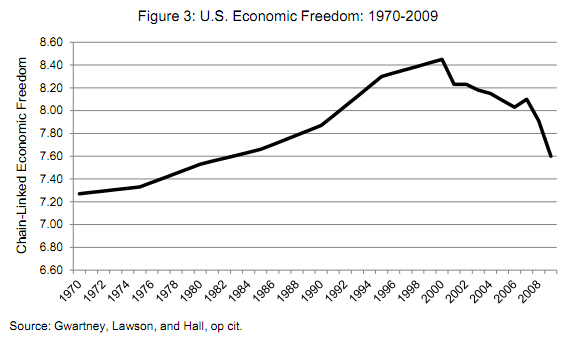

The economic freedom literature demonstrates that the remarkable prosperity of the United States is neither accidental nor inevitable. It is the result of decades of robust and expanding economic freedom. Unfortunately, as Figure 3 demonstrates, that freedom has been in precipitous decline for about a decade.

CONCLUSION

Millions of Americans are unemployed or underemployed. Millions more have given up looking for work. It is only natural to want to perform emergency surgery on our sick economy but we know from experience that drastic interventions can sometimes cause more harm than good.

Instead of implementing a quick fix, we should be creating the conditions that are necessary for long run economic health; we should be enhancing economic freedom. This means that regulations should be informed by sound analysis to ensure that they do not detract from or divert human capital into unproductive uses. The tax code should be made efficient, equitable, and easy to comprehend. Spending should be brought in line with revenue to make policy sustainable. And international trade should be made freer.

1 Bureau of Labor Statistics, The Employment Situation – December 2011, January 6, 2012.

2 Ibid.

3 Ibid. Since the recession began, the share of the working-age population with jobs or looking for jobs has declined dramatically. Because these people are not looking for work, they are not considered “unemployed” by the conventional BLS measure. If you count them as well as those who are in part time work for economic reasons and those who are marginally attached to the workforce, the unemployment rate would be above 15 percent

4 Robert Whaples, “Do Economists Agree on Anything? Yes!” Economists’ Voice 3, no. 9 (November 2006): 1-6.

5 It is important to remember that measured GDP includes government purchases and gross investments. In other words, a $1.00 increase in government purchases and gross investments automatically increases measured GDP by $1.00. This doesn’t necessarily mean that the public sector activity is valuable, only that it is counted in measured GDP. To understand the effect on private GDP, one must subtract one from the multiplier.

6 Andrew Mountford and Harald Uhlig, “What Are The Effects of Fiscal Policy Shocks?” (National Bureau of Economic Research [NBER] Working Paper Series no. 14551, Cambridge, MA, 2008); Thorsten Drautzburg and Harold Uhlig, “Fiscal Stimulus and Distortionary Taxation,” (National Bureau of Economic Research [NBER] Working Paper Series no. 17111, Cambridge, MA, 2011); Andrew Mountford and Harald Uhlig, “What Are the Effects of Fiscal Policy Shocks? (HumboldtUniversität zu Berlin working paper, Berlin, 2005); Ethan Ilzetzki, Enrique Mendoza, and Carlos Végh, “How Big (Small?) Are Fiscal Multipliers?” (National Bureau of Economic Research [NBER] Working Paper Series no. 16479, Cambridge, MA, 2010); Congressional Budget Office, Policies for Increasing Economic Growth and Employment in 2012 and 2013, (Washington, DC, November 15, 2011); John Cogan, Tobias Cwik, John Taylor, and Volker Wieland, “New Keynesian versus Old Keynesian Government Spending Multipliers,” Journal of Economic Dynamics and Control 34, no. 3 (March 2010): 281-95; Robert Barro and Charles Redlick, “Macroeconomic Effects from Government Purchases and Taxes,” (working paper, Mercatus Center at George Mason University, Arlington, VA, 2010); Price Fishback and Valentina Kachanovskaya, “In Search of the Multiplier for Federal Spending in the States During the New Deal” (National Bureau of Economic Research [NBER] Working Paper Series no. 16561, Cambridge, MA, 2010); Robert Hall, “By How Much Does GDP Rise If the Government Buys More Output?” (Brookings Panel on Economic Activity, Washington, DC, September 2009); Eric Leeper, Todd Walker, and Shu-Chun Yang, “Government Investment and Fiscal Stimulus,” (International Monetary Fund [IMF] Working Paper Series, no. 10/229, Washington, DC, 2010); James Feyrer and Bruce Sacerdote, “Did the Stimulus Stimulate? Real Time Estimates of the Effects of the American Readjustment and Recovery Act (National Bureau of Economic Research [NBER] Working Paper Series no. 16759, Cambridge, MA, 2011); Olivier Blanchard and Roberto Perotti, “An Emperical Characterization of the Dynamic Effects of Changes in Government Spending and Taxes on Output,” The Quarterly Journal of Economics 117, no. 4 (2002): 1329-368; Valerie Ramey, “Can Government Purchases Stimulate the Economy?” The Journal of Economic Literature 49, no. 3 (2011): 673-85; Charles Freedman, Michael Kumhof, Douglas Michael Laxton, and Dirk Vaughn Muir, “Global Effects of Fiscal Stimulus During the Crisis,” Journal of Monetary Economics 57, no. 5 (July 2010): 506-26; Jordi Gali, David Lopez-Salido, Javier Valles, “Understanding the Effects of Government Spending on Consumption,” Journal of the European Economic Association 5, no. 1 (March 2007): 227-70; Gauti Eggertsson, “What Fiscal Policy is Effective at Zero Interest Rates?” (Federal Reserve Bank of New York Staff Report no. 402, New York, November 2009); Mark Zandi, “Assessing the Macro Economic Impact of the Fiscal Stimulus 2008,” (Moody’s Economy.com, Washington, DC, January 2008); Christina Romer and Jared Bernstein, “The Job Impact of the American Recovery and Reinvestment Plan,” (White House, Washington, DC, 2009); Alan Blinder and Mark Zandi “How the Great Recession Was Brought to an End,” (Moody’s Economy.com, Washington, DC, July, 2010); Christopher Erceg and Jesper Lindé, “Is There a Fiscal Free Lunch in a Liquidity Trap?” (Board of Governors of the Federal Reserve System International Finance Discussion Paper no. 1003, July 2010); and Lawrence Christiano, Martin Eichenbaum, and Sergio Rebelo, “When is the Government Spending Multiplier Large?” (National Bureau of Economic Research [NBER] Working Paper Series no. 15394, Cambridge, MA, 2009).

7 The $2.70 figure refers to the Christiano, Eichenbaum and Rebelo (2009) study which found a high-end multiplier of 3.7 (see fn 5 above). The $3.80 figure refers to the lower-bound estimate by Mountford and Uhlig (2008).

8 Ilzetzki, Mendoza, and Végh, op. cit.

9 Erceg and Lindé, op. cit., 33-4. 10 White House, “Fact Sheet: The American Jobs Act,” September 8, 2011.

11 Antonio Fatás and Ilian Mihov, “The Case For Restricting Fiscal Policy Discretion,” The Quarterly Journal of Economics 118, no. 4 (2003): 1419-447.

12 Lawrence Summers, “The State of the U.S. Economy,” Brookings Institution Forum, December 19, 2007.

13 Alec MacGillis, “Big Chunk of Economic Stimulus Yet to be Spent by State, Local Governments,” The Washington Post, August 14, 2011

14 Stephanie Condon, “Obama: ‘No Such Thing as Shovel-Ready Projects’,” CBSNews.com, October 13, 2010.

15 Bruce Bartlett, “How Not to Stimulate the Economy,” The Public Interest, Vol. 112 (Summer 1993): 99-109.

16 Blanchard and Perotti, op. cit

17 John Cogan and John Taylor, “What the Government Purchases Multiplier Actually Multiplied in the 2009 Stimulus Package,” (working paper, National Bureau of Economic Research, October 2010).

18 Veronique de Rugy, “Stimulus Facts—Period 2,” (working paper, Mercatus Center at George Mason University, Arlington, VA, 2010); Jason Reifler and Jeffrey Lazarus, “Partisanship and Policy Priorities in the Distribution of Economic Stimulus Funds,” (working paper under review, September 2010); and Robert Inman, “States in Fiscal Distress,” (working paper, National Bureau of Economic Research, June 2010).

19 Garett Jones and Daniel Rothschild, “Did Stimulus Dollars Hire the Unemployed? Answers to Questions About the American Reinvestment and Recovery Act,” (working paper, Mercatus Center at George Mason University, 2011).

20 Christiano, Eichenbaum, and Rebelo, op. cit., 40.

21 Ibid, 40.

22 Blanchard and Perotti, op. cit.

23 The Collected Writings of John Maynard Keynes: Volume 27, Activities 1940-46: Shaping the Post-war World: Employment and Commodities, ed. E. Johnson, D. Moggridge (Cambridge: Cambridge University Press, 1980), 122.

24 James Gwartney, Robert Lawson, and Joshua Hall, Economic Freedom of the World: 2011 Annual Report (Canada: Fraser Institute, 2011).

25 Gwartney, Lawson, and Hall, op cit

26 Ibid, Exhibit 1.9.

27 Ibid, Exhibit 1.12.

28 Mehmet Doucouliagos and Chris Ali Ulubasoglu, “Economic Freedom and Economic Growth: Does Specification Make a Difference?” European Journal of Political Economy 22 (2006): 60-81, 78.

29 Gwartney, Lawson, and Hall, op cit. See, also, Benjamin Friedman, The Moral Consequences of Economic Growth (New York: Random House, 2005).

30 William Ruger and Jason Sorens, Freedom in the 50 States: Index of Personal and Economic Freedom (Arlington, VA: Mercatus Center at George Mason University, 2011).

31 Jed Kolko, David Neumark, and Marisol Cuellar Mejia, “Public Policy, State business Climates, and Economic Growth” (National Bureau of Economic Research [NBER] Working Paper Series no. 16968, Cambridge, MA, 2011).