- | Government Spending Government Spending

- | Expert Commentary Expert Commentary

- |

The Export-Import Bank Socializes Risk for Private Benefit

Since more than 98 percent of all U.S. exports receive no assistance from Ex-Im, this means the vast majority of Americans are victims who bear the costs of political privileges for a tiny number of politically-connected firms. Lawmakers should stand up for these unseen victims of the Ex-Im Bank. But they should also ask themselves why they are protecting a program that mostly benefits Washington.

One reason that governments grow fast without many obstacles is because the benefits of expansion are concentrated on a few while the costs are spread among millions.

Program beneficiaries have strong incentives to coordinate and protect their privileges. Average Americans, on the other hand, simply do not have the time or information to organize enough opposition to defeat these programs. They might bear the costs of government expansion, but individual programs only cost each American a few tax dollars here and there. Fighting for reform is simply not worth it. Bad programs proliferate, then, because cronyism pays more than stewardship.

The Export-Import Bank is a prime example of this dynamic. There is no policy justification for this corporatist program. Economists have long known that these kinds of export credit subsidies will never raise the overall level of trade; rather, they redistribute wealth away from unsubsidized American firms, employees, and consumers and direct it toward a tiny number of subsidy beneficiaries. The bank is allowed to prosper and grow because its costs are spread over millions while its benefits are jealously protected by its few clients.

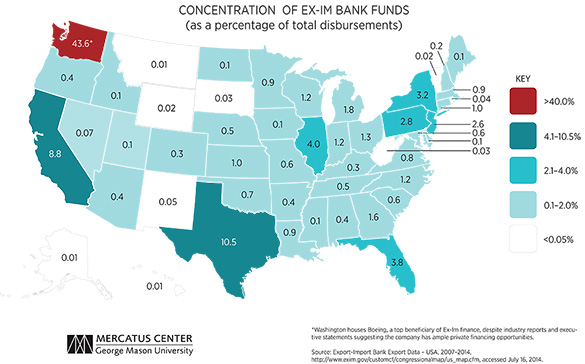

A recent chart series that I produced for the Mercatus Center clearly illustrates this effect. The map above uses data from the Export-Import Bank to display Ex-Im disbursements in each state as a percentage of total disbursements.

Washington is the clear winner in terms of total Ex-Im disbursements, receiving a massive 43.6 percent of all Ex-Im Bank disbursements from 2007 to 2014. Why? The state houses Boeing, one of Ex-Im Bank’s biggest beneficiaries, but the sheer size is nonetheless startling. Larger states like Texas and California only respectively pulled in 10.5 percent and 8.8 percent of total Ex-Im Bank disbursements during the same time. While businesses in most states barely benefit from the Ex-Im Bank at all, their taxpayers are just as exposed to Ex-Im Bank liabilities as taxpayers in handful of states that receive the most Ex-Im Bank backing.

The same is true when look at the portion of total state exports backed by the Ex-Im Bank, as a second chart in the Mercatus series demonstrates. Washington is again the big winner, with an incredible 22.67 percent of state exports backed by the Ex-Im Bank since 2007. The state percentages drop off quickly from there. While almost four percent of Wisconsin’s exports and about 3.5 percent of Massachusetts’s exports were backed by the Ex-Im Bank, the Ex-Im Bank supported less than two percent of the exports of 41 states for the same time period.

The truth of the matter is that the Ex-Im Bank yields negligible benefits for the vast majority of state exports, aside from one big outlier. These charts make it clear that the Ex-Im Bank primarily exists to benefit Boeing at the expense of everyone else in the country.

You might wonder why lawmakers would refuse to acknowledge this reality. For one, politicians are pressured by an army of lobbyists representing powerful companies who are committed to protect their perks even if it hurts everyone else. But politicians are not exactly shrinking violets, here. They like being able to point to the small businesses and American jobs that they “support” through the Ex-Im Bank.

What is much harder is to point to the millions of victims of the Ex-Im Bank. Taxpayers, for instance, bear a massive $140 billion exposure so that giant corporations like Boeing and General Electric can make a little more profit each year. Should the bank’s portfolio go south, normal people like you and I will be on the hook.

Then there’s the economic distortions. Consumers face higher prices for airline travel, for instance, because the bank heavily subsidizes the foreign purchase of aircraft. Unsubsidized companies are subjected to an unleveled playing field. Because Ex-Im artificially lowers subsidized competitors’ financing costs, unsubsidized firms get crowded out of capital markets and find it hard to expand and maintain employment. If they fail, they won’t have the convenient assurance of a de facto taxpayer bailout like Boeing does.

Since more than 98 percent of all U.S. exports receive no assistance from Ex-Im, this means the vast majority of Americans are victims who bear the costs of political privileges for a tiny number of politically-connected firms.

Lawmakers should stand up for these unseen victims of the Ex-Im Bank. But they should also ask themselves why they are protecting a program that mostly benefits Washington.