- | Government Spending Government Spending

- | Research Papers Research Papers

- |

In Search of Austerity: An Analysis of the British Situation

This paper intends to provide a basic overview of the fiscal position of the United Kingdom. The 2008–2009 recession has been deeper and more sustained than the two previous recessions (in 1990–91 and 1979–81).

This paper intends to provide a basic overview of the fiscal position of the United Kingdom. The 2008–2009 recession has been deeper and more sustained than the two previous recessions (in 1990–91 and 1979–81). When the present coalition government formed in 2010, it made deficit-reduction measures a key part of its economic strategy. Indeed, then-opposition leader David Cameron used the phrase “age of austerity” in a speech in April 2009 while attempting to portray the incumbent government as having caused the financial crisis through excessive spending. With gross domestic product (GDP) slipping back into negative growth in Q4 of 2011 and Q1 of 2012, the economic debate about the impact of fiscal policy on economic activity reached fever pitch. Whether the austerity measures the government has introduced have been the cause of this lethargic recovery or whether the lack of growth suggests that austerity measures are in fact a myth is a subject of heated debate.[1]

Section 1 presents official forecasts of government spending and looks into the composition of changes within different departments. Section 2 focuses on the importance of GDP forecasts when assessing the scale of spending changes, and provides some rudimentary scenario analysis. Section 3 analyzes government plans for the balance between spending cuts and tax rises. Section 4 defines and critiques the focus on fiscal adjustment as a means to define the stance of fiscal policy. Section 5 looks at some of the political economy of austerity measures. Section 6 briefly concludes.

1. GOVERNMENT SPENDING IS INCREASING

The term austerity often is used to refer to a reduction in a government’s budget deficit, and logic dictates that there are two means to achieve this: reductions in government spending or increases in tax. In the same way that a traditional fiscal stimulus tends to refer to a fiscal expansion focused mainly on the spending side, an austerity program is a fiscal contraction also focused on spending. For example, Paul Krugman refers to fiscal austerity as “slashing spending in an effort to balance their budgets,”[2] and indeed most economists who advocate austerity are focused on cutting spending. This makes sense given the origins of the word. “Austerity” came into wide usage during World War II, as government policy caused a reduction in the availability of luxury goods and induced “simpler” living.[3]

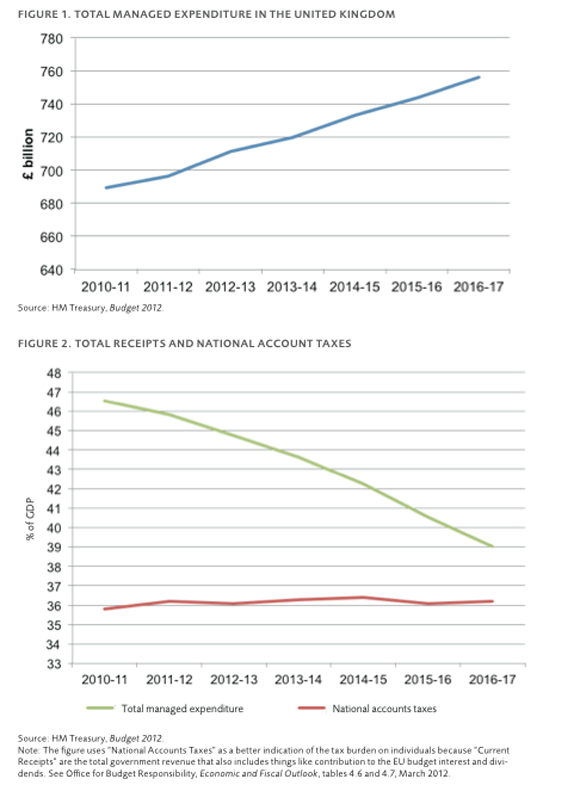

The most obvious place to look for signs of austerity is in government spending. Figure 1 shows the nominal amount of total managed expenditure (TME) in the United Kingdom from 2010–11 through 2016–17.[4] One might think this would be enough to stop the debate: Spending increases.[5]

That government spending continues to grow does not mean actual cuts do not cause genuine hardships. The problem is that commentators use evidence of specific cuts to make an inference about the global picture. It is important also to look at the breakdown of spending. Simply looking at the expenditure limits of the departments of the government (see table 2 in the appendix) reveals that the nominal total is increasing, from £322.5 billion in 2011–12 to £327 billion in 2014–15. Indeed, most departments are seeing increases. In the two years following 2012, the budgets for all departments rise by an average of 7.7 percent: 13 departments receive an increase in budget, 10 see a decrease, and 4 do not change. Over three years, the increase is 4.5 percent: 11 see budgets rise, 14 see a cut, and 2 see no change. The main reason for this is that one of the biggest departments, the National Health Service, is also the most politicized and its budget was protected.[6] The inevitable result of increasing debt repayments and excluding large departments is that the remaining ones are more likely to be cut. Local governments have to cope with significant reductions in resources, and some public services will undoubtedly suffer. But these are changes in the composition of government expenditure, not a fall in the absolute level. They should not cause a recession.