- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

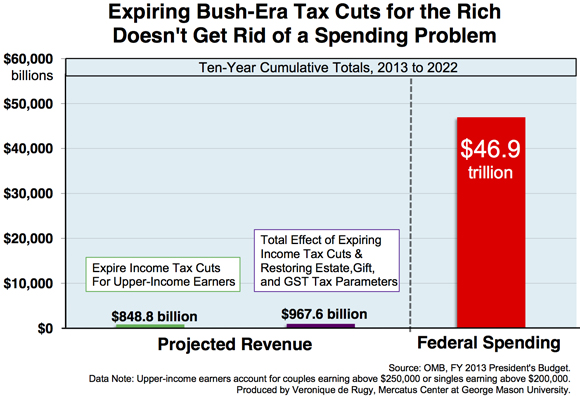

Expiring Bush-Era Tax Cuts for the Rich Doesn't Get Rid of a Spending Problem

Compare the size of the tax revenue increase to the total amount of spending, and you will see where the problem lies. Even if the president manages to collect an additional $967 billion by letting some of the Bush-Era tax cuts expire, Washington still has a spending problem.

President Obama recently proposed extending the Bush-era tax cuts, which are set to expire at the end of the year. The extension applies to couples earning less than $250,000 a year and to singles earning less than $200,000 a year. Everyone else would see his or her taxes go back up. According to the president, the revenue generated by the tax hike is supposed to help put the country on a more solid financial ground.

Using data from the president’s FY2013 budget, this chart places the revenue effects of this expiration into proper perspective. According to Office of Management and Budget data, letting the income tax measures expire for top earners will raise revenue by a projected $850 billion over the next 10 years. With the restoration of the estate, gift, and generational-skipping transfer tax parameters (also part of the Bush-tax cuts that affect high earners), revenue is projected to increase about $967 billion over the next 10 years.

This sounds like a lot of money, but let’s put this number into perspective by looking at how much the federal government will be spending over the course of the next 10 years. Drawing on the president’s own data, the chart above shows that the government will spend more than $46.9 trillion. Even without interest payments, spending will still amount to $41.2 trillion. Moreover, the total interest paid on the debt will reach $5.7 trillion.

Now compare the size of the tax revenue increase to the total amount of spending, and you will see where the problem lies. Even if the president manages to collect an additional $967 billion by letting some of the Bush-Era tax cuts expire, Washington still has a spending problem.