- | Government Spending Government Spending

- | Policy Briefs Policy Briefs

- |

The Economic Situation, September 2013

The economy right now is like traveling on a three-lane GDP expressway with one lane closed. Even worse, we are locked in slow moving traffic, and our gas gauge is pointing to empty. Worse than that, we are borrowing gas from other places and people just to keep our engine running. One might say that we are part of a two-lane deficit economy without a filling station in sight. Have you ever faced this problem? Orange construction barrels everywhere. Little prospect of reaching an exit any time soon. A knot in the pit of your stomach? Worried about running out of gas and wondering if some kind soul will assist you?

The wet blanket blamed for covering our economy might be energy regulation, monetary policy, or healthcare policy, or credit market controls, or environmental policy. But it is not policy per se that chills the economy—it is uncertainty with respect to policy. Most business people tell me, “Just let us know the rules of the game, and we will figure out a way to play.” It is awfully hard to play the game when rules are being changed without a clue as to when they will become final.

Today’s world has enough risk and uncertainty without more being added by Washington.

There’s slow traffic on GDP highway.

When policy uncertainty is folded into an economy where consumer balance sheets are still bruised, where state and local budgets are stressed, and employment growth is miserable, we get an economy that struggles to grow at 2 percent annually, instead of hitting the 3 percent real GDP growth that economists consider the norm.

The economy right now is like traveling on a three-lane GDP expressway with one lane closed. Even worse, we are locked in slow moving traffic, and our gas gauge is pointing to empty. Worse than that, we are borrowing gas from other places and people just to keep our engine running. One might say that we are part of a two-lane deficit economy without a filling station in sight. Have you ever faced this problem? Orange construction barrels everywhere. Little prospect of reaching an exit any time soon. A knot in the pit of your stomach? Worried about running out of gas and wondering if some kind soul will assist you?

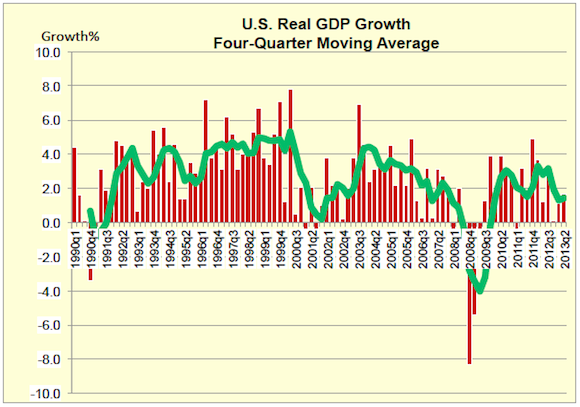

If so, you understand the relief that comes when finally you see service station markers ahead. Believe it or not, there is some relief in sight for our economy . . . maybe. We see the latest GDP growth data in the following chart. The four-quarter moving average points toward 2.0 percent, and there is general agreement that we are headed in that direction. And here’s the better news: there are good signs that the third lane will open in 2014, that the economy will again chug along with 3.0 percent real GDP growth.

There’s still some catching up to do.

Yes, 3.0 percent real GDP growth is out there waiting for some additional real consumer purchasing power. The next chart describes this piece of the 3.0 percent puzzle.

Here we see total US real disposable personal income for January 1994 through June 2013. The chart’s red line shows the start of the recent recession, but it is the white trend line that deserves attention. The gap between “trend” and “actual” forms part of the gap between 2.0 percent and 3.0 percent GDP growth.

We will see solid 3.0 percent real GDP growth when consumers have the purchasing power to make it happen and when employer and worker incentives combine to yield a larger workforce. More on this later.