- | Corporate Welfare Corporate Welfare

- | Data Visualizations Data Visualizations

- |

Export Jobs Won’t Disappear Absent Ex-Im Bank

The charter of the US Export-Import Bank is set to expire on June 30 unless it is reauthorized by Congress. Scare tactics aside, the end of Ex-Im would not mean the loss of thousands of American jobs. Economists have long understood that subsidies doled out by government credit agencies such as the Ex-Im Bank are not merely unnecessary: they can actually harm the economy. In their quest to keep the subsidies flowing, proponents of the bank are claiming that failure to reauthorize its charter would lead to massive job losses. This blatant fearmongering has succeeded in causing concern among some lawmakers.

The charter of the US Export-Import Bank is set to expire on June 30 unless it is reauthorized by Congress. Scare tactics aside, the end of Ex-Im would not mean the loss of thousands of American jobs.

Economists have long understood that subsidies doled out by government credit agencies such as the Ex-Im Bank are not merely unnecessary: they can actually harm the economy. In their quest to keep the subsidies flowing, proponents of the bank are claiming that failure to reauthorize its charter would lead to massive job losses. This blatant fearmongering has succeeded in causing concern among some lawmakers. House Speaker John Boehner only made matters worse on April 30, when he asserted that “there are thousands of jobs on the line that would disappear pretty quickly if the Ex-Im Bank were to disappear.”

First, and fundamentally, export subsidies do not “create” or “support” jobs—they redistribute them from unsubsidized firms to subsidized ones. Second, the job numbers touted by Ex-Im Bank officials are dubious at best and have been roundly criticized as misleading by the Government Accountability Office, among others.

But, just as important, the biggest beneficiaries of the Ex-Im Bank know full well that their employees and those of their suppliers are perfectly safe in the event the charter is not reauthorized. That’s because Boeing, Caterpillar, General Electric, and the like all have billions of dollars of backorders that will keep their workers busy for years to come.

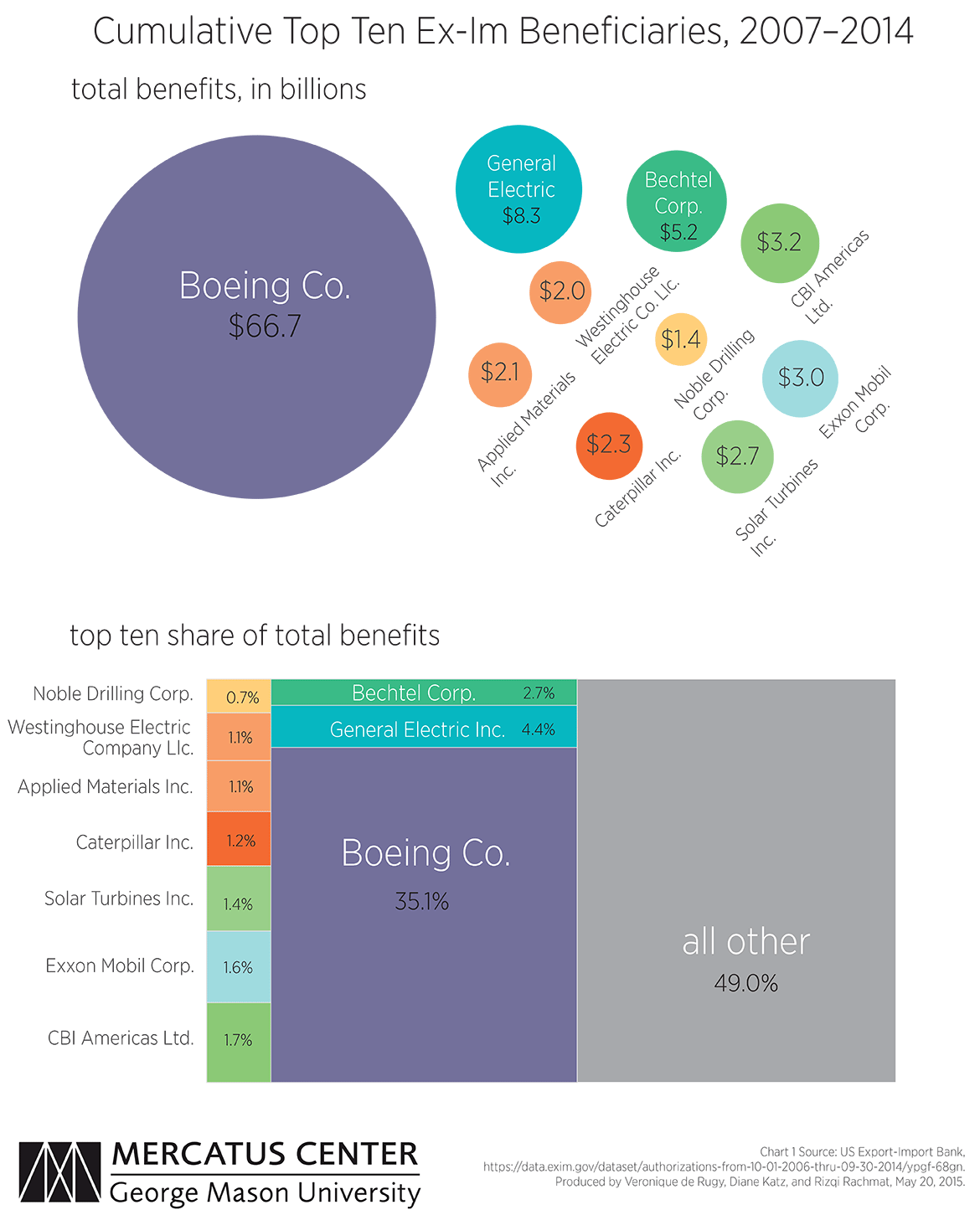

This week’s charts use data from the Ex-Im Bank to display the top 10 beneficiaries for all Ex-Im Bank transactions between 2007 and 2014 and the backlog information from the companies’ annual reports. As the data show, the Ex-Im Bank lives up to its nickname of “Boeing’s Bank.” The aviation giant is the biggest beneficiary by far: the bank has provided $66.7 billion in subsidized financing to foreign purchasers of Boeing planes. General Electric also ranks among the biggest beneficiaries, with $8.3 billion in export assistance, and Bechtel Corp. benefitted from $5.2 billion in support. The $2.2 billion in Ex-Im Bank financing that has benefitted Caterpillar was boosted by the $2.7 billion loan guarantee to its subsidiary, Solar Turbine Inc. (also on the top 10 list).

Click here to download full chart

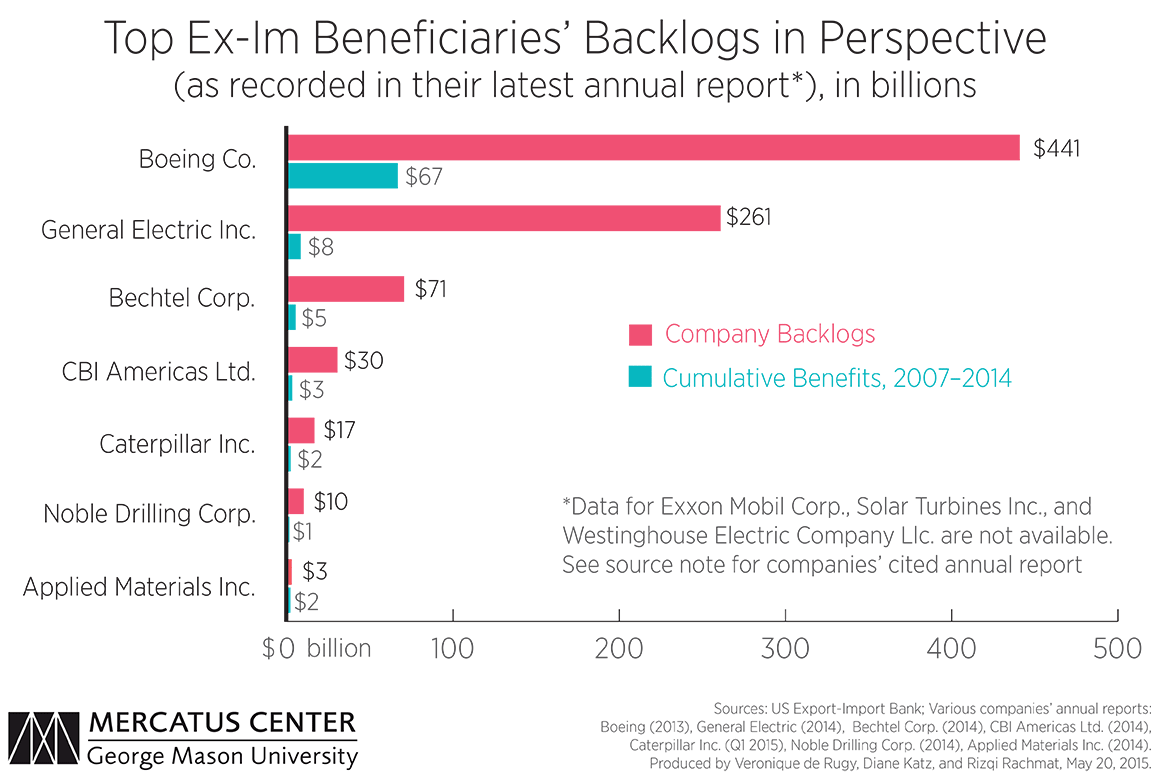

The data also show the companies’ backlogs, as reported in their latest annual reports. Boeing Co. posted a “record” backlog of $441 billion (in 2013); General Electric Co. recorded a backlog of $261 billion (in 2014); Caterpillar Inc.’s backlog is $16.5 million (in the first quarter of 2015); and Bechtel Corp. posted a “strong” backlog of $70.5 billion (in 2014).

Click here to download full chart

The expiration of the Ex-Im Bank charter will have no effect—none—on the financing of deals that already have been approved. The bank will simply be unable to extend new loans, which would be a win for taxpayers who are ultimately on the hook for a total of $140 billion if bank reserves fail to cover defaults.

Absent subsidies from the Ex-Im Bank, these corporations have production backlogs that will take years to fulfill—some with Ex-Im Bank financing in place and others without. This means that shutting down the Ex-Im Bank will not result in job losses—except, perhaps, among the ranks of lobbyists who are trying to scare members of Congress into maintaining this fount of corporate welfare.