- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

Update: Components of the Federal Debt

This week, Mercatus Center Senior Research Fellow Veronique de Rugy reexamines the components of the Federal debt using the most recent data from the Treasury Department’s Bulletin for June 2011 and Monthly Statement of the Public Debt for March 2011.

This week, Mercatus Center Senior Research Fellow Veronique de Rugy re-examines the components of the federal debt using the most recent data from the Treasury Department’s Bulletin June 2011 and Monthly Statement of the Public Debt March 2011.

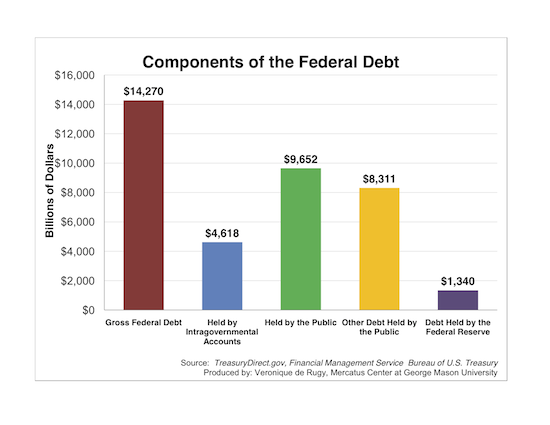

As of March 2011, our gross federal debt amounts to $14.27 trillion. This debt is comprised of debt held by the public ($9.6 trillion) plus debt held in intragovernmental accounts ($4.6 trillion). In total, gross debt is 94.6% of estimated GDP for FY 2011. Debt held by the Federal Reserve—as a portion of public debt—increased 74% from 2010 to 2011.

This debt is projected to grow into the future, and interest payments on the debt are projected to grow alongside it.

The $9.6 trillion in debt held by public includes a variety of investors, such as domestic and foreign investors, state and local governments, the Federal Reserve, and pension funds. Additionally, the $4.6 trillion in intragovernmental debt represents balances in the federal government’s accounts, primarily trust funds like Social Security and Medicare that collect more money than they pay out in benefits each year. This intragovernmental debt is debt that the government owes itself. On top of that, the government must also pay back interest,throwing an even bigger burden onto already hurting taxpayers.

Federal borrowing from the public absorbs resources available for private investment and may put upward pressure on interest rates. Raising the roof of a burning house does little to improve its working institutional parts.