- | Regulation Regulation

- | Policy Briefs Policy Briefs

- |

The Failure of Risk-Based Capital Regulation

In this policy brief, the authors explain the fundamentals of risk-based capital (RBC) regulation and discuss some potential shortcomings of this system. We propose that the Fed end its use of RBC regulation and return to the use of simple capital ratios as measures of bank risk.

Capital requirements are a primary component of US banking regulation. Since 1991, the Federal Reserve has used a “risk-based” method of capital regulation that attempts to account for the riskiness of various types of bank assets. However, evidence shows that this system has increased, rather than decreased, risk in the US banking system.

In this policy brief, we explain the fundamentals of risk-based capital (RBC) regulation and discuss some potential shortcomings of this system. We propose that the Fed end its use of RBC regulation and return to the use of simple capital ratios as measures of bank risk.

BANK CAPITAL REGULATION

Bank equity, or “capital,” functions as a cushion against unexpected losses in the value of bank assets. Equity, or capital, is the value of the bank to its investors, which is calculated as the current value of the bank’s assets minus its liabilities. The greater a bank’s capital, the greater the loss in asset value it can absorb before becoming insolvent. From 1980 to 1991, bank regulators required banks to maintain some minimum level of capital as a percentage of total assets. This standard did not differentiate between different types of bank assets in terms of risk.

In 1991, the Fed introduced a new system of RBC regulations based on the international agreement known as the Basel Accords[1]. These standards were intended to “enhance the resiliency and stability of the banking and financial system.”[2] RBC standards assign a risk weight to each type of bank asset so that banks with greater quantities of risk face a higher capital requirement. The RBC ratio, the Fed’s primary metric for measuring bank risk, is calculated as bank capital divided by risk-weighted assets (RWA). Since RWA is in the denominator of this formula, holding a greater number of risky assets causes the RBC ratio to fall, while holding fewer risky assets causes the RBC ratio to rise.

As often happens with consumer protection laws, the actual effects of RBC regulation have been the opposite of those intended. Rather than limiting banks’ risk, these rules give banks an incentive to acquire risky assets that are not rated properly by the regulators. The system also increases systemic risk by encouraging all banks to hold the same types of assets, thereby reducing diversification and increasing fragility in the banking system. Proponents of RBC regulation claim that these costs are outweighed by the Fed’s improved ability to identify risky banks. However, several studies which will be discussed below have shown that the RBC ratio is actually inferior to the standard capital ratio as a predictor of bank risk.

HOW RBC REGULATION WORKS

RBC standards divide each bank’s assets into four categories, based on their levels of risk. Each category is assigned a different “risk weight.” The assets that regulators perceive as safe, such as cash and government bonds, receive a 0 percent risk weight. Slightly riskier assets, such as securities issued by government agencies, are assigned a 20 percent risk weight. Mortgages, considered riskier still, are weighted in the 50 percent category. All other assets, such as corporate bonds and commercial loans, receive a 100 percent risk weight. The weighted sum of all four asset categories is the bank’s RWA. The RBC ratio is calculated as the bank’s capital divided by its RWA.

The RBC ratio is intended to provide a better estimate of bank risk than the simple capital ratio does. Since the RBC ratio is bank capital divided by RWA, banks holding more risky assets must maintain higher levels of capital to maintain the same RBC ratio. When RBC regulations were implemented in 1991, banks were required to maintain a minimum RBC ratio of 8 percent, up from the previous minimum non-RBC capital ratio of 6 percent.[3] Since regulators expected RBC regulations to increase banks’ levels of capital, they allowed for a period of “adjustment by banks who need time to build up to those levels.”[4] In retrospect, however, it is not clear that replacing the unweighted capital ratio with the RBC ratio should have encouraged banks to hold more capital or reduce their holdings of risky assets.

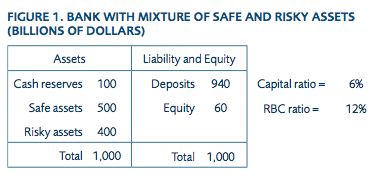

Consider the simple example of a bank with assets, liabilities, and equity, as shown in figure 1. The bank’s capital ratio is its equity of $60 billion divided by total assets of $1 trillion, yielding a ratio of 6 percent. In 1990, this bank would have met the minimum level of 6 percent capital required of all banks. But what would happen in 1992, when the bank is required to maintain an RBC ratio of 8 percent? Let us assume that the bank’s cash assets receive a 0 percent risk weight, safe assets receive a 20 percent risk weight, and risky assets receive a 100 percent risk weight. This bank’s total RWA are calculated as follows:

RWA=(100×0.0)+(500×0.2)+(400×1.0)=$500 billion.

With capital of $60 billion divided by total RWA of $500 billion, the bank’s RBC ratio would be 12 percent. This is above the required minimum of 8 percent, so the bank could reduce its RBC while still meeting the minimum required level—either by converting its cash holdings to holdings of risky assets, or by increasing its liabilities without increasing capital. Thus, moving from the standard capital regulation to the RBC regulation would increase, rather than decrease, the bank’s level of risk.

Let us consider another case that might have similar results. RBC regulation relies on the ability of bank regulators to properly assess the relative riskiness of a wide and varied array of bank assets. If regulators over- or underestimate the risk of a particular type of asset, those assets will be assigned an improper risk weight. Banks can then profit from “regulatory arbitrage” by the buying or selling of the misrated asset. Mortgage-backed securities (MBS), for example, were thought in the early 1990s to be relatively safe but are now considered to be very risky and are widely viewed as a major cause of the recent financial crisis. With the adoption of RBC regulation in 1991, however, MBS were assigned low risk weights of 20 percent or even 0 percent. Banks were therefore able to increase their profits by acquiring these high-risk, high-return assets while simultaneously reducing their RBC ratios.

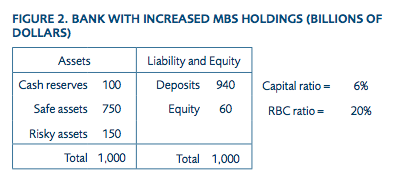

To see how this worked, consider the change from the balance sheet in figure 1 to that of figure 2. Suppose the bank in figure 1 sells $250 billion worth of corporate bonds that are assigned a risk weight of 100 percent. The bank uses the funds to buy $250 billion in MBS. Using the same calculations as in the previous example, with MBS receiving a 20 percent risk weight, we find that the bank’s capital ratio is unchanged but that its RBC ratio has increased to 20 percent. Because MBS were misrated by the regulator, the bank is able to increase its RBC ratio while also increasing its holdings of risky assets. As described in the next section, this is what occurred in the US banking system during the 1990s and the first few years of the 21st century. In a similar situation, the incentive for banks to hold “safe” government bonds caused the Greek government’s debt crisis to destabilize the financial system of the entire European Union.

Banks are required to fulfill two other capital requirements in addition to the regular RBC ratio. These requirements both pertain to “Tier 1 capital,” which includes common equity, some preferred equity, and interest in subsidiaries less goodwill.[5] First, banks must maintain Tier 1 capital equal to or greater than 4 percent of RWA. Second, they must have Tier 1 capital equal to or greater than 4 percent of total assets, a requirement similar to the standard capital ratio used before 1991. Despite these failsafes, the Fed’s RBC regulations may still fall victim to the scenarios outlined in the examples above. Considering the conflicting incentives inherent in the system, it is impossible to accurately predict the effects of RBC regulation.[6] Studies of banking regulation since the adoption of the Basel Accords may be helpful in judging whether RBC regulation has reduced risk in the banking system.

STUDIES OF RBC REGULATION

With the second round of RBC regulation in 2007, the Fed claimed that “the advanced approaches of Basel II are a significant improvement” that would enhance “bank safety and soundness and overall financial stability.”[7] However, RBC regulation has done just the opposite, according to recent evidence thoroughly documented in the book What Caused the Financial Crisis, edited by Jeffrey Friedman.[8] The first chapter, written by Friedman, provides evidence that the misrating of MBS did in fact cause banks to increase their holdings of MBS. Chapters by Viral Acharya and Matthew Richardson[9] and by Juliusz Jablecki and Mateusz Machaj[10] demonstrate how the securitization and acquisition of MBS created systemic risk in the banking sector.

Supporters of the Basel system propose that, despite these shortcomings, the RBC ratio can improve the accuracy of bank regulation by identifying particularly risky banks. Indeed, a 1991 study by Robert Avery and Allen Berger finds that RBC regulations were superior to pre-1991 capital regulations as predictors of bank risk and performance.[11] However, recent studies directly comparing the capital and RBC ratios tend to find that the standard capital ratio is a better indicator of risk than the RBC ratio. Arturo Estrella, Sangkyun Park, and Stavros Peristiani find that “the risk-weighted ratio does not consistently outperform the simpler ratios, particularly with short horizons.”[12] Asli Demirgüҫ-Kunt, Enrica Detragiache, and Ouarda Merrouche find that the capital ratio performs better than the RBC ratio as a predictor of bank stock returns, which, since the financial crisis, have been strongly related to bank risk.[13]

Our own study, “Evaluating Risk-Based Capital Regulation,” reconsiders the evidence provided by Avery and Berger.[14] Using more recent data, we find that the standard capital ratio is significantly better than the RBC ratio as an indicator of bank risk and performance and that using both ratios simultaneously does not produce better results. Taken in conjunction with the other available evidence, our findings indicate that RBC regulations lead to more risk-taking by individual banks, and more overall risk in the banking system, without improving the effectiveness of the Fed’s capital regulations.

CONCLUSIONS

Since 1991, the Federal Reserve has employed a risk-based measure of bank capital as its primary tool for regulating bank risk. However, RBC regulations are easily exploited and susceptible to regulatory arbitrage. Evidence indicates that such regulations have increased individual bank risk as well as systemic risk in the banking system. In addition, RBC regulations do not appear to improve the Fed’s identification of risky banks, even when used in conjunction with the standard capital ratio. On these grounds, we propose that the Fed end its use of RBC regulation and return to the capital ratio as the primary basis for bank regulation.

ENDNOTES

1. Basel Committee on Banking Supervision, “International Convergence of Capital Measurement and Capital Standards,” Bank for International Settlements (July 1998).

2. Randall S. Kroszner, “Statement by Governor Randall S. Kroszner,” press release, Board of Governors of the Federal Reserve System, November 2, 2007, http://www.federalreserve.gov/newsevents/press/bcreg/krosznerbasel20071….

3. Total capital typically includes common and preferred equity, subordinated debt, and interest in consolidated subsidiaries less goodwill. See Robert B. Avery and Allen N. Berger, “Risk-Based Capital and Deposit Insurance Reform,” Journal of Banking & Finance 15 (1991): 851–53.

4. Basel Committee, “International Convergence,” 14.

5. See Avery and Berger, “Risk-Based Capital,” 852–53.

6. “This literature produces highly mixed predictions, however, regarding the effects of capital regulation on asset risk and overall safety and soundness for the banking system as a whole.” David VanHoose, “Theories of Bank Behavior Under Capital Regulation,” Journal of Banking & Finance 31 (2007): 3680.

7. Randall S. Kroszner, “Statement by Governor Randall S. Kroszner,” press release, Board of Governors of the Federal Reserve System, November 2, 2007, http://www.federalreserve.gov/newsevents/press/bcreg/krosznerbasel20071….

8. Jeffrey Friedman, ed., What Caused the Financial Crisis (Philadelphia: University of Pennsylvania Press, 2011). For a summary, see Thomas L. Hogan’s “Book Review of Friedman, Jeffrey, ed., What Caused the Financial Crisis,” Reason Papers 34, no. 2 (October 2012): 222–28.

9. Viral V. Acharya and Matthew Richardson, “How Securitization Concentrated Risk in the Financial Sector,” in What Caused the Financial Crisis, ed. Jeffrey Friedman (Philadelphia: University of Pennsylvania Press, 2011), 183–99.

10. Juliusz Jablecki and Mateusz Machaj, “A Regulated Meltdown: The Basel Rules and Banks’ Leverage,” in What Caused the Financial Crisis, ed. Jeffrey Friedman (Philadelphia: University of Pennsylvania Press, 2011), 200–27.

11. Avery and Berger, “Risk-Based Capital.”

12. Arturo Estrella, Sangkyun Park, and Stavros Peristiani, “Capital Ratios and Credit Ratings as Predictors of Bank Failures,” FRBNY Economic Policy Review (July 2000): 33–52.

13. Asli Demirgüҫ-Kunt, Enrica Detragiache, and Ouarda Merrouche, “Bank Capital: Lessons from the Financial Crisis” (IMF Working Paper No. 10/286, Washington, DC, 2010), http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1751399.

14. Thomas L. Hogan, Neil Meredith, and Xuhao Pan, “Evaluating Risk-Based Capital Regulation,” (Mercatus Working Paper, Arlington, VA: Mercatus Center at George Mason University, January 2013).